For centuries, gold has been the go-to haven asset in times of political and economic uncertainty. Its status as a reliably high-value commodity that can be transported easily and sold anywhere offers a sense of safety when everything else is in turmoil.

Not everyone’s a fan. Famed investor Warren Buffett has called the precious metal a “sterile” asset, telling Berkshire Hathaway Inc. shareholders in a 2011 letter that “if you own one ounce of gold for an eternity, you will still own one ounce at its end.”

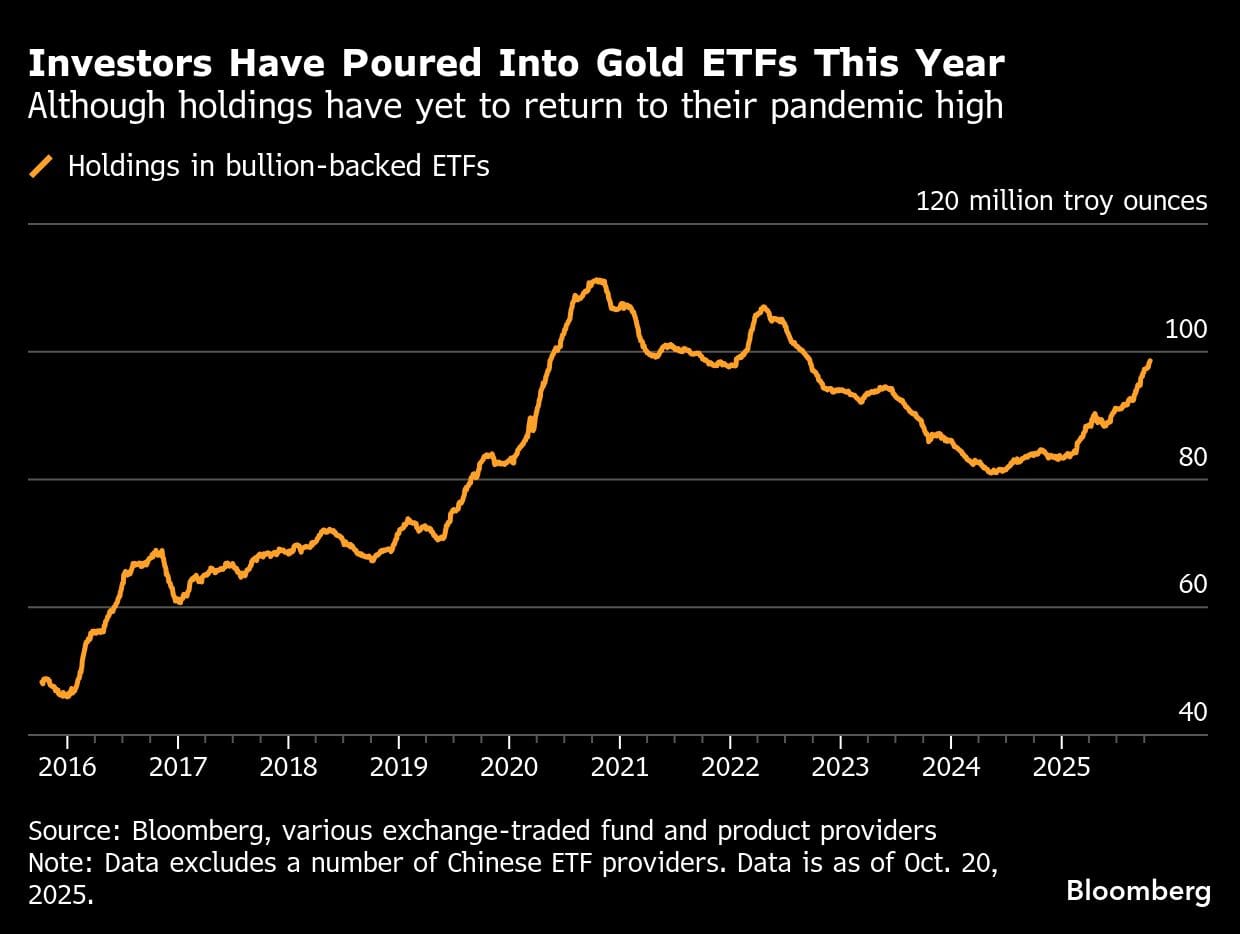

Nonetheless, central banks have been adding to their bullion reserves and investors have sought refuge in gold this year amid President Donald Trump’s expanding trade war, record US debt levels sparking concerns about the country’s fiscal health, and growing encroachment on the independence of the Federal Reserve. As investors piled into gold-backed exchange-traded funds, total holdings hit their highest point in more than three years in October, according to data collected by Bloomberg.

