Is the world’s most bitterly contested coal mine finally getting the go-ahead?

After the opposition Labor party suffered heavy losses in coal-mining regions in Saturday’s Australian federal elections, the Carmichael project looks to be getting closer than ever to approval. In the view of the government’s resources minister Matt Canavan, the pit being developed by., a unit of Indian billionaire Gautam Adani’s business empire, is all systems go:

There’s a rarely discussed problem with this, though: The numbers on Carmichael don’t stack up – and haven’t for most of the past decade, despite the mine becoming a high-profile proxy for broader fights over fossil fuels among politicians, lobbyists and environmentalists. (An Adani spokeswoman said our assumptions were incorrect, but didn’t dispute any specific figures or provide alternative ones. “The Carmichael Project economics are strong and are projected to remain strong,” she wrote.)

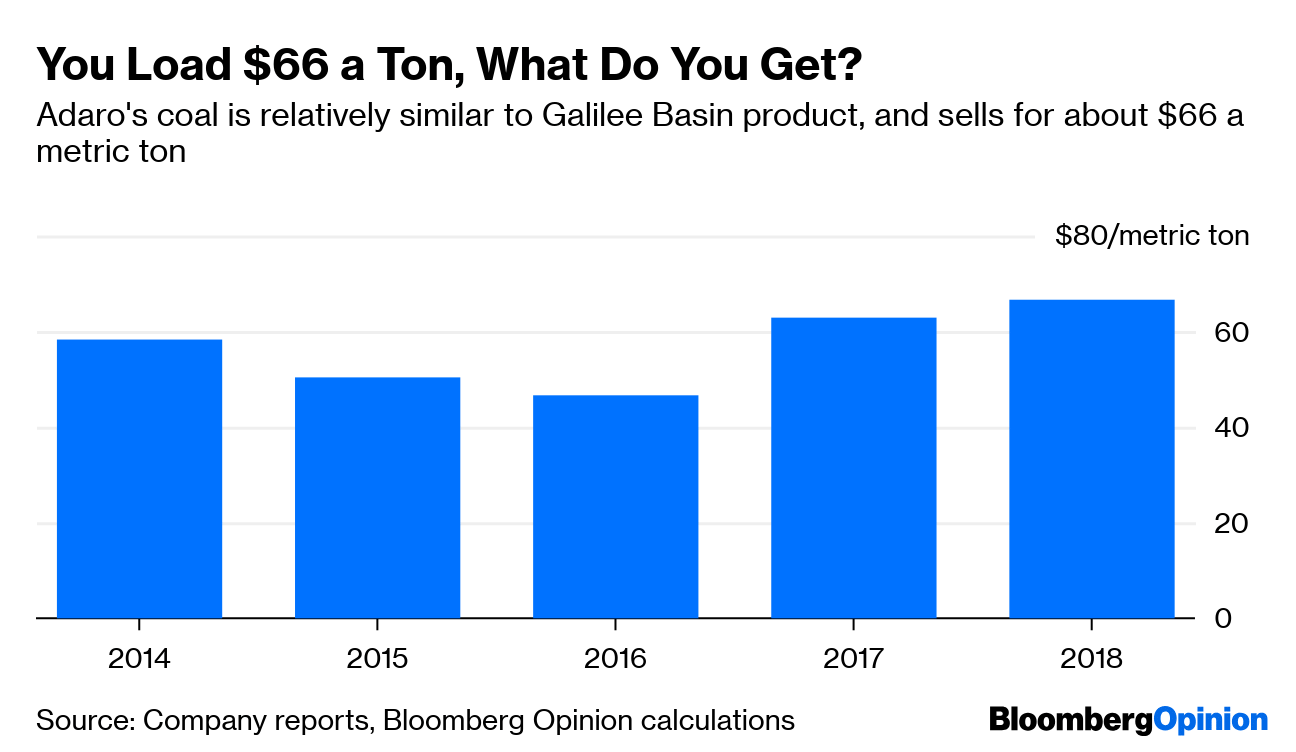

The most important factor in determining coal pricing is its energy content. In the case of Carmichael, we’ve known since Adani’s initial regulatory applications in 2010 that this is around 20.7 gigajoules or 4,950 kilocalories per kilogram.

That’s roughly in line with the stuff sold by Indonesia’s PT Adaro Energy Tbk. At present, Adaro makes about $66 of revenue per metric ton of coal sold, a number pretty consistent with charts published in its investor materials. Put that together with the 10 million tons a year (mtpa) output from the first stage at Carmichael and you have something like $660 million of annual revenue.

