India has historically enjoyed strong trade relations with Bangladesh, but the recent political turmoil could affect this trend.

Bangladesh is India’s largest trading partner in South Asia. It is a major market for India’s textile and agricultural exports. Bangladesh has been grappling with high inflation and unemployment among the youth, which has led to slackness in import demand, particularly that of non-textile items. The persistent dollar crisis has exacerbated external vulnerability. The ongoing disruption could further complicate the situation.

The exports of agricultural products could take an immediate hit as the Kharif harvest is around the corner. The unrest could also cast uncertainty over the potential free trade agreement talks, affecting investment.

India-Bangladesh trade

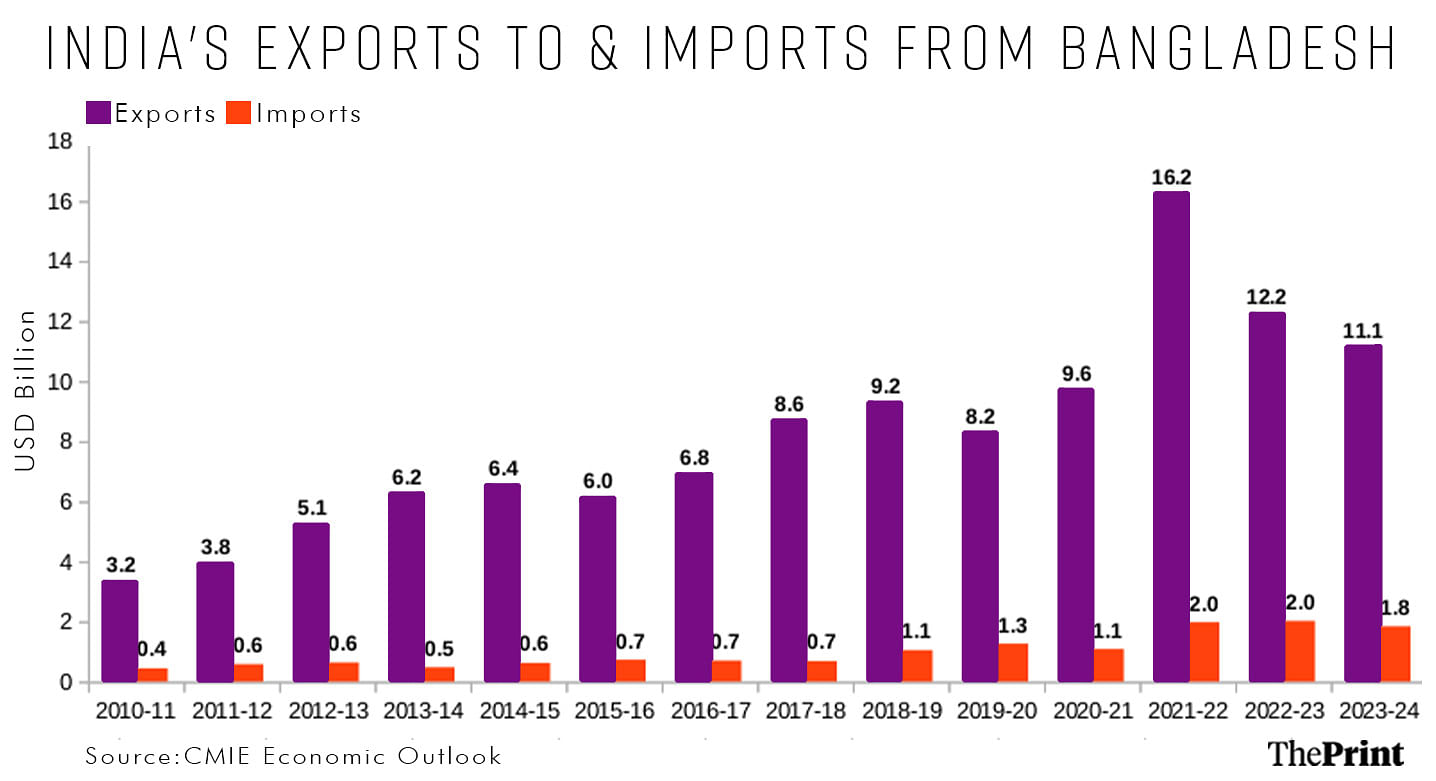

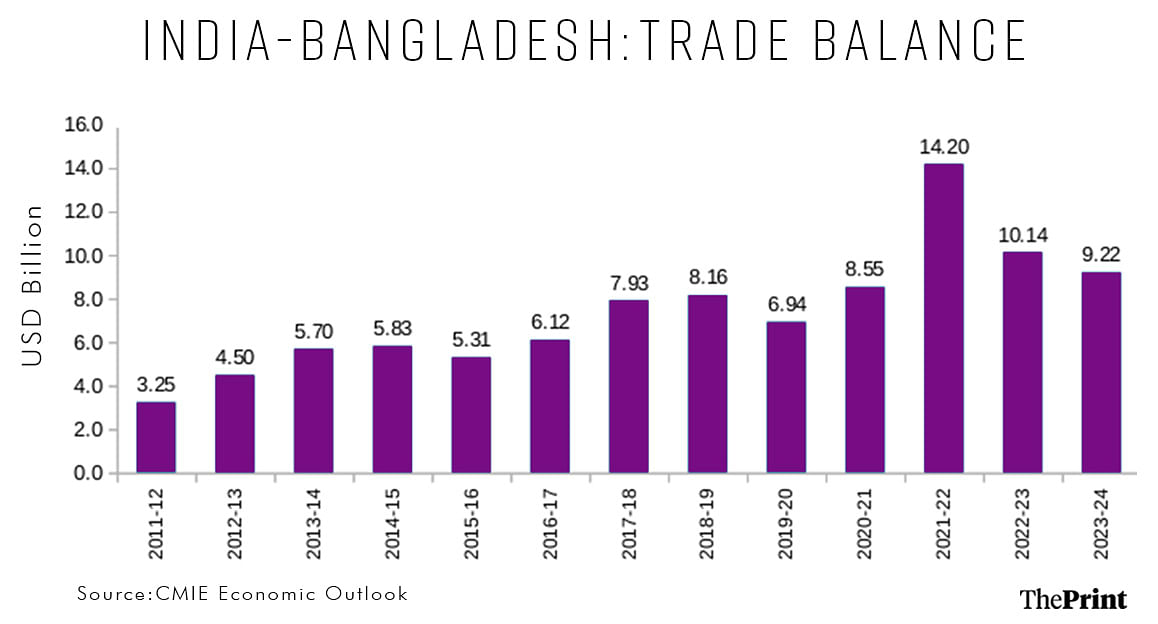

India’s trade with Bangladesh has traditionally been characterised by strong export performance leading to a trade surplus. Exports to Bangladesh rose from USD 3.2 billion in 2010-11 to a peak of USD 16.2 billion in 2021-22.

The last two years saw a moderation in exports. In the last financial year, exports to Bangladesh were valued at USD 11 billion. The decline is partially attributable to a decline in exports of agricultural products, owing to export restrictions on rice, wheat and sugar to rein in domestic prices. Dollar shortage and rising inflation in Bangladesh also led to lower demand for exports.

In 2021-22, Bangladesh was India’s fourth largest export market. It slipped to the eighth position in FY 24 due to decline in outbound shipments.

Imports from Bangladesh remained in the range of USD 0.4 billion to USD 0.7 billion from 2010-11 till 2017-18. Imports crossed USD 1 billion in 2018-19 and peaked at USD 2 billion in 2022-23. Last financial year saw a moderation in imports to USD 1.8 billion.