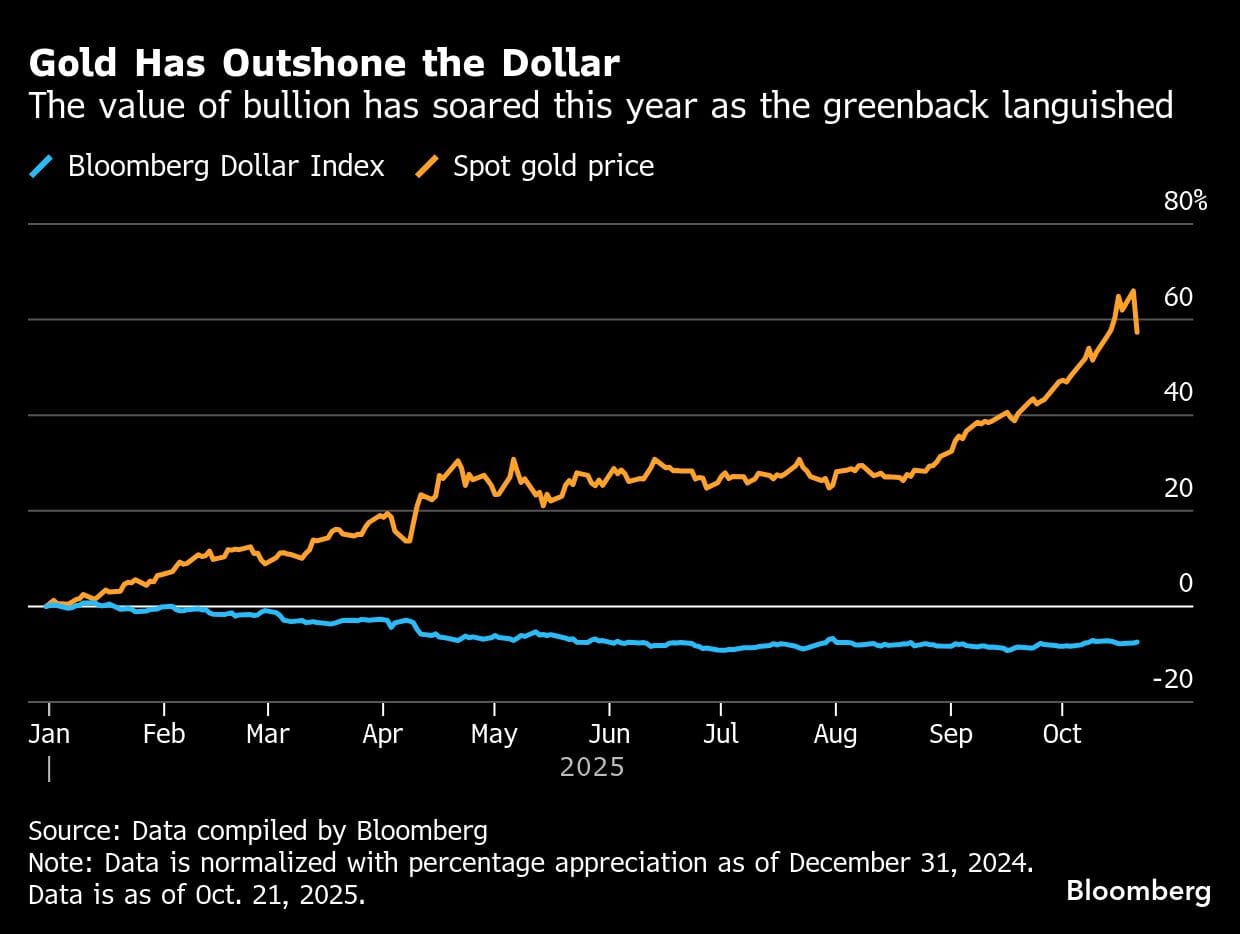

The rush to bullion has prompted the precious metal to keep setting price records in 2025, outpacing the returns from equities and raising concerns about a potential bubble. After smashing through $4,300 per troy ounce, the gold price took a breather, experiencing its steepest drop in more than a decade on Oct. 21.

