Singapore: Oil resumed its decline as the fallout from Russia’s war in Ukraine and China’s Covid-19 resurgence continued to rattle the market.

West Texas Intermediate futures have whipsawed wildly this week, tumbling below $99 a barrel and climbing as high as $110. Investors are weighing a raft of news, from shrinking US fuel stockpiles ahead of the summer driving season, rising inflation and the outlook for China’s virus lockdowns.

Adding further volatility is uncertainty about the European Union’s proposed ban on Russian oil imports. The EU had already softened potential penalties but Hungary has hardened its stance against the embargo. The International Energy Agency will provide its snapshot of the overall oil market later Thursday.

“It’s just a very volatile market within a relatively tight $100-to-$110 a barrel range,” said Stephen Innes, managing parter at SPI Asset Management Pte. “Oil prices are likely to remain capped until China either changes Covid policy or shifts out of lockdown.”

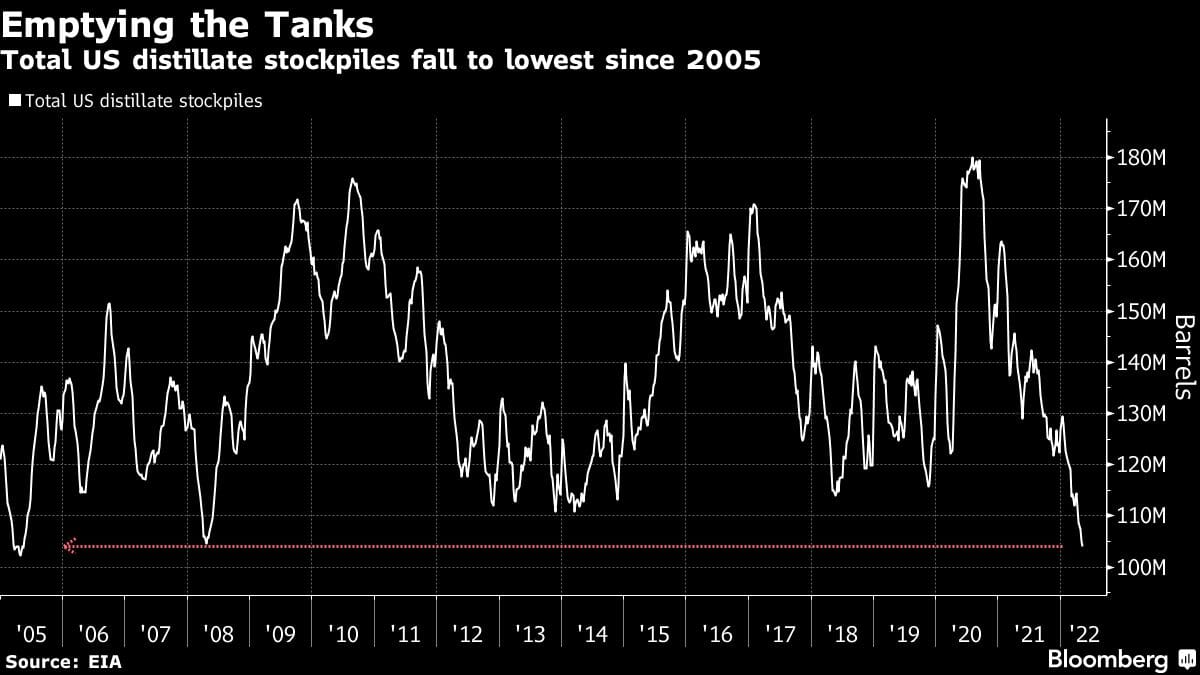

Oil jumped about 6% on Wednesday after tumbling around 9% over the previous two sessions. US distillate stockpiles — a category that includes diesel — fell to the lowest level since 2005 last week, while gasoline supplies declined for a sixth week, according to the Energy Information Administration.

While domestic fuel demand fell last week, inventories are shrinking as US refiners export more products to cover a shortfall of Russian barrels. Buyers are shunning energy from the OPEC+ producer due to its invasion of Ukraine, which has upended trade flows and led to higher volatility in the oil market.

Russia’s invasion has fanned global inflation, driving up the cost of everything from food to fuels. The US consumer-price index for April increased more than analysts were expecting, raising the case for aggressive monetary tightening. American retail gasoline and diesel prices are already at records.

US distillate inventories fell by 913,000 barrels last week to 104 million barrels, according to EIA data released on Wednesday. Crude stockpiles rose by 8.5 million barrels. The US driving season starts at the end of this month. — Bloomberg

Also read: What are wet bulb temperatures, and why they probably won’t cross 35°C long enough to be lethal