Also Read: Near-term volatility can bother Indian markets. US slowdown, Middle East tensions may spook them

Diverse exports to Bangladesh

India exports a diverse set of commodities to the neighbouring country, ranging from raw cotton, spices, textiles, machinery, transport equipment and metals. Looking at the broad categories, manufactured goods and agriculture and allied products together accounted for more than 75 percent of exports to Bangladesh in 2023-24. Of this, agriculture and allied products accounted for 22 percent of the exports, a decline from 34.2 percent in 2021-22.

Raw cotton (including waste), oilmeals and spices are the top three exports in the agriculture and allied products category. Bangladesh is the main destination for India’s cotton exports. Over half of India’s raw cotton exports of USD 1.2 billion is accounted for by Bangladesh. Bangladesh is also India’s top importer of oilmeals, accounting for almost 24 percent of India’s exports of oilmeals. After China and the USA, Bangladesh is the third largest export destination for spices. The unrest in Bangladesh has brought these exports to a standstill.

Manufactured goods accounted for 55 percent of India’s exports to Bangladesh in 2023-24. Textiles (excluding readymade garments), engineering goods, and chemical and related products, are the major exports within the manufacturing basket.

Exports of textiles (excluding readymade) garments account for 20 percent of India’s exports to Bangladesh. The importance of Bangladesh as a market for textile can be gauged from the fact that since 2016-17, Bangladesh has the second largest share in India’s exports of textiles (excluding readymade garments), next only to the USA.