Why is gold considered a safe haven?

For modern investors, it’s primarily because of gold’s stability and liquidity rather than any intrinsic utility.

Gold has a track record of increasing in value in times of market stress. The metal breached $1,000 an ounce in the aftermath of the global financial crisis, $2,000 during the Covid-19 pandemic, and $3,000 as the Trump administration’s tariff plans washed over global markets in March.

Bullion is also seen as a hedge against inflation, when the purchasing power of currencies is eroded. Inflation worries are front of mind for many right now as the duties Trump has imposed on imports into the US risk pushing up prices across the global economy.

Price increases and the labor market in the US have been in the spotlight as Trump has piled pressure on the Fed to bend to his will and cut interest rates. Gold, which pays no interest, typically becomes more attractive in a lower-rate environment, as the opportunity cost of holding it versus interest-earning assets decreases. Investors have been betting that the Fed will cut interest rates further this year.

The safe-haven status of gold has also been elevated as Trump’s trade agenda and runaway budget deficits shake trust in other traditional shelters from market gyrations, namely sovereign debt and currencies, in particular the US dollar. Investors haven’t just flocked to bullion, but also silver, other precious metals and even Bitcoin as part of the so-called debasement trade.

Gold has historically been negatively correlated with the dollar. Because bullion is priced in dollars, when the greenback weakens, gold becomes cheaper for holders of other currencies. In mid-September, the dollar fell to its weakest level in more than three years against other major currencies.

Beyond market movements, owning gold is deeply rooted in Indian and Chinese cultures — two of the world’s largest markets for the metal — where jewelry, bars and other forms of bullion are passed down through generations as a symbol of prosperity and security. Indian households own about 25,000 metric tons of gold, more than five times what’s stored in the US depository at Fort Knox.

Physical buyers are famously sensitive to prices. When gold’s appeal to investors in financial markets starts to fade, buyers of jewelry and bars often step in to grab a bargain, putting a floor under prices in the process.

Why have central banks been buying more gold?

