Wishing for better news on a joyous occasion like Holi is, unfortunately, misplaced as the Sensex hits an all-time-low since 1991 and dominates the headlines. And as crude oil prices crash, newspapers disagree on whether or not this is a good thing for India.

The coronavirus cases is still the big story of the day, as the numbers continue to increase worldwide and in India.

Politics resurface on Page 1 with the Uttar Pradesh government being slammed by the Allahabad High Court for its controversial hoardings in Lucknow. And the Congress state government in Madhya Pradesh totters on the brink this festival day.

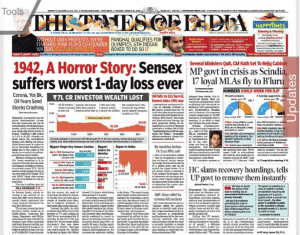

The Times of India calls it “1942, A Horror Story” as Sensex suffers worst loss in history, “tumbling down to 1,942 points” amid “the coronavirus impact and sliding oil prices. Dalal Street caved in under fears of financial instability in India due to the crisis at Yes Bank.”

“MP govt in crisis as Scindia, 17 loyal MLAs fly to B’luru” reads the second lead’s headline as overnight the “15-month-old Kamal Nath government plunged into crisis”.

Another report (“HC slams recovery hoardings, tells UP govt to remove them instantly”) notes how “The Allahabad high court on Monday ordered immediate removal of hoardings carrying names, address and photographs of anti-CAA protesters against whom recovery notices had earlier been served for allegedly damaging private and public properties.”

And a tragic tale of a love gone terribly wrong is the anchor story — “ Youth enters east Delhi flat, kills ex-girlfriend & her mom”. The horrifying murder took place because “Samrita, who was interning at a five-star hotel in Lutyens’ Delhi, had ended her relationship with Nagar but he hadn’t reconciled with the break-up”.

The must-read here is the slump in crude oil prices — the lowest ever since 1991. The paper calls this a “silver lining” and says this will help “ease pressure on the current account deficit and enable the government to improve its fiscal health if it is able to raise duties”.

The must-read here is the slump in crude oil prices — the lowest ever since 1991. The paper calls this a “silver lining” and says this will help “ease pressure on the current account deficit and enable the government to improve its fiscal health if it is able to raise duties”.

Also, pay attention to the exclusive report which offers some hope in the treatment of the deadly virus: ‘First time in India, anti-HIV drugs used on Italian couple with coronavirus in Jaipur’ explains that antiretroviral or HIV drugs were used to treat the Italian couple. The report quotes Health Minister Harsh Vardhan who said, “Yes, ICMR (Indian Council of Medical Research) has taken approval for the second line HIV drugs on COVID patients.”

The monsoon may be far off on the horizon, but some people believe in the motto, be prepared. The report “Monsoon months away, fearful Kerala prepares” describes how with the southwest monsoons, three months away, “scores of residents in flood-prone areas of Kerala are marking a new addition to their parking slots at home alongside two-wheelers and cars: small fibre-glass canoes”. This after their lives were “battered” by floods over the last two years.

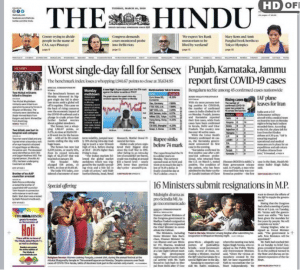

Like the other newspapers, Hindustan Times leads with the Sensex drop (“Bloodbath on Dalal St: Sensex down 1.9K pts”). The paper notes, “The Indian stock market was hazardously poised, halfway between a correction and a bear market at close on Monday,” adding that today being a holiday on account of Holi is a relief.

Like the other newspapers, Hindustan Times leads with the Sensex drop (“Bloodbath on Dalal St: Sensex down 1.9K pts”). The paper notes, “The Indian stock market was hazardously poised, halfway between a correction and a bear market at close on Monday,” adding that today being a holiday on account of Holi is a relief.

The coronavirus is spreading: “3 yr-old infected in Kerala; first cases in J&K, Punjab” reports that this case has taken the “total number of cases in the country to 44 and prompting top authorities to intensify preparations for a possible surge in the outbreak by beefing up isolation and quarantine facilities”.

An accompanying report reveals an “Italy link in 35 of India’s 44 corona cases”. Italian tourists account for 16 of the 44 corona positive cases as the story identifies the country of pasta and pizza as the “superspreader”.

Developments in the Yes Bank saga make the anchor — “CBI raids 7 places, issues look-out circular” notes that “seven premises in Mumbai belonging to Rana Kapoor, his family members, and entities belonging to Kapil and Dheeraj Wadhawan as it deepened its investigation into whether Yes Bank’s founder and former chief benefited from loans given by the bank”.

Like Express, Hindu reports on the arrests made in connection to the Delhi riots (“Three men picked up by police in midnight swoop, families clueless”), but gives it much more importance. The report notes that those close to those arrested claim the innocence of the arrested men: “Their relatives claim they were guarding the area, especially a temple in the vicinity.”

