The global oil industry is on its knees. Without action from producers to reduce supply, the situation will get much worse as the world runs out of places to store crude pumped out of the ground that nobody wants. A big production cut could delay reaching that breaking point, perhaps for long enough for demand to start to pick up again. But it won’t happen unless everybody plays their part.

The oil market got quite in a flap over President Donald Trump’s Thursday tweet that Saudi Arabia and Russia had agreed to cut production. But it’s quite clear from subsequent comments out of Riyadh and Moscow that nobody had pledged any such cuts; not of 15 million barrels, nor 10 million, nor even anything at all. In fact, the leaders of Russia and Saudi Arabia hadn’t even spoken with each other. Perhaps Trump was just getting his ducks in a row — setting up a fictional promise of cuts that wouldn’t materialize, which would give him an excuse to resurrect his Tariff Man persona and slap duties on imports of their oil into the U.S.

But it’s clear that something has shifted, even if it’s only in tone. Saudi Arabia is now audaciously seeking a global deal to cut oil production, not just by the Organization for Petroleum Exporting Countries, nor only with the extended OPEC+ coalition that includes Russia. It did so by calling for “an urgent meeting” aimed “at reaching a fair agreement to restore the desired balance of oil markets,” among the OPEC+ group “and other countries.”

That last bit is crucial. The kingdom led by Crown Prince Mohammed bin Salman is making painfully clear that the sacrifice must be shared or Saudi Arabia will take no part in it at all. There can be no free-riders.

It’s a tactic the country has used before, and the current nosedive in oil prices shows it stood by its word. The kingdom was the driving force behind cuts proposed at the March meeting of OPEC+ oil ministers. But it said then, as it’s saying now, that it would only make them if others joined in too. The only thing that has changed in the last month is that the “others” has now become an even bigger group that needs to include all of the world’s big oil producers.

Here’s what Saudi Arabia needs to do.

At the virtual meeting of oil producers, now tentatively pushed back to Thursday from Monday, it should give its counterparts — including those who don’t show up — a clear binary choice and an unequivocal ultimatum. Either they agree to strict, enforced, observable output curbs for everybody and Saudi Arabia will join in by reducing its own output to, say, 8.5 million barrels a day (I picked that number out of the air). Or Saudi Arabia should make clear it will continue to pump 12.3 million barrels a day, which would result in prices collapsing to single digits to force oil off the market.

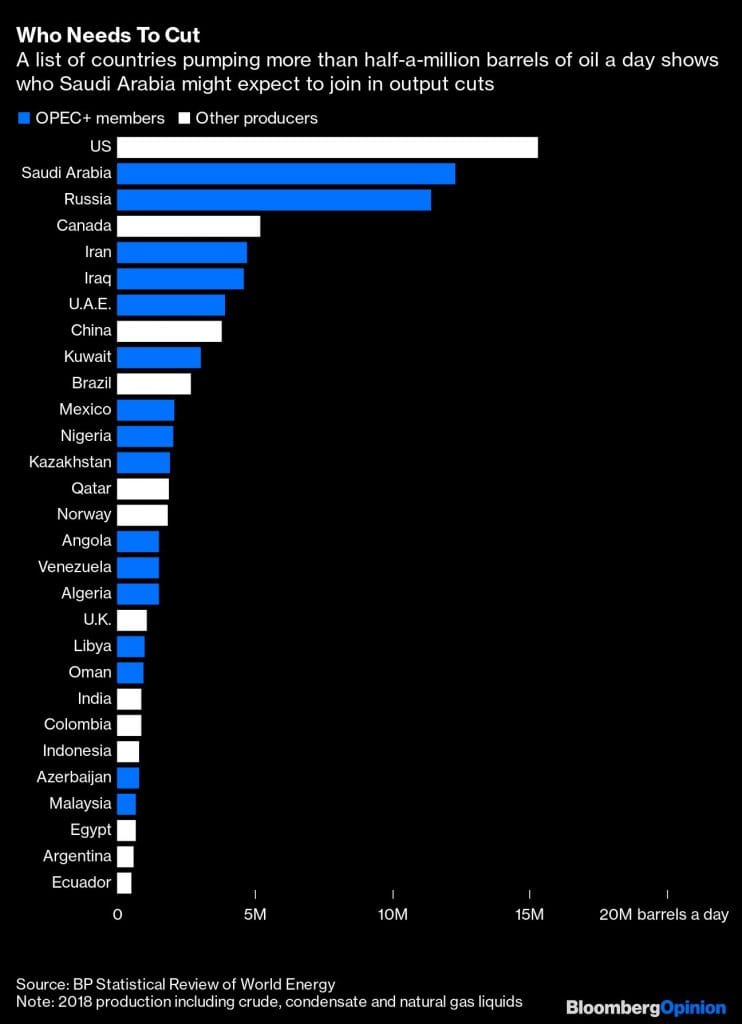

The kingdom could even go so far as to include a list of all the countries it would require to take part. The chart above suggests who some of those required participants might be. Alongside the U.S. and the OPEC+ countries, it includes Canada, China, Brazil, Qatar, Norway and the U.K., each of whom pumps more than 1 million barrels a day.

Sure, there are obstacles to be overcome. Some on that list may be more willing to participate than others. But the alternative will hurt the oil industries of the countries on that list much more than they will Saudi Arabia. And such a collapse in prices may happen anyway if the cut isn’t big enough, or is delayed.

I know lots of people argue that Saudi Arabia needs higher oil prices than shale producers to fund its budget. But I’ve never been a big fan of using budgetary break-even prices for determining the relative pain that would be experienced by oil-producers. Budgets, to some extent, reflect price expectations. If you expect oil to be $60 a barrel, say, you prepare a budget based on the level of income that implies. If that price is not achieved, you can cut expenditure, draw on reserves, or borrow — all options that remain open to Saudi Arabia.

The kingdom will, though, face the same storage problem as everybody else. It shouldn’t go unnoticed that Saudi Arabia said it would boost exports in May to 10.6 million barrels a day because its own refineries didn’t want as much crude because of the drop in demand. Refiners elsewhere may not want it either. Saudi Arabia will probably have to rebuild its own stockpiles, which it has drawn down during the past four years, but it has more than twice as much room to do so than is available in the U.S. Strategic Petroleum Reserve.

Finally, Saudi Arabia should make clear that this is a short-term solution crafted for an extraordinary situation. It must avoid the temptation of tying any deal into a long-term supply management initiative. Anything that whiffs of an OPEC+ extension won’t fly with the U.S. or others. This is not OPEC++. It has to be a time-limited, one-off solution to the extreme situation the global oil industry is facing as a result of the world locking down to fight the Covid-19 virus. Once things pick up again — as they will — it will be back to business as usual, and a return to the dash for market share. –Bloomberg

Also read: Global oil war will continue as Putin won’t submit to Saudi price ‘blackmail’