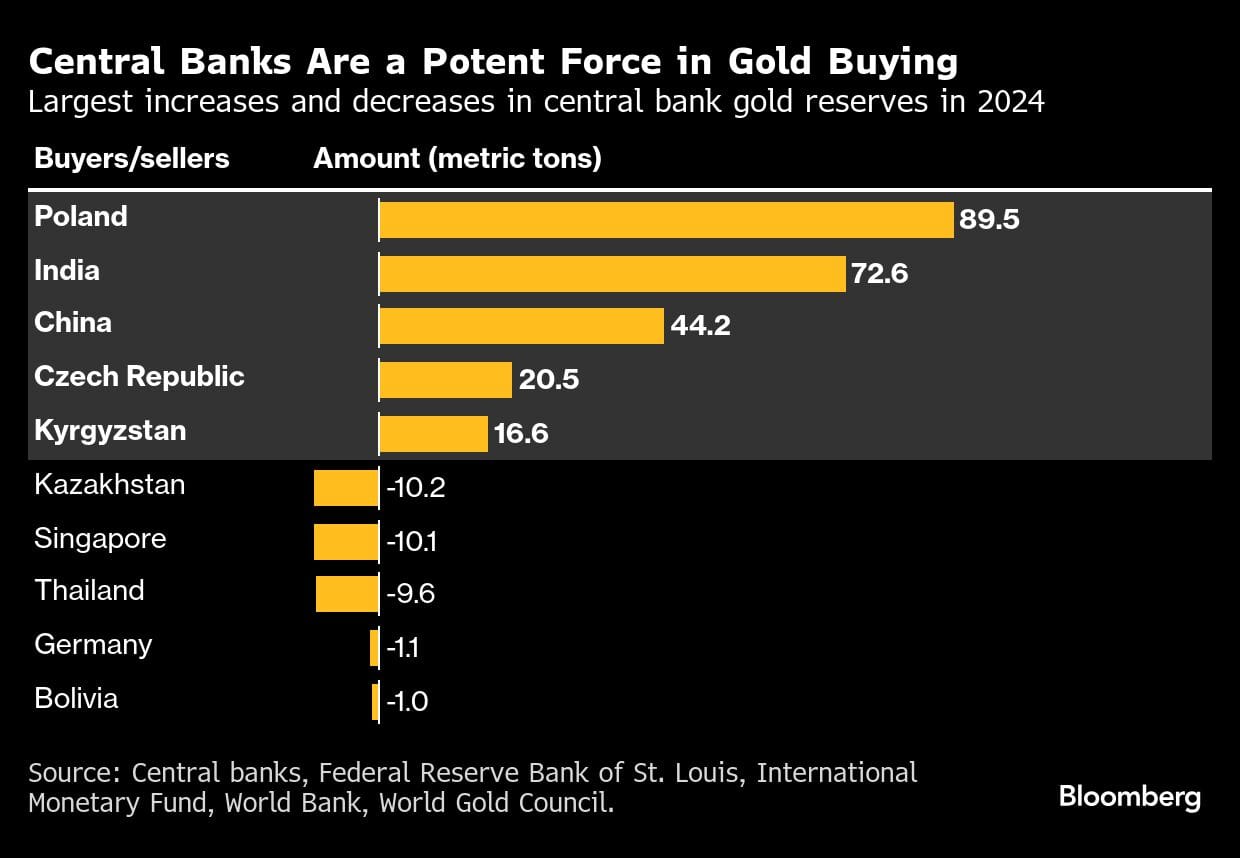

The metal’s blistering price rally since the start of 2024 has partly been driven by huge purchases by central banks, particularly in emerging markets as they seek to reduce their dependency on the US dollar, the world’s primary reserve currency. Gold helps diversify a country’s foreign exchange reserves and guard against currency depreciation.

Central banks have been net buyers of gold for the past 15 years, but the speed of their purchases doubled in the wake of Russia’s invasion of Ukraine. As the US and its allies froze Russian central bank funds held in their countries, it underscored how foreign currency assets are vulnerable to sanctions.

In 2024, central banks bought more than 1,000 tons of bullion for the third year in a row, according to the World Gold Council, and they hold around a fifth of all the gold that’s ever been mined. The nations that have been most active in building up their reserves include those that weren’t part of the post-Second World War Bretton Woods system — a monetary order that was essentially underpinned by gold.

The People’s Bank of China has been on a buying streak, adding to its gold holdings for an 11th consecutive month in September. The PBOC is also looking to become a custodian of foreign sovereign gold reserves, in a bid to strengthen its standing in the global bullion market, Bloomberg reported. Most countries that keep gold abroad store it in the Bank of England, whose vaults contain more than 5,000 tons of the world’s reserves.

What could stop gold from resuming its record-breaking rally?

