New Delhi: Union Budget 2025 has attempted to strike a fine balance between giving income tax relief to the middle class while also maintaining its capital expenditure efforts and fiscal consolidation roadmap.

At the same time, budget documents show the government is expecting a marginally smaller subsidy bill from what it had budgeted last year.

Overall, despite the income tax cuts, the government expects its fiscal-deficit-to-GDP ratio to come in at 4.4 percent in 2025-26, as compared to a revised estimate of 4.8 percent for 2024-25.

This fiscal consolidation, financial documents in the budget show, is because the government expects its total receipts to grow by a little more than 10 percent in 2025-26 compared to the amount budgeted for 2024-25, while total expenditure is budgeted to grow about 5 percent.

Finance Minister Nirmala Sitharaman, while presenting the budget in the Lok Sabha Saturday, announced a substantial hike in the minimum threshold below which income would attract no tax. This has been done through a system of tax rebates.

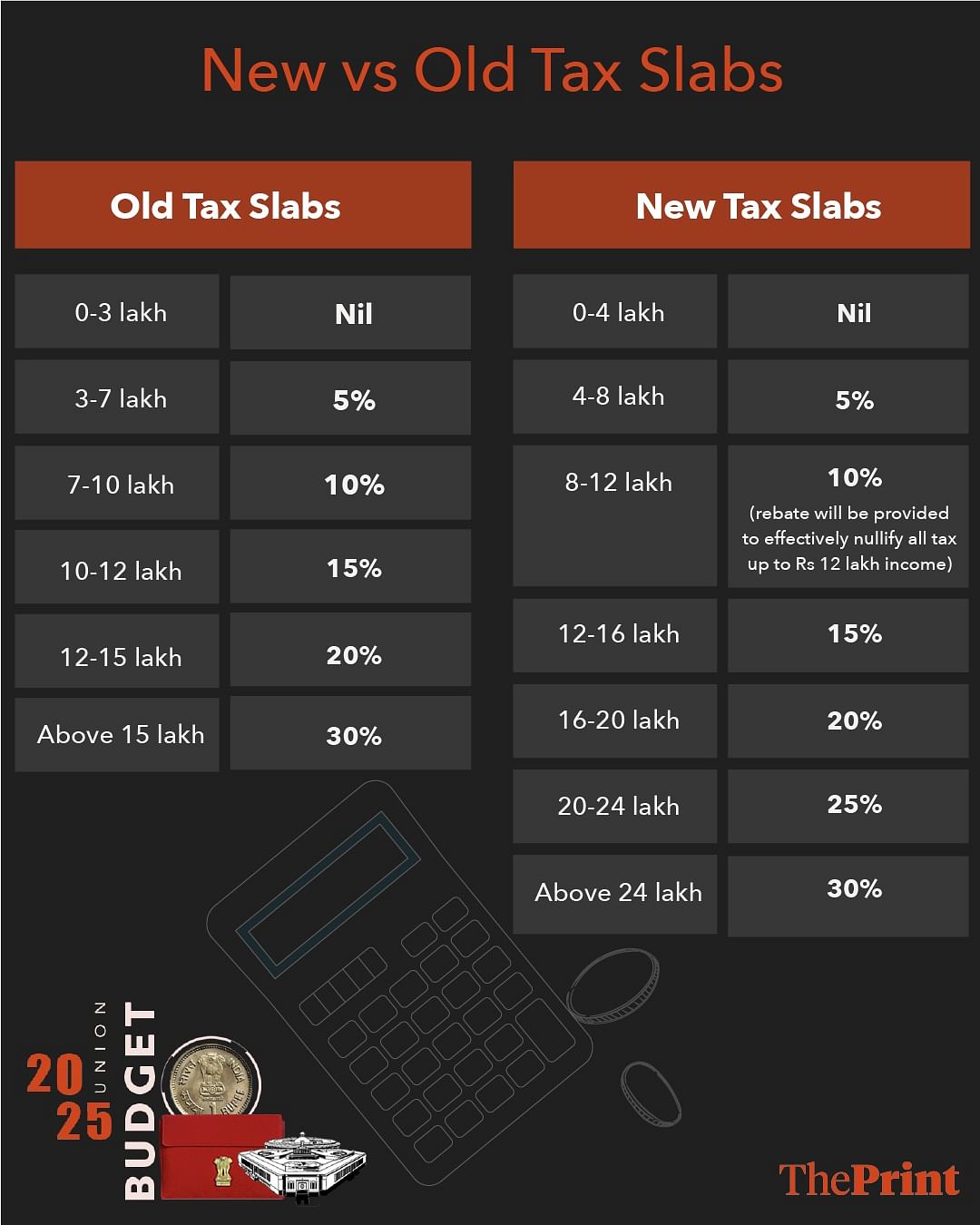

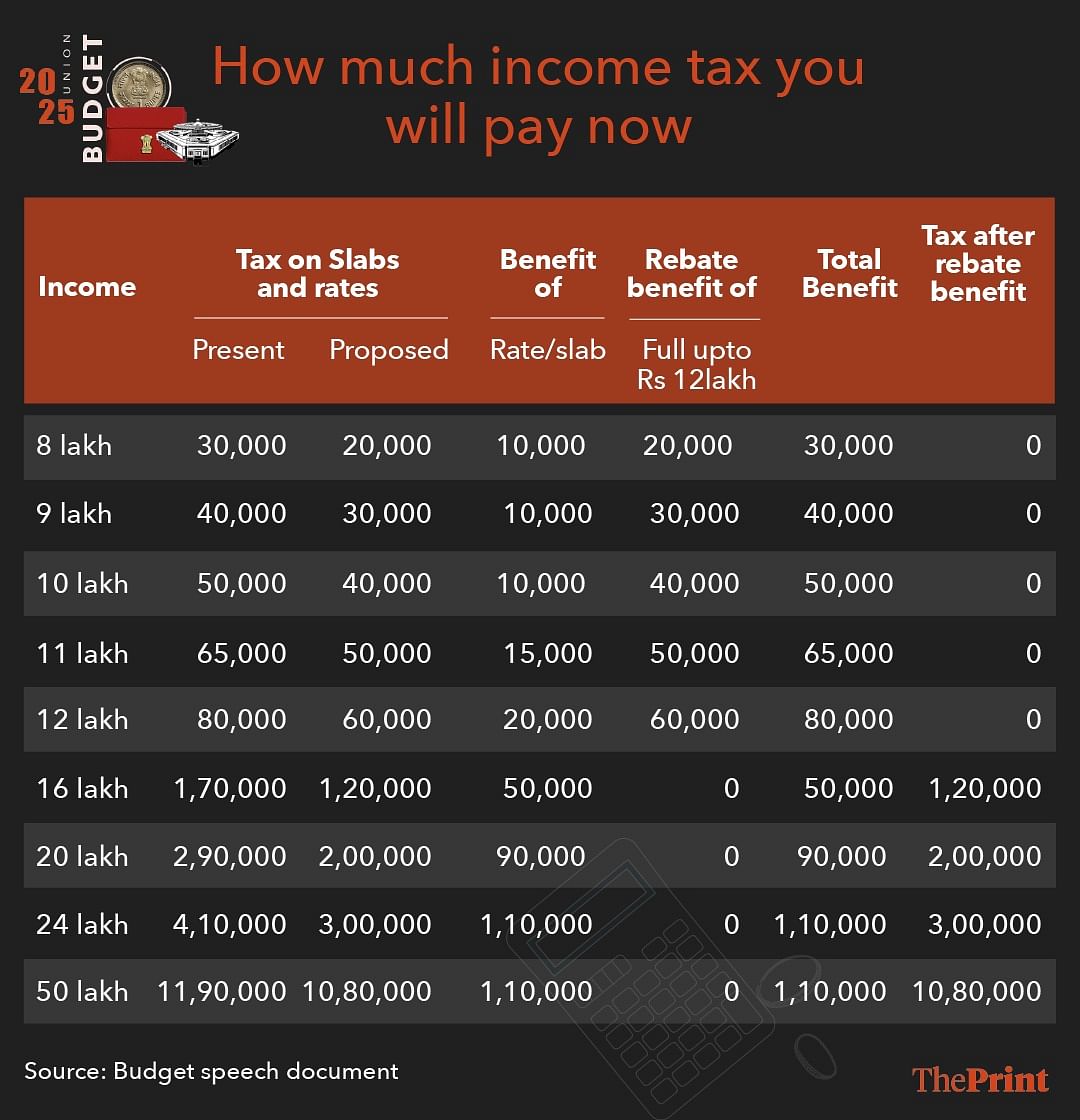

Incomes of up to Rs 12 lakh a year will receive a rebate which will effectively nullify the tax. This limit was earlier for an annual income of Rs 7 lakh.

Further, for incomes above that level, the slabs have been rejigged to reduce the tax. All of these provisions apply to those who choose the new tax regime, which was introduced in the financial year 2020-21.

Under the new regime, the highest tax rate of 30 percent applied on incomes above Rs 15 lakh a year. This has now been raised to Rs 24 lakh a year. Several other tweaks have also been made to the slabs.

