About a year ago, the National Statistical Office (NSO) of the Union government announced what was certainly a much-delayed and much-needed statistical reform. Instead of releasing about half a dozen versions to estimate India’s gross domestic product (GDP) and its components, the NSO decided to release only five such iterations. The wait for knowing the final estimate of India’s economic growth was, therefore, reduced from three years to two. The decision to reduce the number and duration of these revisions was implemented starting with the GDP data for 2021-22, with its final estimate becoming available by the end of February 2024, against the earlier wait that would have lasted until February 2025.

Statisticians across the spectrum welcomed this decision, though questions remained about why the timeline for releasing a given year’s GDP data and the number of revisions couldn’t be reduced further. After all, many countries finalise their GDP data with fewer iterations within a year. In India, one of the reasons for a three-year wait for producing the final GDP figure was that many state-owned enterprises and government agencies took a long time in supplying the final data on their economic activities. By February 2024, the NSO, it seemed, had succeeded in persuading these entities to expedite the process.

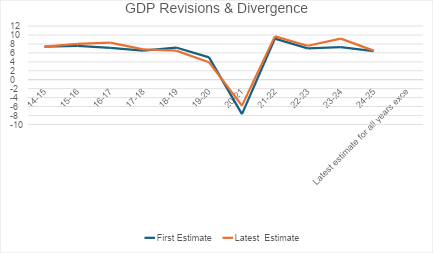

But has the NSO been able to address another key area of concern — a disturbing variation in the different GDP estimates for the same year? To be sure, this has been a cause for concern for years. As the accompanying chart shows, the variations over these GDP iterations have moved in both directions, with the final estimate being lower as well as higher than the first estimate. Since the launch of the new GDP series data in January 2015, when the base year was changed to 2011-12, the different iterations of growth figures for nine years from 2014-15 to 2022-23 reveal an intriguing trend.

During this period, the final growth number compared with the First Advance Estimate (FAE) improved by over 1.2 to 1.9 percentage points in two years (2016-17 and 2020-21), saw a marginal increase of 0.3 to 0.6 percentage points in four years (2015-16, 2017-18, 2021-22 and 2022-23), and a deterioration of 0.7 to 1.1 percentage points in two years (2018-19 and 2019-20). In only one year — 2014-15 — was there no divergence between the growth numbers in the FAE and the final estimate.

The government explanation for such divergence has invariably been that updates to data from many sectors caused these changes in the final estimates.

The sharp improvement in the final GDP number over the FAE for the Covid year of 2020-21 can perhaps be understood, as institutional capacity to furnish data on time was seriously constrained. But there could be no such justification for the data divergence of about half a percentage point in each of the following two years. Equally striking, if not puzzling, was the sharp upward revision of the GDP figure for the demonetisation year of 2016-17—from 7.1 per cent in the FAE to 8.3 per cent in the final estimate.

Also read: Govt has reduced time taken to finalise GDP data by an entire year. Here’s inside story of how

The political angle of India GDP revisions

The downward revision in GDP numbers in 2018-19 raises an interesting question, as this pertains to a period just before the general elections of 2019. The FAE of GDP in 2018-19 was released in January 2019, a few months before the elections, and was pegged at 7.2 per cent. Three years later, the final number showed the growth to be much lower at 6.5 per cent. A similar story was repeated in 2019-20, when the FAE of 5 per cent, released in January 2020, ended up at 3.9 per cent in the final estimate.

It would appear that the final GDP estimate is often higher than the FAE when the economy is in reasonably decent shape. The reverse happens when the economy is not doing well. Perhaps over-optimism in a year when the chips are down influences the economic agents to present or project numbers that eventually are not achieved because of economic headwinds. Critics will also argue that in national election years there could be a natural tendency, on the part of state-owned entities, to project a rosier growth prospect than what the ground reality may justify.

Whatever may be the reasons for such sharp divergences, they seem to be taking place quite consistently and irrespective of whether the year in question is one of strong or weak growth. That was once again borne out by last month’s release of the latest GDP numbers for 2023-24. In fact, the extent of divergence has increased, raising even more questions.

On February 28, 2025, the NSO released the First Revised Estimate (FRE) of GDP for 2023-24, which is the penultimate round of data releases before the final one. The FRE placed GDP growth for 2023-24 at 9.2 per cent, up from 8.2 per cent in the previous iteration—the Provisional Estimate released seven months earlier at the end of May 2024. And compared with the FAE of 7.3 per cent, released in January 2024, the FRE for GDP growth in 2023-24 was 1.9 percentage points higher. Even the Second Advance Estimate for 2024-25 showed GDP growth to be slightly higher at 6.5 per cent, compared to 6.4 per cent in the FAE.

Such sharp variations were attributed to upward revisions for both demand-side and supply-side components of GDP. For 2023-24, government consumption expenditure growth almost doubled (raising questions about why government consumption data should be revised with such a large variation). Similarly, private consumption expenditure growth also rose by over a percentage point. Interestingly, the manufacturing sector growth doubled along with an uptick in agricultural growth. Usually, the manufacturing sector data gets revised based on returns from the unorganised sector and medium as well as small industrial units. Does this mean a revival in the medium and small industrial sector? Note that these sharp revisions took place over just about a year and in four iterations of the GDP numbers.

From a public finance perspective, these revisions improved the Centre’s fiscal consolidation performance. Instead of 5.6 per cent of GDP, the fiscal deficit for 2023-24 was now lower at 5.5 per cent. And for 2024-25, the fiscal deficit was now further down from 4.8 per cent to 4.7 per cent of GDP, making the target of 4.4 per cent for 2025-26 look far less daunting.Even the Modi government’s average annual growth performance in its second term suddenly looked better—now close to 5 per cent, compared to 4.6 per cent based on earlier estimates.

These changes are now noticeable as the NSO has significantly revised its GDP estimates. Of course, some degree of revisions cannot be ruled out. But if the revisions are large enough to alter the assessment of the government’s growth performance or its fiscal consolidation record, then questions over data reliability will be raised, making the task of managing the economy more onerous and underlining the need for further reform of the country’s statistical system. If such reforms can lead to fewer revisions with smaller or very marginal variations over a shorter time period, then they should be prioritised without any delay.

AK Bhattacharya is the Editorial Director, Business Standard. He tweets @AshokAkaybee. Views are personal.