Next, subtract the costs of blasting, shoveling, washing, blending and loading the coal. At BHP Group Ltd.’s lean Mount Arthur mine north of Sydney, cash costs have averaged about $48 over the past 18 months, toward the bottom end for Australian coal mines:

Adjusting that for the cost of transporting the coal to port on third-party networks comes to about $50 a ton of operating costs, or $500 million for the whole project, enough to leave $160 million of gross profit. (Adani in January estimated a figure of $39 a ton at port, which seems implausibly low.)

Then consider the cost of building the mine and a separate 200 kilometer railway line from Queensland’s Galilee Basin, where it’s situated. Comparable projects suggest about A$1.8 billion ($1.24 billion) for the mine, pretty much in line with figures of A$2 billion cited in news reports. The railway would likely be another A$1 billion, for a total $1.9 billion capital project.

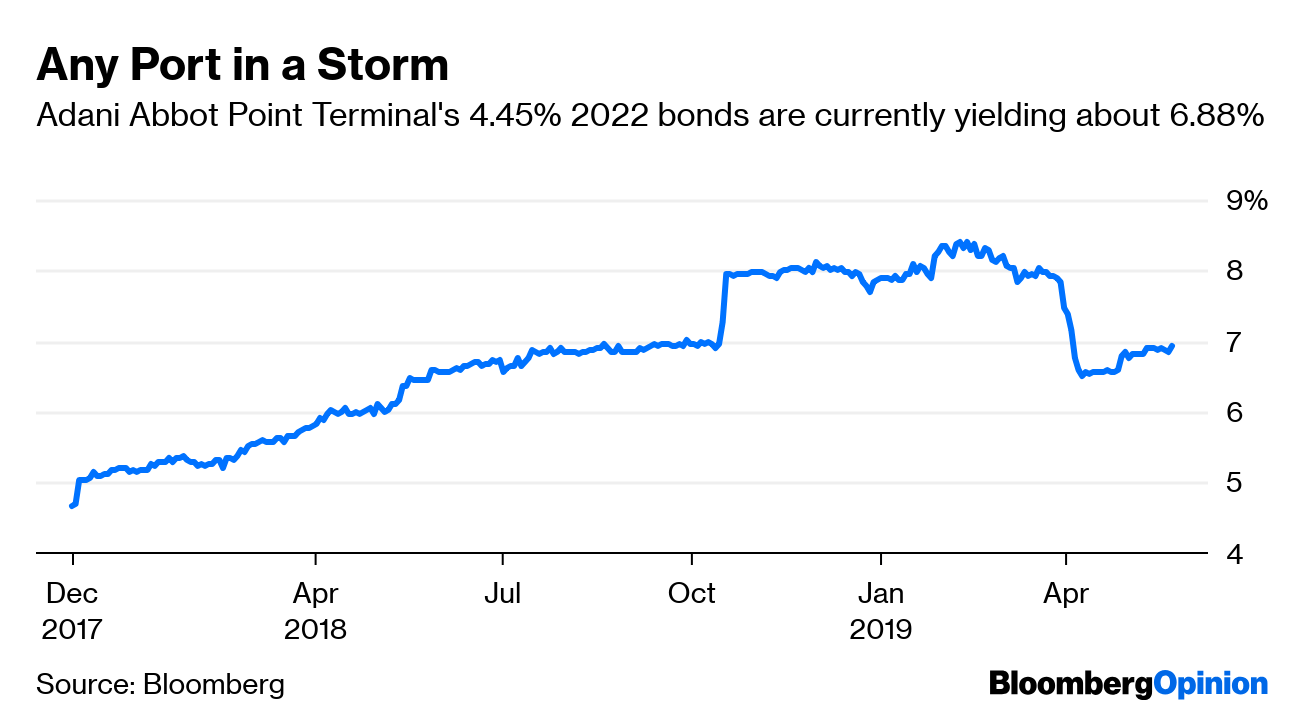

To get an idea of what that would cost to fund with debt, look at bonds for Adani’s Abbot Point terminal, a coal export port in northern Queensland. They’re currently yielding 6.88%, which would mean $131 million a year of interest costs. On top of that you have to depreciate the asset and amortize the debt itself; let’s assume you depreciate over 30 years and amortize over 10 and the result is $250 million.

Add all that together and Adani is losing $220 million a year: It would cost about $88 to produce a ton of coal that would sell for $66 on the open market. Those challenging numbers (rather than pressure from environmentalists) look like the best explanation for why banks have refused to lend to Carmichael. Adani has promised to fund the project from its own balance sheet.

All this raises the question of why everyone is so adamant that this project is going ahead.

For Australia’s Coalition government, the attractions are obvious: Carmichael is a potent wedge issue that may have just helped swing last weekend’s federal election in its favor. For environmentalists, too, the prospect of an operating Adani mine represents a totemic fundraising and rallying opportunity. The Labor party, meanwhile, can’t risk alienating the coal industry by declaring that this emperor has no clothes.