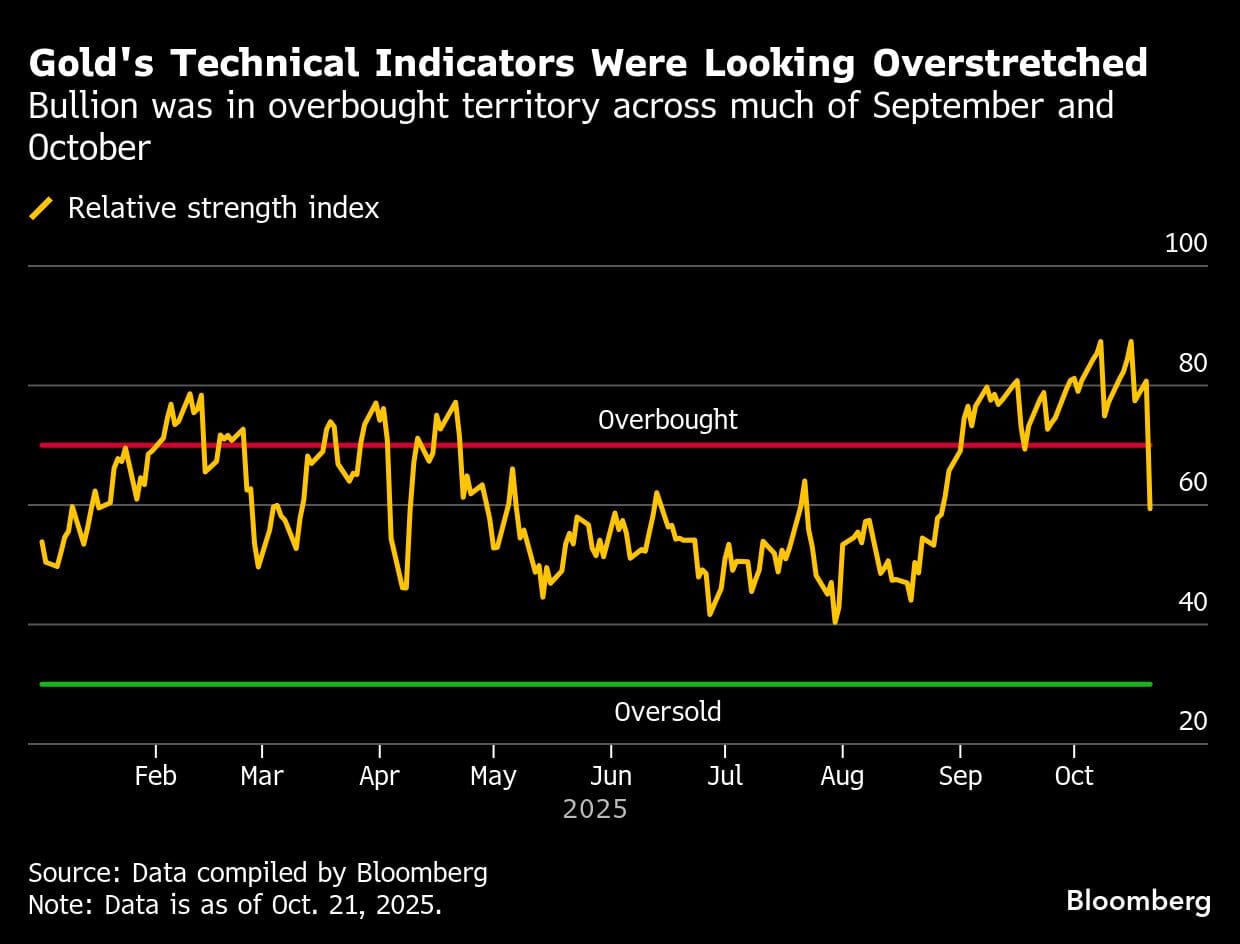

Gold’s bull run this year put it in uncharted territory. In September, the price eclipsed its inflation-adjusted peak from 1980 and for weeks bullion was in overbought territory based on its relative strength index.

The price decline in October was driven by a confluence of factors: positive sentiment on the US-China trade front, a strengthening of the dollar making gold more expensive, and the end of the seasonal Diwali buying spree in India.

There was also a lack of visibility over investor positioning in the gold futures market as the US government shutdown made this data unavailable. Without these figures, speculators may be more likely to build abnormally large positions one way or another.

If a meeting between Trump and China’s President Xi Jinping proceeds and produces a headline trade deal or an ultimate truce, this could stop gold from resuming its record-breaking rally — as could a broader de-escalation of US tariffs. Bullion could also pull back further on an end to the US government shutdown, a continued dollar rally, a resolution to the legal proceedings against Fed Governor Lisa Cook, and a peace deal between Russia and Ukraine.

Investors could also opt to bank more of their gains. That said, their appetite for the precious metal may not have reached its limit just yet — total gold ETF holdings are still some way off their 2020 peak.

Central banks have been the most important pillar of support for gold’s bullish momentum, meaning they have the power to do the most damage if they trim their reserves. But there’s no indication any large holder is considering this.

The central banks of developed economies have sold very little gold in recent decades compared to the 1990s, when persistent sales sent bullion prices down by more than a quarter over the decade. Amid concerns that those uncoordinated sales were destabilizing the market, the first Central Bank Gold Agreement was struck in 1999, under which signatories agreed to limit their collective sales of bullion.

Does gold being a physical asset cause any issues for investors?

Owning gold typically isn’t free. Because it’s a physical object, holders have to pay for storage, security and insurance.

Investors buying gold bars and coins will usually pay a premium over the spot price. There can be geographic price differentials, too, and traders take advantage of these arbitrage opportunities.

