India’s overall exports reached USD 778.2 billion in 2023-24, compared to USD 776.4 billion in 2022-23. While the country’s merchandise exports dipped by 3 percent to USD 437.06 billion, services exports rose to USD 341.1 billion, registering a growth of 4.8 percent over the previous year. Exports were hit owing to geopolitical disruptions, muted demand and export curbs on agricultural items.

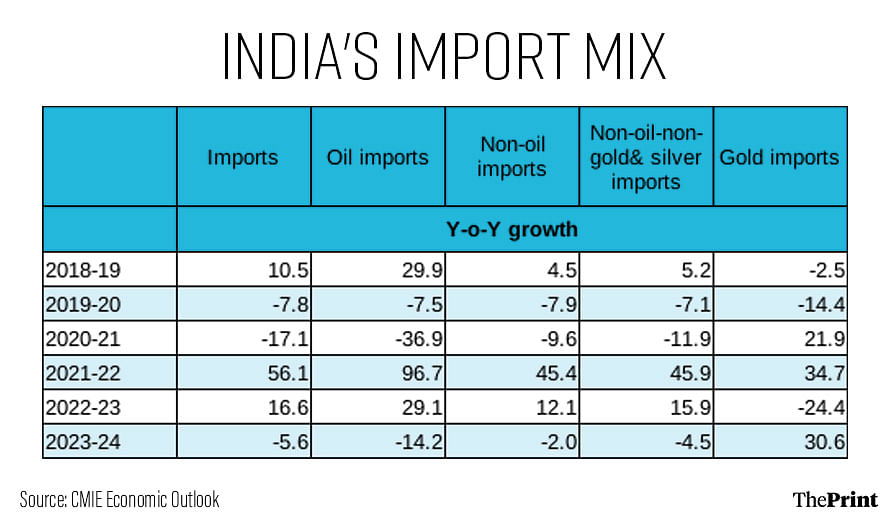

Compared to merchandise exports, India’s merchandise imports fell more steeply by 5.6 percent in 2023-24, primarily because of the correction in global commodity prices from the highs of 2022-23. This led to an improvement in India’s trade balance in 2023-24.

Imports benefitted by easing of commodity prices

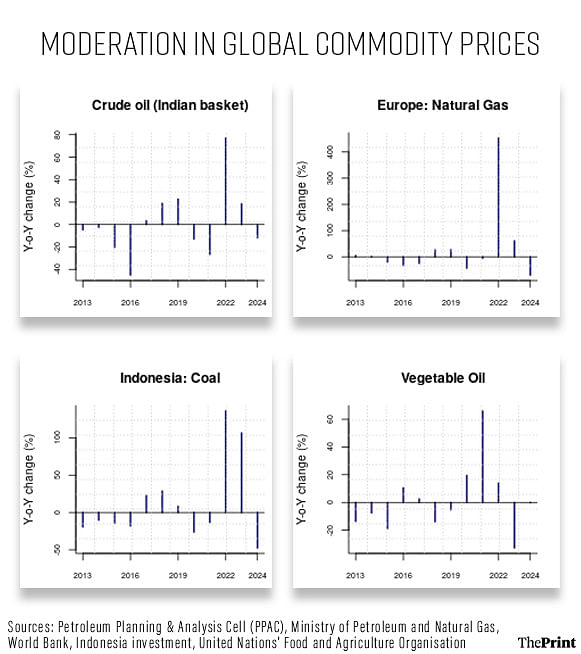

India’s imports of crude oil and petroleum products, accounting for roughly 27 percent of the merchandise imports, declined by 14 percent last year. The decline can be attributed to a moderation in global crude oil prices in 2023-24.

Non-oil imports also fell by 2 percent from USD 506 billion to USD 495.8 billion in 2023-24. The 2 percent deceleration in non-oil imports was due to decline in imports of non-gold and silver commodities. Non-oil, non-gold and silver imports fell by 4.5 percent in 2023-24.

In contrast, gold imports surged by almost 31 percent in 2023-24, driven by rise in prices as well as quantity of gold imports.

Among major non-oil imports, vegetable oils, fertilisers, coal, organic chemicals, transport equipment, and pearls, precious and semi-precious stones recorded significant reduction in their import bill in 2023-24.

Vegetable oil imports declined by 28.6 percent due to the decline in vegetable oil prices. Fertiliser imports also fell by a steep 39.3 percent, mainly due to the easing of natural gas prices — one of the key inputs in fertilisers.

Imports of pearls, precious and semi-precious stones also decreased by 22 percent in 2023-24. Fall in exports of gems and jewellery due to subdued demand translated into lower imports of pearls, precious and semi-precious stones.

Imports of coal declined by a substantial 21 percent owing to the drop in international prices of coal. India imports coal from Indonesia and South Africa, both of which witnessed a significant reduction in coal prices last year.

