On Wednesday, the CEO and director of the Bank of Maharashtra were booked in a Rs 3,000-crore default case involving real estate developer DSK Group. This is the most recent in a spate of arrests made by the CBI and other investigative agencies for alleged corruption.

The Indian Banks’ Association has condemned the chargesheets and arrests of bankers and has called an emergency meeting in Mumbai Friday to discuss the matter.

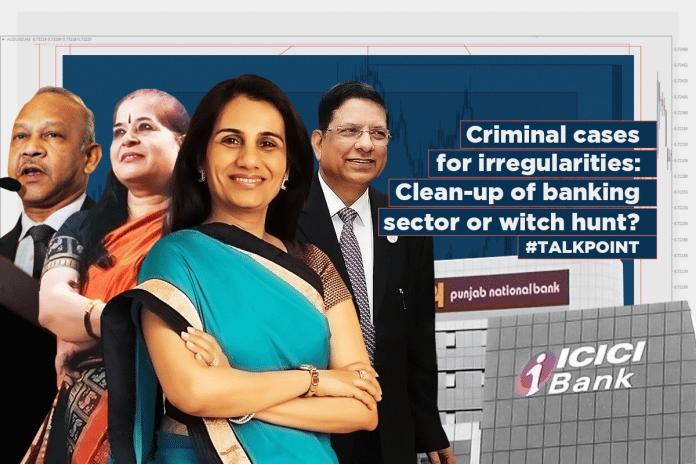

ThePrint asks – Criminal cases for irregularities – Clean up of banking sector or witch hunt?

Fear psychosis won’t work, banks need to lend

Vinod Rai

Vinod Rai

Former CAG and former BBB chairman

This witch hunt is not a good thing and will not help in resolving the situation. It is true that NPAs have risen to alarming levels and this needs to be addressed at the earliest. We need to have a clean banking system. It is absolutely critical to give a free hand to bankers to be able to resolve the situation.

Having said that, there are a few instances involving wilful defaulters and some pertaining to alleged collusion between bankers and borrowers.

Those cases need to be identified and handled separately and there should be zero tolerance there. The message needs to go out clear that culprits cannot and should not be allowed to go scot-free. That is equally important. The enforcement agencies need to handle these cases with utmost sincerity.

However, fear psychosis will not work. Banks will need to lend and carry out their regular banking activities. They need freedom and autonomy for the same. Bankers must be allowed to take prudent and timely decisions. They need to be trusted. They need to be given that confidence.

The IBA has asked the Department of Financial Services (DFS) to intervene. But I don’t think the DFS can play a very large role in this issue.

It’s a much-needed clean-up, but more needs to be done

C. H. Venkatachalam

C. H. Venkatachalam

General Secretary, AIBEA

What the CBI is doing is not unexpected. If there is corruption, there will be such raids. However, bankers accepting bribes should not be the only target. This is just one step in cleaning the banking system.

There are sinners in banks, who must be weeded out, but let us also think about the need to punish those giving bribes. In the Syndicate Bank-Bhushan Steel scandal, the banking executive was punished. However, Bhushan Steel got off scot-free. We must consider the other side of the coin as well.

Also, why not clean up the political nexus too? Loans aren’t just conferred because of bribes. Oftentimes, there are political pressures that necessitate them as well.

Then, there is laxity on part of the RBI. All loans are sanctioned with their knowledge and monitored by them. All four steps need to be monitored for proper reform.

The CBI must target corrupt people, but not selectively. Why not go after the likes of Nirav Modi and Vijay Mallya?

We need stern reforms to recover bad loans and strengthen the public banking system. That is the larger need of the hour. Priority must be given to the recovery of bad loans if we are to fix our banking system.

Corporate credit needs are growing, but the bankers’ attention is on facing investigations instead

Ashvin Parekh

Ashvin Parekh

Banking expert and managing partner, consultancy firm APAS

It is very unfortunate that the banking system has to address so many issues all at the same time. There are signs of the economy reviving and the credit needs for the corporates are growing. But the banking management’s attention has been drawn to facing investigations instead.

