New Delhi: Foreign portfolio investors (FPIs) are not pulling out their money due to tax policy but on account of stretched valuations, National Stock Exchange (NSE) CEO Ashishkumar Chauhan has said, expressing hope the government would announce some measures in the upcoming budget to bring them back.

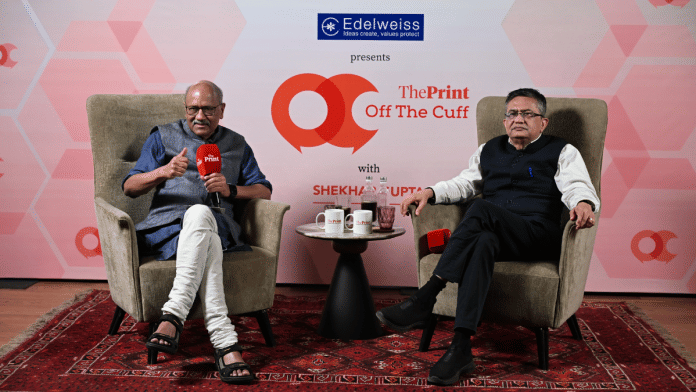

“For me, that’s what I call a storm in a teacup,” Chauhan said at Off The Cuff, hosted by ThePrint’s Editor-in-Chief Shekhar Gupta in Mumbai Thursday, arguing that taxes matter only if investors are making profits in the first place.

FPIs, he said, pulled back (over the past year or so) largely because Indian equities began trading at stretched valuations—stock prices rising faster than company earnings or fundamentals—not because of tax policy.

“When India’s price-to-earnings ratio went above a particular number, that’s when they thought prices had run ahead of profits,” Chauhan said, adding “When profits come closer to that reality, they will come back.”

However, Chauhan expects the government to ease operational hurdles for FPIs, possibly in the upcoming budget or soon after. He stressed that capital will ultimately chase returns, not concessions.

Chauhan also spoke about domestic investors, who overtook FPIs as the largest owners of Indian equities late last year. Equity returns, he reminded, are inherently lumpy and should not be compared to the “illusion of consistency” offered by fixed deposits.

Despite the recent rally in gold, Chauhan maintained that equities, and the Nifty in particular, remain superior long-term wealth creators.

“If you had put Rs 1,000 in the Nifty in the mid-1990s and just slept over, it would be worth over Rs. 25,000 today, with dividends, closer to Rs. 30,000 to 32,000,” he said, requesting people to resist the urge to trade frequently.

Talking about cryptocurrencies during the conversation, Chauhan remarked that unlike equities, crypto offers no claim on profits or cash flows. “In a stock, you have a promise of a share of profits. In crypto, you don’t even have that promise.”

He adds, “There are different asset classes, but for me, crypto is neither an asset nor anything.”

On NSE’s long-awaited IPO, Chauhan offered no timeline, implying that it is part of an ongoing process that requires regulatory clearance from the SEBI, drafting and reviewing of prospectus, and offer for sale. “It will take somewhere around seven to eight months for us to do an IPO.”

He added, “I mean NSE has tried to list itself from 2016 onwards, so it’s like nine years, and each time some or other things happen and it has not been able to list.”

Incidentally, the SEBI gave a green signal to the IPO of the National Stock Exchange (NSE) on Friday.

Also Read: Why FPIs are fleeing Indian debt and how bond markets have become volatile

Role of influencers

On the rise of financial influencers, Chauhan said that this problem is not new, only amplified by technology. Every generation, he argued, has had its own version of influencers—today they happen to be on Instagram.

Chauhan resisted drawing sharp moral lines between influencers and mainstream media, noting that good and bad actors exist across print, television and digital platforms alike. Reputation, he suggested, is not a permanent —voices that are credible in one moment can lose that standing in the next.

“For me, anyone who tries to make you buy or sell something usually has an agenda…. it could be a very benevolent agenda or it could be a malevolent agenda,” he said.

He cautioned domestic investors to not buy stocks on tips. “Don’t buy on tips, because tips are free every day, they keep on coming on your SMS, WhatsApp, wherever you go,” he said.

Cyberattacks during Operation Sindoor

Recalling the period around Operation Sindoor, Chauhan said the NSE was subjected to an extraordinary spike in cyberattacks. “In 10 minutes, we got 40 crore attacks aimed at taking down our websites,” he said, adding that what was once an occasional threat has now become routine.

“Three years back we used to get three crore attacks on a normal day, today on a normal day we get about 20 crore cyberattacks,” Chauhan noted, describing them as largely automated, pay-per-use attacks. “You pay them 10 dollars and they will attack you like one crore times and you pay them 20 dollars and they will attack twice.”

He called this “an unfair game”. “I have to be right every time, the attacker has to be right only once,” he said.

(Edited by Ajeet Tiwari)