Tax experts said these moves were expected to significantly increase the amount of disposable income available for the middle class, thereby potentially boosting consumption in the economy.

“In a commendable move, the Union Budget 2025 has recognised the immediate need to provide relief to taxpayers and help reinvigorate India’s consumption engine,” said Haigreve Khaitan, Senior Partner, Khaitan & Co.

“The proposed income tax slab changes will result in more disposable income in the hands of the middle class, providing a shot in arm for the domestic demand growth story which had begun to show signs of slowing down,” he added.

Also Read: Modi 3.0 gives giant relief to middle class—no tax on income up to Rs 12 lakh

How the revenue math plays out

Sitharaman said the changes to the income tax structure and rates, along with other changes she announced on tax collected at source (TCS) and tax deducted at source (TDS), would entail a revenue hit of Rs 1 lakh crore a year.

However, despite this, the government is expecting total receipts to be at Rs 34.1 lakh crore in 2025-26, 10.2 percent higher than what was budgeted for 2024-25, and only marginally lower than the revised estimates for that year.

Within this, gross tax revenue is expected to increase by 11.2 percent in FY26 to Rs 42.7 lakh crore. Drilling down further, income tax revenue is expected to grow more than 21 percent in FY26 as compared to the budget estimates of FY25, despite the various changes announced to the slabs and rates.

On corporate tax collections, the budget expects receipts of Rs 10.8 lakh crore, just 6 percent higher than what was budgeted for FY25.

