One of the biggest miracles of today’s software-eaten world is that technological disruption has spared the cross-border money transfer system, with the Brussels-based Society for Worldwide Interbank Financial Telecommunication, or Swift, at its core.

Swift is a system in which cross-border transactions often involve several intermediaries, and that means costs add up — to $25-35 per transaction, according to a 2018 report by Swift and management consultants McKinsey & Co. It’s also a system that barely works for smaller and poorer countries. And yet it’s still so dominant that, for example, the threat that Russia could be cut off from Swift, the way Iran has been, is a scary prospect for many Russians and the Kremlin alike.

It’s not just the support of the U.S., the issuer of the world’s dominant currency, that contributes to the miracle. Swift has pursued just enough technological innovation to make the search for alternatives relatively unattractive. Still, a big shock to the system could set off a chain reaction of change.

Swift, founded in 1973, has grown to encompass some 11,000 banks. Even oversimplified, its workflow is by no means seamless. When I want to make a bank transfer to my mother’s Moscow account, I notify my German bank, providing the Russian bank’s Swift code. My bank doesn’t have a direct business relationship with my mother’ s bank, so it uses Swift to message its correspondent bank in Russia, which, in turn, notifies my mother’s lender. At a certain point in the highly secured, reversible process, the currency conversion occurs. Only after the message exchange runs its course is the payment actually settled.

In reality, of course, I don’t use a bank for transfers to my mom these days. Instead, I send money via a fintech company that folds multiple payments into one Swift message or even nets out multiple transactions and only uses Swift to transfer the remaining balance. This fintech provider makes money by pocketing a little of the difference between the fee I would have paid a bank and the lower wholesale cost of aggregating transactions. But Swift is still indispensable to this business model, and the fintech is, essentially, just another intermediary — although it saves me money instead of increasing my costs.

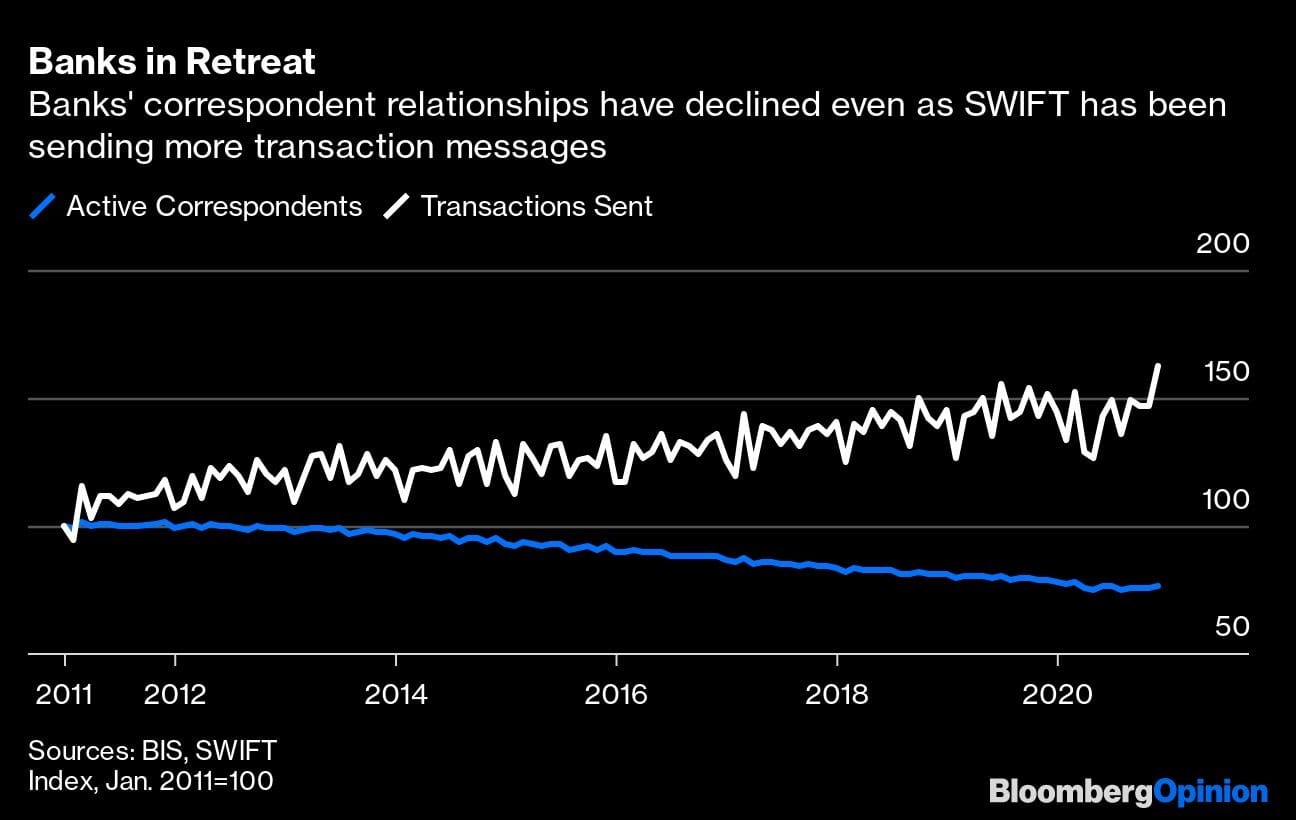

The correspondent relationships between banks that make Swift run have been in decline in recent years, even as Swift has handled more transactions. In a 2020 Bank of International Settlements paper, Tara Rice, Goetz von Peter and Codruta Boar listed several reasons for this, including stricter compliance standards — banks have pulled out of relationships in jurisdictions perceived as corrupt — and cost cuts. The smaller a country, the less profitable it is to maintain correspondents in it. The aggregators are another driver of the increased concentration of correspondent relationships.

