New Delhi: India’s next connectivity milestone, 6G, will play out over an invisible resource that underpins every mobile call, video stream and internet search: the radio spectrum.

Reliance Jio, Bharti Airtel and Vodafone Idea, along with their industry body, the Cellular Operators Association of India (COAI), have urged the government to auction the entire 1,200MHz of the 6GHz band exclusively for licensed mobile use. Their pitch to the Telecom Regulatory Authority of India (TRAI) warns that splitting this spectrum—by reserving portions for Wi-Fi and other unlicensed services—could undermine India’s 6G ambitions.

The decision could potentially shape the country’s digital infrastructure for decades.

Understanding the spectrum foundation

Spectrum is a shared natural resource of invisible electromagnetic waves that carry everything from FM radio broadcasts to high-speed mobile data. Every wireless device—from television remotes to Bluetooth headsets—uses a specific slice of these radio frequencies.

It operates like a vast data superhighway with different lanes engineered for specific traffic.

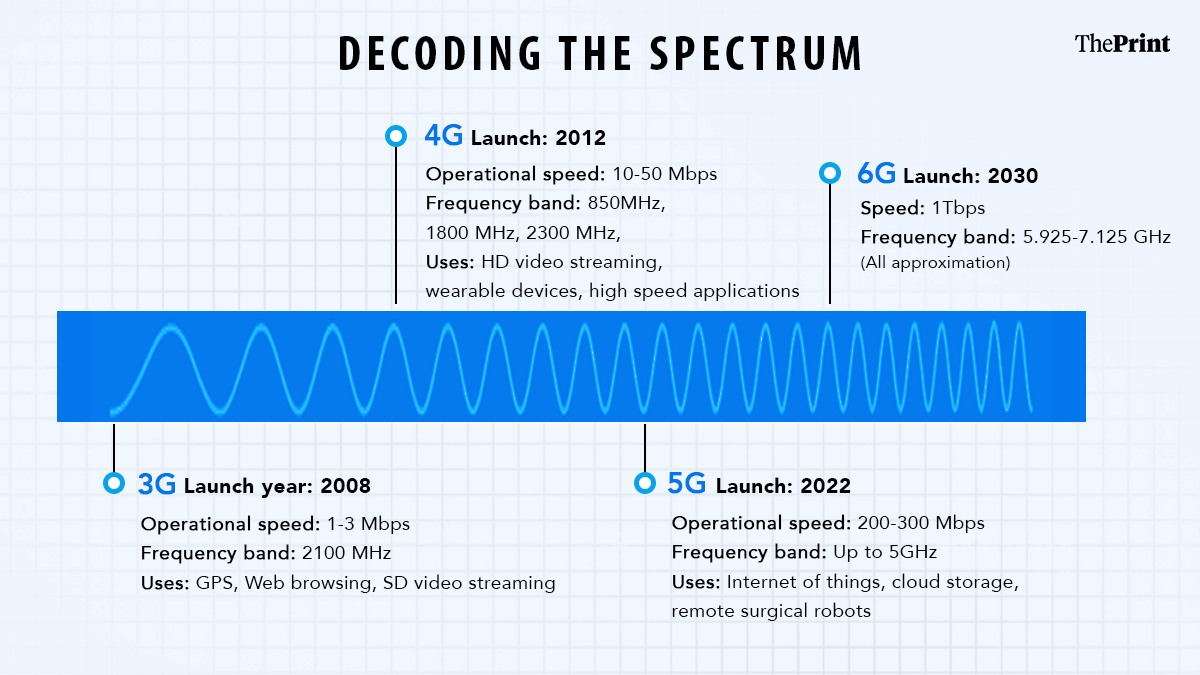

Low-frequency bands below 1 GHz function as broad, steady lanes optimised for long-range coverage and robust penetration, making them ideal for legacy systems like FM radio. Mid-band frequencies between 1 GHz and 6 GHz strike a balance between coverage and capacity, forming the workhorse layer for 4G and 5G networks. At the upper end, millimeter-wave bands serve as high-speed express lanes, delivering gigabit data.

The key trade-off in wireless communication lies between frequency, speed and coverage.

Higher frequencies carry data much faster, enabling ultra-high speeds and low latency, but their coverage shrinks because these signals struggle to travel far or penetrate obstacles like buildings and trees. Lower frequencies travel long distances and blanket wider areas but carry less data at slower speeds.

Think of spectrum frequencies as different types of runners. High-frequency signals resemble sprinters—incredibly fast but covering only short distances before losing strength. They transmit massive data volumes at lightning speed, yet their range remains limited and they struggle passing through walls or trees.

Low-frequency signals perform like marathon runners — slower but steady and long-lasting, travelling much farther and requiring fewer towers to maintain coverage. High-frequency bands, by contrast, demand many more cell sites placed close together, especially in cities where buildings and density block signals.

The 5G-to-6G evolution

5G delivered data speeds reaching up to 10 gigabits per second and slashed latency to as low as 1 millisecond, enabling real-time communication that powered the Internet of Things, smart cities and autonomous vehicles. Devices could communicate almost instantly, supporting everything from intelligent traffic systems to remote-controlled machinery.

But as digital demands grow more complex, even 5G shows limitations. Operating in the terahertz range of the spectrum, 6G aims to deliver data speeds of up to 1 terabit per second—roughly 100 times faster than 5G—while cutting latency to below a millisecond. In practical terms, users could download 4K films in seconds, stream 8K video without buffering, or enable remote surgery and immersive virtual reality with almost zero delay.