It certainly will have a devastating effect on the morale of the bankers. It may perhaps discourage them from making business decisions.

I wouldn’t use the word witchhunt. To my mind, it is important to understand whether there is a pattern to the borrowers and their connection with the political system, or the government or, other influential elements.

Instead of the system directing its attention to investigate bankers, I suppose larger focus should be placed on recovering the defaulters’ assets. They should launch investigations in areas where the funds are siphoned by the defaulters rather than focusing on punishing bankers.

Time and again, we have seen the management bandwidth of the banking system being diverted to areas including financial inclusion, Jan Dhan, demonestisation, and then on recovery. Recovery has become the last priority whereas it should be the first.

I suppose it is important for the government and the regulators to perhaps strategise and channelize such efforts. Instead of opening up too many fronts, there should be a planned effort to utilize the management bandwidth in more effective manner.

Investigations may impact the direction of how the management bandwidth is to be utilized.

Government is clueless about dealing with financial crimes

Debashis Basu

Debashis Basu

Co-founder, Moneylife.in

Opinions on such matters differ from case to case. However, in this case the actions taken by the government are out of hand. It has turned into a witch hunt. It is partly political since the 2019 elections are around the corner and the government wants to show that it is going after corrupt bankers.

This has repeatedly happened in India. First there is a complete failure of governance, and then the system comes to the rescue. If the government was divorced from the happenings in these banks it would be one thing, but the government is a major shareholder in most of these banks.

The 1992 scam comes to my mind wherein a lot of excesses were reported. Innocent people were allegedly targeted. Even today, courts that were set up to resolve a 26-year-old issue are functional. Bankers are behind bars and several innocent people took a hit.

Today, there is a collapse of governance. After having failed to efficiently run these banks and punish or reward participants, the government is mindlessly targeting people. The present CEO of Maharashtra bank isn’t the one who sanctioned the loan. Why has he been picked up?

It just goes to show that the government is clueless on how to deal with financial crimes. There is no in-built system of checks and balances. They are just doing this to show that they are taking some action. This is lawlessness.

We have managed to corrupt every single institution and every single process. The long-term solution is privatisation but it must be done thoughtfully. Also, experts like P. J. Nayak have elaborated on what needs to be done. If don’t implement what experts suggest, we will see more of the same.

(As told to Deeksha Bhardwaj)

Witch hunt will prompt bankers to not disclose fresh NPAs

Mahua Venkatesh

Mahua Venkatesh

Associate Editor

The aggression by the CBI and other enforcement authorities in dealing with bankers is leading to an unprecedented crisis-like situation instead of resolving matters. The spate of arrests and chargesheets in the last few months has only given rise to an environment of utter fear, discount and anger among bankers.

Banks have to increase lending to ensure growth, and the business of lending will always come with an element of risk. If the government wanted to give full autonomy to bankers in carrying out their operations, they need to be allowed to take calculated risks.

True, there has been a surge in the NPA level and there have been instances where borrowers such as Vijay Mallya and Nirav Modi have played foul, but to believe each defaulter is a fraudster is a cardinal mistake.

Often an account can become non-performing for genuine reasons too, and this needs to be taken into account. The witch hunt will also prompt bankers to not disclose fresh NPAs, which will lead to further complications.

A banker has to be trusted and s/he needs to be given a fair amount of freedom to take decisions without fear. With this witch hunt, loans will not come easy and low credit would eventually impact economic growth. At a time, when the government needs to take all measures to boost growth and economic activity in the country, banks’ aversion to lend could have far-reaching consequences.

The Indian Banks’ Association (IBA) has already registered its concern over the matter, but it is time for the government to intervene. It needs to act fast before the situation goes out of control.

Compiled by Mahua Venkatesh and Deeksha Bhardwaj.