What of Adani itself? We’ve speculated in the past that keeping the project on life support helps avoid a painful billion-dollar write down; perhaps a sufficient level of taxpayer subsidy might be enough to salvage something from the wreckage.

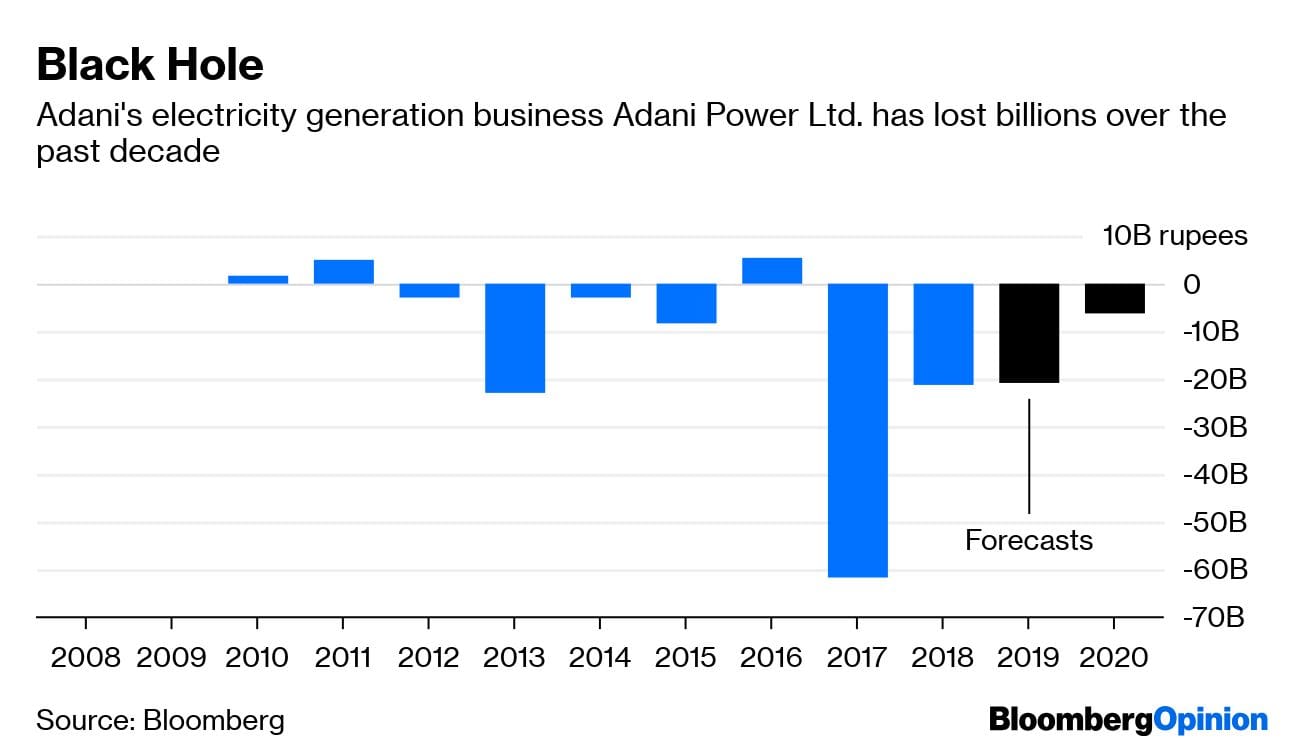

The company has argued that coal market prices don’t matter because it intends to burn the product in its own generators. But that doesn’t sidestep basic economics: Adani Power Ltd. has lost an aggregate 107 billion rupees ($1.5 billion) over the past decade, and would likely be doing even worse if it were buying overpriced coal from Carmichael.

And yet the belief that only environmentalists and obstructionist politicians are holding Carmichael back continues to shamble on. Comparable projects like Glencore Plc’s Wandoan have been mothballed for years.

As we’ve argued, investors seem to be fleeing coal finance as the economics get increasingly challenging. Yet away from the spotlight, Carmichael-scale mines with higher-quality coal and access to existing infrastructure such as MACH Energy Australia Pty.’s Mount Pleasant and Whitehaven Coal Ltd.’s Vickery are quietly coming online to replace production declines elsewhere.

That’s not why Carmichael is a lightning rod, though. Opening up a whole new coal basin like the Galilee represents a very different image for the future of coal than adding niche projects – suggesting coal power isn’t being “phased out, potentially sooner than expected” (as BHP suggested this week) but on the brink of a bright new future. Letting go of that pipe dream is proving remarkably painful.- Bloomberg

Also read: Adani abandons 2020 target date to begin mining coal in Australia