As gold pushed higher and higher into uncharted territory in recent weeks, even die-hard enthusiasts warned that the rapid rally was getting out of hand. Now, with prices plunging, they’re keeping faith that bullion’s longer-term bull market isn’t over yet.

Kevin Smith, who runs the $420 million Crescat Capital hedge fund, has been bullish on gold since 2019, when prices were trading below $1,500 an ounce. After a 6.5% selloff over the past two days that’s taken prices near $4,000, he says it’s still a buy.

Investor qualms over ballooning budget deficits have been just the latest driver in a flight to gold’s safety that saw the precious metal break one record after the other — lately luring frothier sources of demand such as retail speculators. Longtime investors like Smith view this week’s pullback as a healthy correction, saying many of the factors that propelled prices are still in place.

“It got ahead of itself, no doubt about it,” he said by phone. “Given the still unsustainable debt and deficit imbalances that we have in the US and most of the developed world, it’s still a very favorable fundamental backdrop.”

A long-standing driver underpinning gold’s relentless rally has been a wave of central bank buying. Most agree that’s what helped push gold past $3,500 last month, and there’s a widespread belief throughout the industry that those purchases will stop prices from falling too far as shorter-term investors pull out of the market.

“The weaker hands — institutional flows and retail flows — have only really been in the market for six weeks or so. Most of this rally has been strong hands,” said Ross Norman, an industry veteran who runs Metals Daily, a pricing and analysis website. “I think some of those weak hands have definitely been taken out now.”

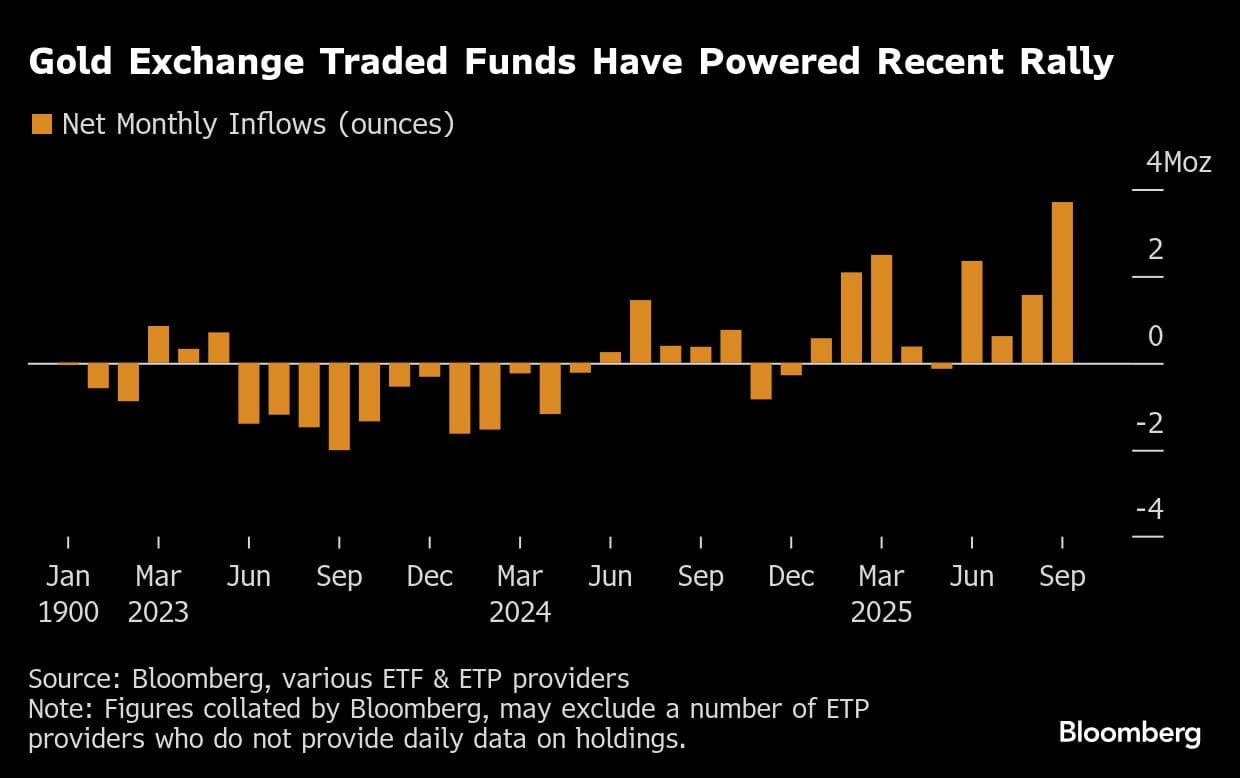

The volume of gold held by exchange-traded funds has grown by 4.2 million ounces in the past five weeks to almost 100 million, extending an increase since late May, according to data compiled by Bloomberg. But global central banks have been on a steady buildup of their bullion reserves since the financial crisis, and they doubled the pace of their buying after the US and allies froze Russian assets in 2022.