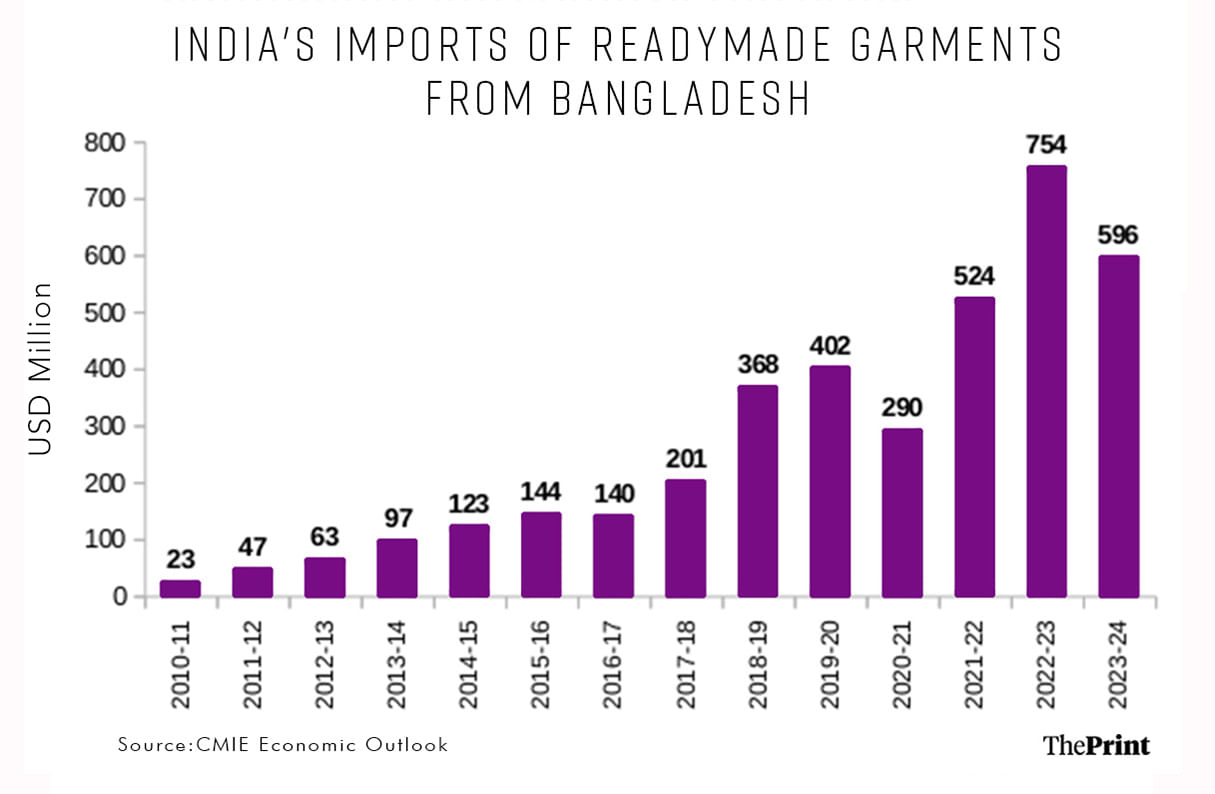

Bangladesh has occupied a pivotal position as an exporter for readymade garments, in the aftermath of the China plus one strategy. Readymade garments now account for around 85 percent of Bangladesh’s exports. The country relies on imports of raw materials, such as yarn and fabrics, from India and China.

Surat is a major exporter of products, such as sarees and fabrics to Bangladesh. Due to the current disruption, the textile and yarn business in Surat has been hit as there are no new orders and payments are also stuck. Sales ahead of the festive season may be impacted if the ongoing crisis persists for long.

Engineering goods account for 19 percent of India’s exports to Bangladesh. The turmoil in Bangladesh could exacerbate the already weakening demand for India’s engineering goods exports. India’s exports of engineering goods have been in slow lane due to the weak demand in advanced economies.

In the last two years, Bangladesh has seen a reduction in the demand for machinery, and industrial raw materials due to the challenging economic landscape. The current situation could constrain their import demand and impact exports of engineering goods. Exports of chemicals, which account for another 10 percent of India’s exports, have also seen a contraction in the last two years.

The inbound shipments from Bangladesh are concentrated towards readymade garments, which account for 32 percent of imports. Jute, both raw and manufactured, marine products, spices and transport equipment are some of the other items of import from Bangladesh.

Global supply disruption & opportunity for India

While Bangladesh has a miniscule share in global merchandise exports, it is the world’s second largest exporter of textiles, with knitted and non-knitted apparels making up 85 percent of its export basket.

Many argue that the advantage Bangladesh has in terms of duty free access to EU and other nations because of its Least Developed Country status, gives it the edge, but the country’s competitive labour cost and the ability to specialise in bulk production and access to cheap imports of raw materials from China have also contributed in cementing its position as a major supplier of readymade garments. Germany, US and UK are major importers of Bangladesh’s knitted and non-knitted apparel.

Disruptions and unrest are likely to lead to delays in supply of textiles and supply chain uncertainties, compelling importers to seek alternative markets. If the uncertainty persists, a potential diversification away from Bangladesh to suppliers offering a more stable environment could benefit countries like Vietnam, Cambodia and India.

While India can potentially benefit from the turmoil, it needs to put forth effective strategies to improve its footprint in textile trade. As the Economic Survey mentions, over 80 percent of the textile and apparel producers are MSMEs, where the benefits from economies of scale and efficiency are limited.

In addition to technological constraints and the fragmented nature of the sector, the composition of exports of readymade garments also need a relook. Diversification towards readymade garments of manmade fibres and speciality garments, which are in greater demand in global markets, will help improve India’s prospects of becoming a preferred supplier of garments.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at National Institute of Public Finance and Policy (NIPFP). Views are personal.