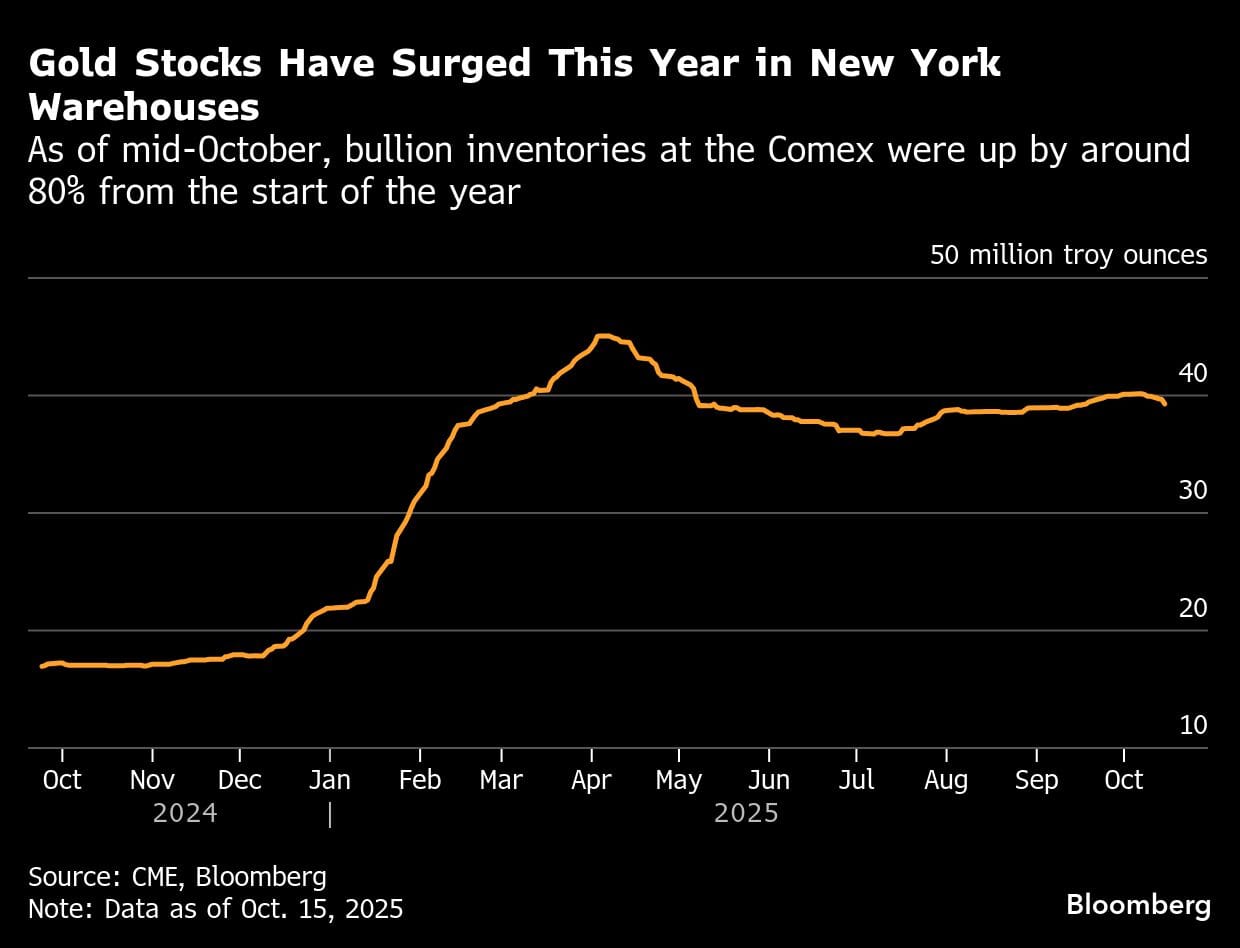

That’s what happened earlier this year when fears that Trump could introduce tariffs on bullion imports pushed gold futures on New York’s Comex significantly above spot prices in London. There was a worldwide dash among those in possession of the physical metal to shift it to the US to capture the large premium and potentially hundreds of millions of dollars in profit.

That arbitrage trade came to an abrupt halt in April, when the Trump administration indicated that bullion would be exempt from duties. The market had a brief scare that this wouldn’t be the case, after US Customs and Border Protection said in August that certain gold bars are subject to Trump’s “reciprocal tariffs.” However, Trump himself then weighed in to say that gold wouldn’t face import taxes.

Gold is usually relatively simple to shift, stashed away in the cargo holds of commercial aircraft, unbeknown to the holiday and business travelers in the cabin above. But it’s not as straightforward as loading up a jet from Heathrow Airport to JFK thanks to a quirk in the global gold market: different size requirements. In London, 400-ounce bars are the standard, while for Comex contracts, traders must deliver 100-ounce or 1-kilogram bars.

That means bullion being sent to Comex warehouses has to first go to refiners in Switzerland to be melted down and recast to the correct dimensions, before journeying on to the US. This creates a bottleneck when there’s a particular rush to rejig the location of bullion stocks.

(Reporting by Jack Ryan and Yvonne Yue Li)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.