The New Indian Express focuses on the crash in crude oil prices with a pun banner headline, “Oil roils markets”. But this brings little cheer to consumers, apparently: the report “Retail tariff doesn’t match price plunge” says although global crude prices have been decreasing over the years, “retail fuel prices instead of falling has shot up” as “the government has pocketed most of the gains through higher central and state levies”.

And “Why crash is not always good news”, observes that “the benefits of the price crash may remain elusive for India”. Quoting several analysts, the report notes that the benefits might be capped because of the “demand destruction caused by the Covid-19 outbreak”.

On the slump in markets, The Tribune notes how the “Covid scare has crippled travel industry in the region with over 95-98 per cent booking cancelled. A haunting detail in the report: “offices of tour operators wearing a desolate look, despite it being a peak period”.

On the slump in markets, The Tribune notes how the “Covid scare has crippled travel industry in the region with over 95-98 per cent booking cancelled. A haunting detail in the report: “offices of tour operators wearing a desolate look, despite it being a peak period”.

There’s an interesting anchor story about a truck driver’s son from Rohtak, who was chosen to represent India in the upcoming Olympic Games.

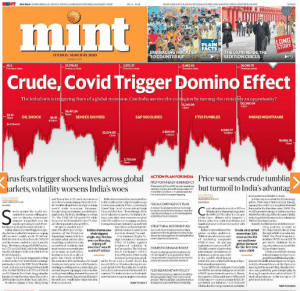

Although it may seem that Mint sees red in the crash in markets and crude oil prices, the paper indicates that while the slip in markets will worsen India’s woes, the price war could work to its advantage. Like Express, the paper notes in “Virus fears trigger shock waves…“ that “Indian shares saw their biggest single-day decline in absolute terms ever, wiping off investors’ wealth worth ₹7 trillion”. But while the crash in prices of crude oil has increased a risk of recessions, it “augurs well for the Indian economy”.

The paper still sounds an alarm in its flap noting the record drop in crude oil prices “could spark new global price war”. The explainer notes that the “low prices have implications for energy markets and the US, which has made heavy capital investments in the sector”.

The anchor story is about the findings of the probe into the crash of Ethiopian Airlines. According to the report, “software designed to stop an aerodynamic stall activated four times as Ethiopian Airlines pilots struggled to control their Boeing 737 Max 8”.

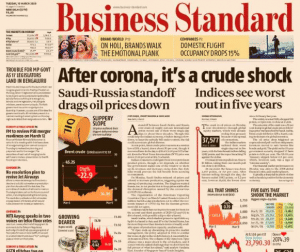

Business Standard also leads with the “Saudi-Russia standoff“ which has dragged oil prices down. The report notes that while this “could help the Indian economy, which is facing a slowdown, to keep the subsidy bill under control, the fall could accentuate global distress”.

There’s an anchor story based on an exclusive interview of Prashant Kumar, the “new man in charge of Yes Bank”. Kumar remained “hopeful that by Friday we will be able to lift the moratorium on withdrawals”.

RUSSIA AND SAUDI ARABIA LOOK TO BE IN WAR –LIKE CONDITIONS OVER CRUDE PRICES FOLLOWING NEW CORONAVIRUS ( COVID-19 ) OUTBREAK . THIS SCENARIO CAN LIKELY GENERATE CONCERN FOR THE U.S. ENERGY COMPANIES , CALLING UPON THE U.S. TO ADDRESS THE EMERGING CONCERN.

According to news reports in first week of March 2020 , new Coronavirus ( COVID-19 ) across the world looks to be fueling war-like conditions in the energy sector because falling oil prices can be attributed to it. Russian President Putin is reported to have rejected proposal of OPEC to cut production of crude oil. This has sparked oil price war between Russia and Saudi Arabia. The latter has responded by deciding to reduce the crude prices substantially and to increase the production. The energy titan Saudi Aramco has reportedly said that it will boost its supply of crude oil to 12.3 million barrels per day in April , flooding markets as it escalates a price war with Russia. Obviously , these circumstances can have the potential to give a push to trading war in energy sector in the Middle-East involving other countries like the US as well. In the opinion of some analysts , the scenario can impact the U.S. energy companies as well. In this context , it may be apt to refer readers to this Vedic astrology writer’s predictive alerts of 11 November 2019 through the article –“ Astrological probable alerts for 2020” – published on 1 January 2020 at wisdom-magazine.com/Article.aspx/5176/. The following text in the said article had on 11 November 2019 precisely alerted that which is coming to a pass in March 2020 :-

“ PREDICTIVE CONCLUSIONS.

4. The months of April to June , particularly May-June 2020 , look to be trending into the scene some serious landscapes. There could be some war or war-like conditions across the world , which the U.S. may be called upon to address. Sea or oil regions or such stuff seems to be calling attention. More care and appropriate strategy may be taken during April to June , particularly May-June in 2020 , against spill or loss of such stuff as are known for repugnant and repulsive smell through air passage. It may be alright to take pre-emptive measures against potential leakage or spill of oil-gas , dangerous energy resources in vulnerable regions or locations during said period of time. Economy may pose a huge concern during the said period. ………………Industrial or manufacturing engine could halt for the time being. Energy resources , aviation sector could be either hit or face serious issues and roadblocks.”