Since the invasion of Ukraine “we saw a big step change in central bank buying, and that’s been obviously the key underlying long-term buyer in the market since that time,” Andrew Matthews, head of precious metals distribution for UBS Group AG, said in an interview early on Tuesday, before the selloff began. “We feel that will continue to be the case.”

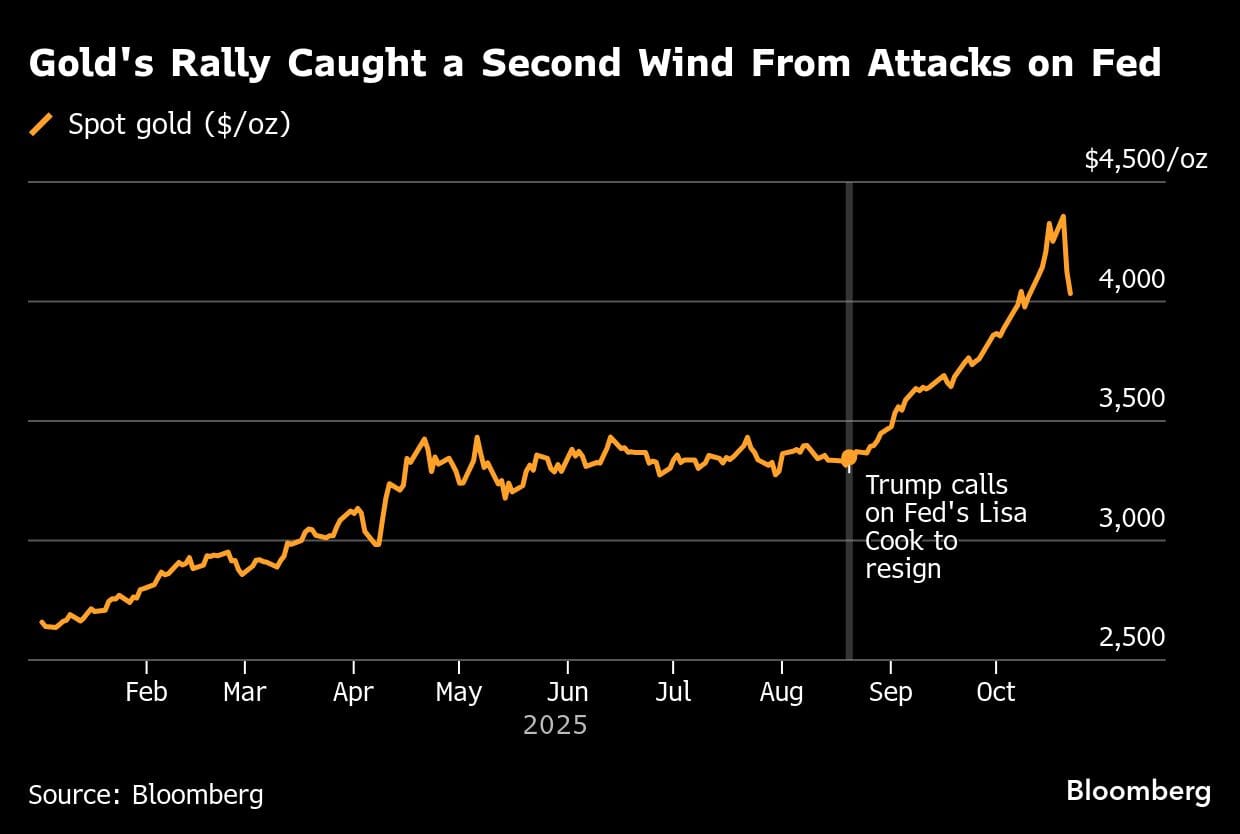

This year, US President Donald Trump’s aggressive moves to reshape global trade and heightened geopolitical uncertainty have added fuel to the rally. The outlook for Federal Reserve rate cuts also boosted gold’s appeal against assets that bare interest, while Trump’s threats to the central bank’s independence furthered its appeal as a safe haven.