But terahertz waves face significant constraints. They cannot travel far and are easily blocked by walls or trees, which means 6G will require denser networks of small, intelligent transmitters guided by artificial intelligence to manage data traffic in real time.

If 5G made real-time interaction possible, 6G promises networks so responsive and adaptive that they can function as a digital nervous system.

The allocation debate

Spectrum as a resource is owned by the government in India. The Department of Telecommunications (DoT) sets policy, conducts auctions and grants licences, while TRAI advises on pricing and allocation.

Most telecom spectrum is auctioned to operators who bid for specific frequency blocks within service areas. Winners pay the bid amount and receive spectrum usage rights for a fixed term, usually 20 years.

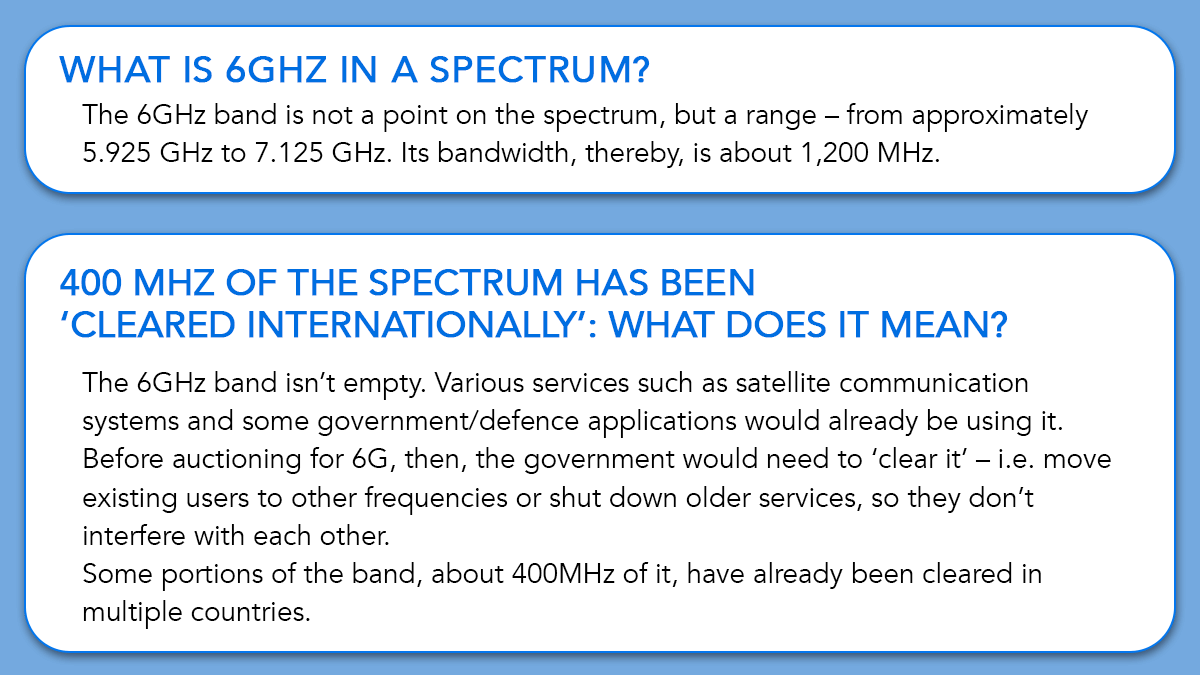

The current TRAI consultation proposes splitting the 6GHz band: the upper 700MHz for licensed mobile operators like Jio, Airtel and Vodafone Idea, and the lower 500MHz for unlicensed use, including Wi-Fi and enterprise connectivity. Simply put, mobile data flows through cell towers operating on licensed spectrum, and home Wi-Fi runs on unlicensed spectrum that telcos do not pay for.

Telecom operators have pushed back against this split in the 6G band. Their core argument is that India operates as a mobile-first internet country. Most users depend on mobile networks rather than fibre broadband, placing heavy traffic loads on each cell tower.

Allocating the entire 6GHz band for licensed use, they argue, would help build robust, high-capacity 6G networks capable of handling data demands for decades.

The industry has also requested extending spectrum rights validity from 20 to 40 years, arguing that this would enable better financial planning and reduce borrowing costs for the massive infrastructure investments 6G deployment requires.

Though the full 6G rollout likely will not arrive until 2030, telcos have proposed auctioning 400MHz of the 6GHz band — the portion already cleared internationally — immediately, allowing network expansion to begin without waiting for full spectrum clearance.

Technical challenges

Part of the 6GHz band is currently used by satellite communication systems transmitting signals to and from space. This overlap means sharing the same frequency range for mobile towers could cause interference. Telcos are urging the government to conduct India-specific coexistence tests to determine how both systems can operate side by side, possibly by defining power and proximity limits.

Industry players also want India to align its 6G roadmap with the 3GPP n104 band plan — the international blueprint for how the 6GHz band is divided, tuned and synchronised across equipment. They recommend continuing with existing timing and coordination methods to ensure smooth inter-operability between legacy and future systems.

6G around the World

Internationally, 6G remains in the research-and-development stage, with no commercial networks yet in operation. Key players such as South Korea, Japan and the US are investing heavily, and are considered frontrunners in the race that could help shape the standards and infrastructure of this technology.

India, too, is positioning itself as a global participant. The government’s Bharat 6G Vision, announced in 2023, sets the target of making India a frontline player in designing and deploying 6G by 2030. To advance this, it created the Bharat 6G Alliance, bringing together academia, industry, standards bodies, and R&D institutions to build a coordinated national strategy.

(Edited by Prerna Madan)

Also watch: India’s 6G leap: Researchers have three years to deliver data speeds up to one terabyte per second