The other source of significantly increased revenue is from dividends and profits of public sector enterprises and the Reserve Bank of India. In total, the government expects this income to touch Rs 3.25 lakh crore in FY26, up from Rs 2.89 lakh crore budgeted for the previous year.

Also Read: 36 drugs to treat cancer, rare diseases exempted from basic customs duty in Union Budget 2025

Where is the government spending its money?

The flip side of the government’s accounts are its expenditures. The total expenditure is budgeted to grow to Rs 50.6 lakh crore in 2025-26, up about 5 percent from 2024-25.

Within this, the government’s capital expenditure is expected to remain flat in 2025-26 as compared to what was budgeted for the previous year, albeit higher than the revised estimate for that year.

That is, the government had budgeted a capital expenditure of Rs 11.1 lakh crore for 2024-25, which was revised down to Rs 10.2 lakh crore. For 2025-26, the government has budgeted a capital expenditure of Rs 11.2 lakh crore. This is an increase of just 0.9 percent over last year’s budgeted amount, but a 9.8 percent increase over the revised estimates.

The government is also expecting a marginally smaller subsidy bill than it budgeted last year. Compared to a subsidy bill of Rs 42.8 lakh crore budgeted for 2024-25, which was revised to Rs 42.78 lakh crore, the government is expecting to spend Rs 42.6 lakh crore on subsidies in 2025-26.

The government’s total revenue expenditure, which includes salaries, pensions, interest payments, and subsidies, is expected to increase by just 6 percent to Rs 39.4 lakh crore in FY26.

(Edited by Tikli Basu)

Also Read: 36 drugs to treat cancer, rare diseases exempted from basic customs duty in Union Budget 2025