Also Read: Indian banking sector’s boom continues, but low deposit rates for some banks point to future risks

Exports hit, but some sectors showed resilience

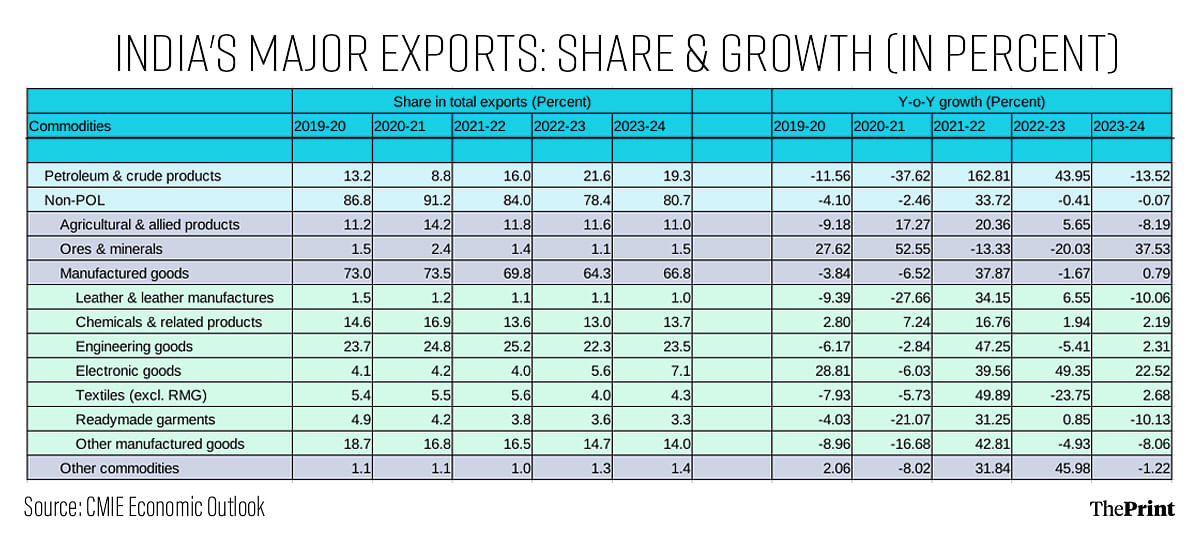

Merchandise exports fell in 2023-24, the first decline since 2020-21. India’s exports of petroleum and crude products, with a share of 19 percent, declined by 13.5 percent last year after witnessing robust growth in the previous two years. Growth in oil exports has been volatile, and is dependent on the trajectory of global oil prices.

Notably, Europe, which curtailed direct oil imports from Russia, has emerged as a prominent destination for India’s oil exports. Europe’s share in India’s oil exports was 17 percent in 2021-22, which rose to 21 percent in 2022-23, and further to 27.8 percent in 2023-24. There has been a commensurate decline in the share of Africa, America and Asia in India’s oil exports.

Agricultural exports, accounting for 11 percent of the total merchandise exports, contracted by 8 percent. In addition to geopolitical factors, export restrictions on commodities like wheat, rice, sugar and onion impacted agricultural exports last year.

Manufactured goods account for 67 percent of India’s merchandise exports. Overall, the growth of manufactured goods exports was flat in 2023-24, owing to the slowdown in global demand, the ongoing Russia-Ukraine conflict and the Red Sea crisis.

One segment that was hit hard by poor demand was leather and leather manufactures. Exports of leather and leather manufactures declined by 10 percent due to poor demand in major markets like Europe and USA.

However, things might improve in the next few years, as Taiwanese companies are likely to bring in investments to set up footwear manufacturing facilities in Tamil Nadu. These developments augur well for India’s export prospects.

Engineering goods, which account for roughly one-fourth of merchandise exports, grew by 2 percent in 2023-24. Exports to the US, a major market for engineering goods, fell by 5 percent. Exports to China also remained flat.

Saudi Arabia seems to have emerged as another big market for engineering goods in 2023-24 with a strong growth of 72 percent. Exports of these goods to Russia also grew sharply to USD 1.19 billion, compared to USD 625 million in the preceding year.

Two sectors that have exhibited resilience amidst the global trade slowdown are electronic goods, and drugs and pharmaceuticals. These two, contributing about 14 percent share together in India’s export basket, saw an annual growth of 22 percent and 9.7 percent, respectively in 2023-24.

While USA, UAE and Netherlands account for roughly 50 percent of India’s electronic goods exports, the growth is mainly powered by demand from the US. The boost has come from telecom instruments, whose exports grew by 33 percent in the last financial year.

Improvement in merchandise trade deficit

Despite a contraction in exports, India’s merchandise trade deficit improved in 2023-24, owing to a steeper contraction in imports. Notably, India’s trade deficit with China and Russia widened in 2023-24, compared to the previous year. At the same time, the trade deficit with Saudi Arabia, UAE, Iraq and Indonesia narrowed. India’s trade surplus with its major export destinations — USA and Netherlands — increased further in 2023-24.

Notwithstanding the geopolitical disruptions that have hampered India’s trade, this may be an opportune time to address structural impediments in the way of boosting India’s exports. India has entered into Free Trade Agreements (FTAs) with many countries, but despite this, it is facing persistent trade imbalances.

A review of the FTAs, alongside addressing inverted duty structure (a situation in which higher import duties are applicable on inputs than those on finished products), would help in boosting India’s trade. The trade policies of countries with which India has these agreements also need continuous monitoring to assess their potential impact on India’s trade prospects.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Don’t jump at 1st unemployment number you see. Different databases yield varying but valid results