In the last few years, financial education has become a critical tool for individuals striving toward financial independence. Among the key players in this movement is Chalo Seekho—a platform that is rapidly expanding its influence in educating Indians about personal finance. Launched in 2017, Chalo Seekho focuses solely on delivering free, accessible, and practical financial knowledge across social media platforms. With a YouTube channel nearing 100,000 subscribers and an Instagram following of over 330,000, it is clear that there is a growing appetite for financial education.

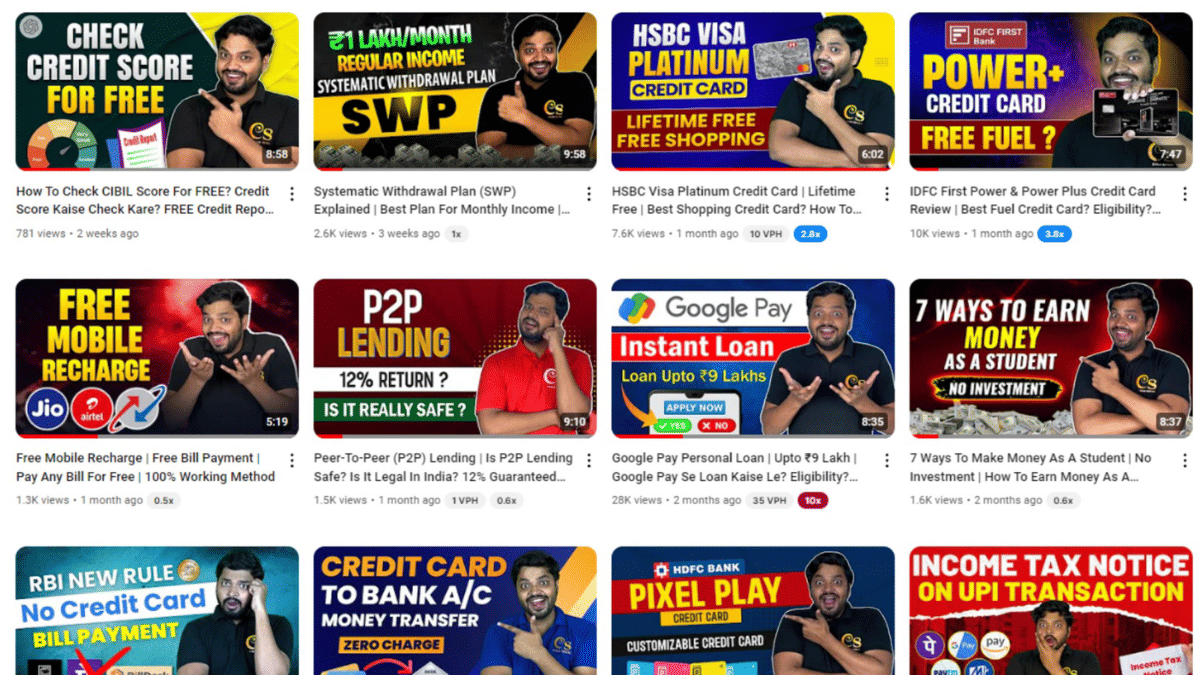

Chalo Seekho’s content spans a wide range of finance-related topics, including savings, insurance, loans, mutual funds, and online money-making opportunities. The platform helps individuals understand the fundamentals of personal finance, offering guidance on topics like opening a savings account, understanding insurance policies, or getting started with mutual funds. Its primary mission is to break down complex financial concepts into simple, actionable steps, empowering people to make informed financial decisions.

In a world where financial products and services are becoming more sophisticated, individuals are often left in the dark about how to navigate them. This is where Chalo Seekho steps in, offering clear, research-based content that is designed to build a foundational understanding of finance. By making financial literacy more accessible, the platform is helping a wide audience—particularly those unfamiliar with the more intricate aspects of banking, investments, and digital finance.

Chalo Seekho also recognizes the importance of evolving with its audience’s needs. While organic growth has been strong, the platform has recently introduced segments focusing on topics like debt management, credit score improvement, and digital entrepreneurship, ensuring that its content remains relevant and comprehensive.

Despite its expanding influence, Chalo Seekho maintains a focus on education. The platform does not engage in trading or investment services, nor does it ask for any fees. It is dedicated solely to educating individuals on personal finance, ensuring they are equipped with the knowledge to make better financial decisions without feeling pressured to invest or spend money.

A key driving force behind the platform’s success is Bhubaneswar-based entrepreneur and digital marketer Abhinab Das, whose vision for Chalo Seekho is rooted in his background in IT and digital marketing. His goal is to provide accessible financial education to a wide audience through social media, without charging for services or promoting risky investments.

Looking forward, Chalo Seekho plans to continue expanding its educational outreach, possibly through partnerships with financial institutions to offer more value-added educational services to its community. As financial products continue to evolve and new technologies like cryptocurrency gain popularity, Chalo Seekho is committed to staying at the forefront of financial education in India.

ThePrint BrandStand content is a paid-for, sponsored article. Journalists of ThePrint are not involved in reporting or writing it.