By Sinéad Carew

NEW YORK (Reuters) – Global equities edged lower on Wednesday while oil prices tumbled as investors weighed their enthusiasm about the potential economic boost from China lifting COVID restrictions with concerns about rising infections there.

The yield on the benchmark U.S. 10-year Treasury dipped before turning higher in a choppy session after it recorded its biggest one-day jump in just over two months on Tuesday.

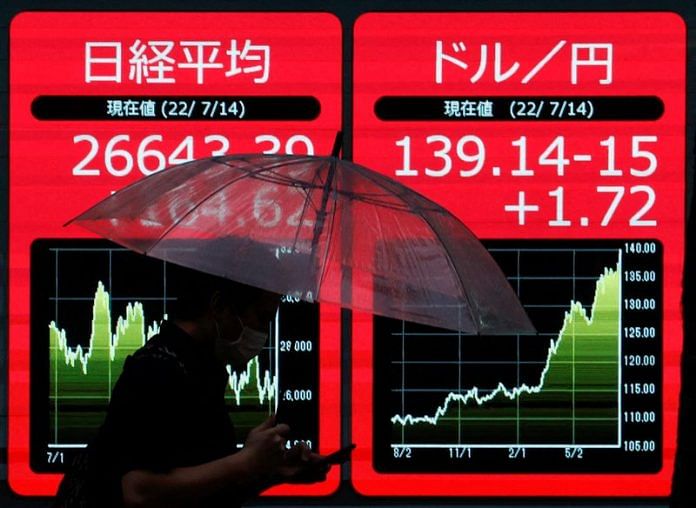

In currencies the dollar pared some gains after hitting a one-week high against the yen but fell sharply against sterling.

MSCI’s broadest index of global stocks was flat as investors stayed on the sidelines close to the end of a brutal year for equities. The global index is on course to end 2022 down about 20%, in its biggest percentage decline since 2008, during the financial crisis.

China’s government announced on Monday it would stop requiring inbound travellers to go into quarantine starting from Jan. 8.

While China’s health system has come under heavy stress from the lifting of restrictions so far, strategists at JP Morgan forecast a “likely infection peak” during the Lunar New Year holiday next month, followed by a “cyclical upturn after nearly three years of on and off restrictions.”

“What people are underestimating is the fact that the secondlargest economy in the world is now reopening and all thateconomic activity is going to benefit the U.S.,” said ThomasHayes, chairman at Great Hill Capital LLC in New York. “The speed at which they have reversed their stance hascaught people off guard. People are sceptical because the lasttwo years have been such a debacle in China.”

The Dow Jones Industrial Average fell 56.22 points, or 0.17%, to 33,185.34, the S&P 500 lost 8.81 points, or 0.23%, to 3,820.44 and the Nasdaq Composite dropped 29.01 points, or 0.28%, to 10,324.21.

The pan-European STOXX 600 index lost 0.05% and MSCI’s gauge of stocks across the globe shed 0.23%.

In Treasuries, benchmark 10-year notes were up 1.5 basis points to 3.873%, from 3.858% late on Tuesday. The 30-year bond was last up 2.3 basis points to yield 3.9657%, from 3.943%. The 2-year note was last was down 1.3 basis points to yield 4.3553%, from 4.368%.

“If the 10-year gets to 4% the floodgates are going to open, there will be a lot of buying at that level,” said Jay Sommariva, managing partner and chief of asset management at Fort Pitt Capital Group in Pittsburgh.

“That is really not that far considering you went from a 3.41% to a 3.862%, that is a major move, so 15 basis points on top of that the floodgates will probably open at that point and you will see an enormous amount of buying there.”

In currencies, the dollar index rose 0.048%, with the euro down 0.08% to $1.063.

The Japanese yen weakened 0.45% versus the greenback at 134.08 per dollar, while sterling was last trading at $1.2068, up 0.39% on the day.

Oil prices dipped as traders weighed concerns over the surge in COVID cases in China against the easing of restrictions in the world’s top oil importer, which had fuelled some hopes for a demand boost.

U.S. crude fell 2.34% to $77.67 per barrel and Brent was at $82.29, down 2.42% on the day.

Gold prices on Wednesday edged lower from the last session’s six-month peak on short-term profit taking.

Spot gold dropped 0.7% to $1,800.79 an ounce. U.S. gold futures fell 0.64% to $1,803.10 an ounce.

(Reporting by Sinéad Carew, Chuck Mikolajczak, Ankur Banerjee, Naomi Rovnick; Additional reporting by Ankika Biswas; Editing by Bradley Perrett, Tomasz Janowski and Alison Williams)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.