Also read: Chinese Tiger and Russian Bear together again? Beijing has openly picked side in Ukraine

The BIS’s list of 50 countries with the biggest declines in the number of correspondent relationships between 2011 and 2020 makes interesting reading. For some poor, small or war-torn nations, of little interest to banks and payment aggregators alike, the drops have been accompanied by similar declines in transaction volume. These places have slid toward being the nation-state equivalents of unbanked individuals: Transfer chains have lengthened and become prohibitively expensive (and some Pacific islands are even unable to receive money the traditional way). According to the World Bank, in 2020, the cost of remittances to Syria reached 23%, just ahead of Angola’s 22%.

Other countries — such as the Baltics — have consciously shrunk their cross-border banking business in order to avoid the costs imposed by the U.S. and the European Union on facilitators of Russian corruption. Others appear to have shifted toward channels not covered by the BIS statistics. Ukraine, with high fintech and cryptocurrency penetration rates, is one example.

“Where banks are retreating, users may resort to less regulated or unregulated channels,” Rice, von Peter and Boar wrote.

Countries where banks are retreating, however, don’t set the tone in the global financial system. In bigger, wealthier nations, banks are happy enough with the way Swift has been innovating to speed up payments and increase the transaction and conversion fee transparency. There’s no reason for them to seek out alternatives — for example, to try blockchain-based solutions such as that offered by Ripple Labs Inc. at a negligible transaction cost. A big traditional player, MoneyGram International Inc., tried cautiously to partner with Ripple until the U.S. Securities and Exchange Commission charged Ripple with selling unregistered securities in 2020. The cryptocurrency company is fighting back, but the volume of transactions it facilitated last year only reached $10 billion, making it an insignificant rival to the Swift-based transfer industry.

Even the alternative financial messaging systems created by China (CIPS) and Russia (SPFS) aren’t built on the blockchain and are, to a large extent, Swift clones that compete with it only to the limited extent that the renminbi and the ruble compete with the U.S. dollar and the euro as international payment currencies.

Also read: India breaks its silence on Russia-Ukraine crisis, calls for ‘peaceful resolution’

As for central bank digital currencies, which are often named as a potential competitor to Swift, they are still in their infancy. Venezuela’s petro, the world’s first state-backed cryptocurrency, is more suitable for comic relief than for competition with the existing system, and Venezuelans prefer private cryptocurrencies to overcome their country’s lack of usable fiat money. Bigger central banks still haven’t come close to releasing digital currencies despite discussing them. The lack of coordination among these projects makes Swift’s claim to the role of payment facilitator for central bank digital money look realistic. Someone would need to make all the different currencies interoperable, and at least Swift has given serious thought to what would be required.

Creating a transparent, low-fee, fast system for international transfers, blockchain-based or along the lines of Visa Direct and Mastercard Send, neither of which relies on Swift, would be a great project for a group of developing nations — perhaps for an institution like the New Development Bank, set up by Brazil, Russia, India, China and South Africa in 2015. It might help poor countries lower remittance costs, and the developing world’s combined resource and industrial goods trade could give Russia and China the leverage necessary for the new system’s broader adoption, which would make it more resistant to possible U.S. sanctions.

Instead, America’s two big geopolitical rivals are looking into linking their Swift-like systems, a play that won’t help them much if Russia is booted from Swift, as U.S. politicians keep threatening. It’s hard to imagine the buyers of Russian hydrocarbons lining up to join CIPS or SPFS to pay in rubles or renminbi — the failure of Instex, the European Union’s puny attempt at Iran sanctions-busting, is a good indication of how that likely would turn out. In keeping with the generally poor quality of government projects under Vladimir Putin, Russia’s efforts so far haven’t reflected the potential of its engineering brains.

Perhaps a more urgent challenge is needed for the emergence of a truly disruptive alternative to Swift. If Russia is actually excluded from Swift and forced to come up with a workable solution quickly, it may even get help from some Western nations, not just from China. With goods exports of $341 billion last year (some 55% denominated in U.S. dollars and 29% in euros, based on three quarters of last year), and imports of $219 billion, Russia’s expulsion would represent a huge loss to too many trading partners.

That may help explain recent reports that Russia’s expulsion from SWIFT is not seriously on the table. While kicking it off would indeed cause severe pain to Russians and the Russian economy in the short term, it also could be too much of a shock to a Western-led payment system that, for all of Swift’s innovative drive, is no longer best suited to the modern world’s technological capabilities and needs. -Bloomberg

Also read: With Ukraine situation tense, India-Russia hold high-level talks as Moscow takes up UNSC chair