Then came the “debasement trade,” a loose term describing the retreat from sovereign debt and the currencies they are denominated in, over fears their value will be eroded over time. That led retail investors to take a bigger role in recent months. Inflows into bullion backed exchange-traded products, popular with Western institutional and retail investors, soared, as did the volume of options traded. Pictures showing queues of buyers lining up outside bullion retailers went viral on social media.

“For many institutional investors that was the last straw,” Jane Foley, head of currency strategy at Rabobank, told Bloomberg TV. “I think it is going to struggle, quite clearly, to match those recent highs in the near future.”

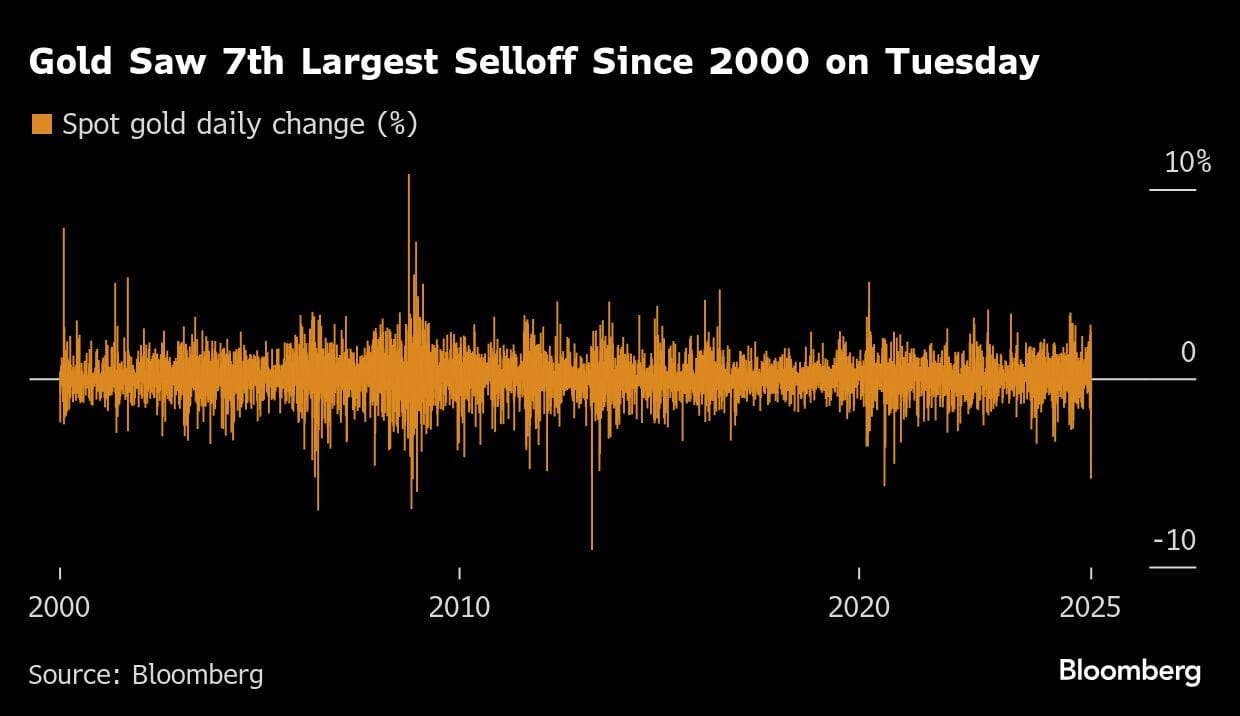

Bullion’s scorching rally came to an abrupt halt on Tuesday after a series of technical indicators signaled that too many people had bought in too short a period, elevating chances of a correction. Spot gold plunged as much as 6.3%, the most since 2013.

That day gold faced several headwinds — the dollar ticked higher, demand associated with the Indian festive period came to an end, and the US-China trade standoff was showing some signs of easing.

But for Jerry Prior, chief executive officer of the $1.7 billion Mount Lucas Management hedge fund, the long-term drivers for gold are “firmly in place.” Prior expects prices to trade in a tight range, with a possible drop to about $4,000 before buying returns on haven demand and economic data.

The retreat in prices this week, while huge for such a steady asset, has still only brought gold back to where it was little more than a week ago. The precious metal is still up this month, and has gained about 55% this year.

The selloff is likely “some form of consolidation, it is a large drop, but we are down to a one-week low,” Giovanni Staunovo, commodity strategist at UBS said on Tuesday. “I still think the structural case for gold remains, but some form of consolidation is likely healthy for the metal.”

(Reporting by Jack Ryan, Yvonne Yue Li and Sybilla Gross)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.