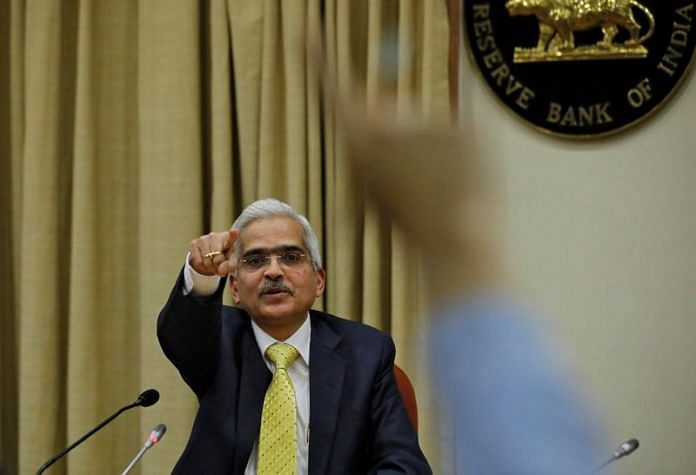

BENGALURU (Reuters) – The Reserve Bank of India’s key repo rate was raised by 35 basis points (bps) on Wednesday as widely expected, the fifth straight increase as inflation remains elevated and the central bank says that there will be no let up in flight to tame inflation.

The monetary policy committee (MPC), comprising three members from the RBI and three external members, raised the key lending rate or the repo rate to 6.25% in a majority decision. Five of the six members voted in favour of the decision.

The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 6.00% and 6.50%, respectively.

COMMENTARY

MADHAVI ARORA, LEAD ECONOMIST, EMKAY GLOBAL FINANCIAL SERVICES, MUMBAI

“The MPC expectedly delivered a 35 bps hike, with a 5-1 vote, and kept its stance unchanged at ‘withdrawal of accommodation’. The tone was still cautious and data-dependent, and with the governor emphasizing the need to calibrate the policy.”

“At this point, we still think that the RBI would not turn too restrictive. However, the extent of global disruption will remain key. We are closely watching the global pace of inflation deceleration and how the impending recession will shape DM central bank policies, which could influence the RBI’s reaction. The still-fluid global situation might require frequent adjustments in macro and policy assessments ahead as far as terminal rates are concerned.”

UPASNA BHARDWAJ, CHIEF ECONOMIST, KOTAK MAHINDRA BANK, MUMBAI

“The MPC delivered the 35 bps hike as expected while retaining the stance as ‘withdrawal of accommodation.’ We continue to expect the focus of MPC to remain in a watchful mode as uncertainties on inflation settle down. We see a possibility of another 25 bps rate hike before a prolonged pause.”

(Reporting by Rama Venkat in Bengaluru; Editing by Savio D’Souza)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.