In a much-anticipated move, JP Morgan Chase & Co announced that it will include Indian government bonds to its emerging market bond index from June 2024. The inclusion of Indian government bonds in the global bond index, which would be staggered over a period of 10 months, will attract more foreign funds and support a much-needed diversification of the investor base.

The government started discussing the prospects of inclusion of its bonds in global bond indices way back in 2013, but the complex set of restrictions on foreign investment in government bonds, including quantitative limits, held back the inclusion. Further, the disagreement on settlement of transactions and lack of tax benefits for international investors delayed the inclusion of government bonds.

While these roadblocks still persist, the need to diversify the index following Russia’s exclusion triggered India’s inclusion. Recent measures at easing the restrictions on foreign participation in debt also led to greater attractiveness of Indian bonds.

Also read: Share of Asian countries in India’s exports is falling, Europe’s is rising. Why this is worrying

Liberalisation of controls on foreign investment in debt market

In recent times, the RBI has been liberalising the rules governing foreign investment in government and corporate bonds.

A major milestone in this was the announcement of the Fully Accessible Route (FAR) in March 2020, that gave unlimited access to foreign portfolio investors to a select set of government securities.

Removal of caps on foreign investment in government securities through the FAR paved the way for inclusion of government bonds in global bond indices. JP Morgan announced that the bonds issued under the FAR will be included in the index. Currently, 23 bonds issued under this route with a combined value of about USD 330 billion will be included in the index.

Diversification of investor base

One of the key limitations of the debt market is that the current investor base is largely captive in nature. Investors such as banks and insurance companies are subject to RBI’s regulations on minimum holding of government securities. Banks are subject to Statutory Liquidity Ratio (SLR), whereby they are required to hold a certain percentage of demand and time liabilities in government securities. A large proportion of captive buyers in the investor base impacts fiscal discipline. Many expert committees have recommended a reduction in SLR. Over time SLR has indeed come down and currently stands at 19 percent.

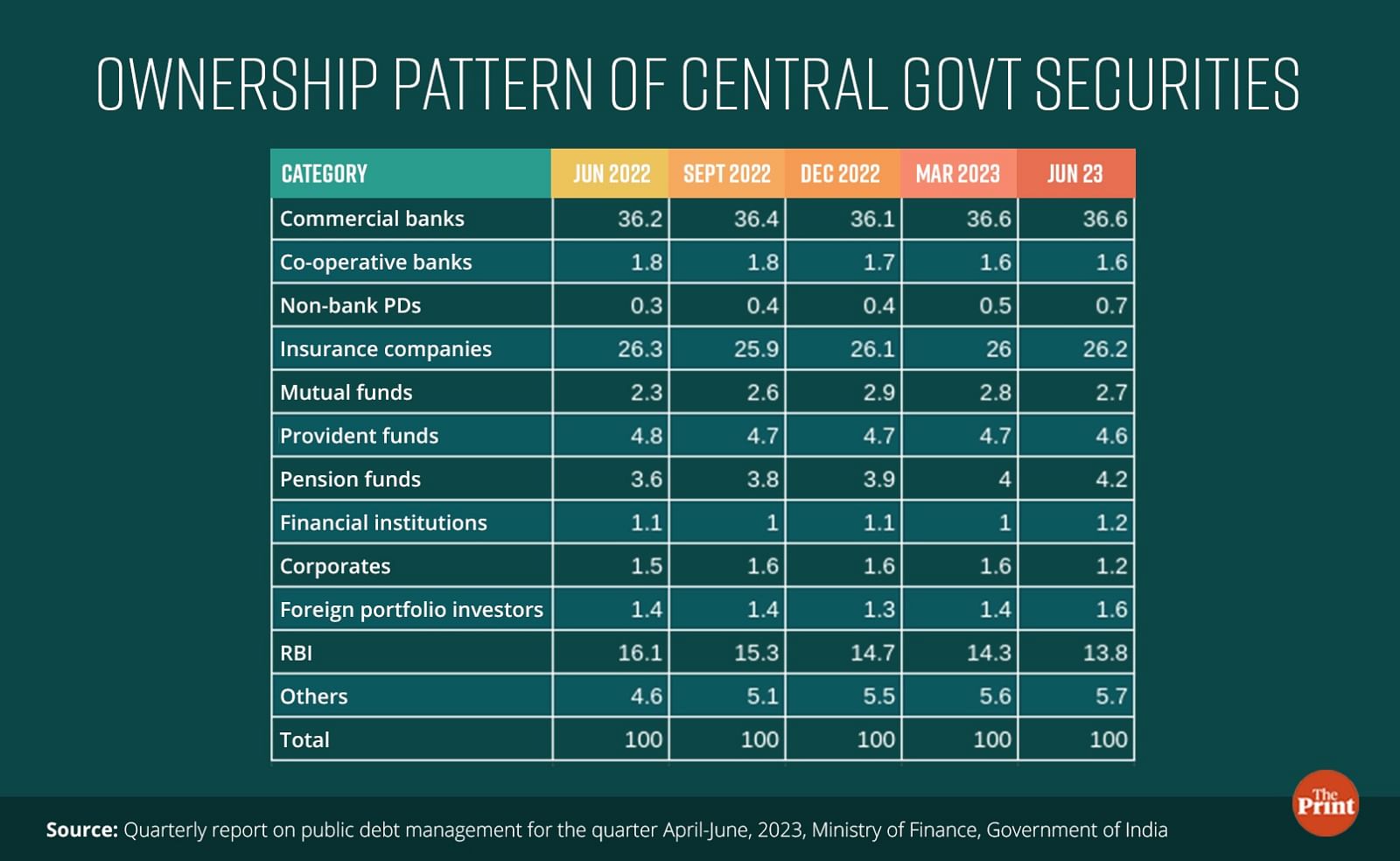

The government’s quarterly report on public debt management shows that more than 60 percent of the outstanding government securities are held by commercial banks and insurance companies. The share of foreign portfolio investors is less than 2 percent. Inclusion of government bonds in the global bond index will likely result in an increase in foreign investor holding of government securities to 3-4 percent of the outstanding stock.

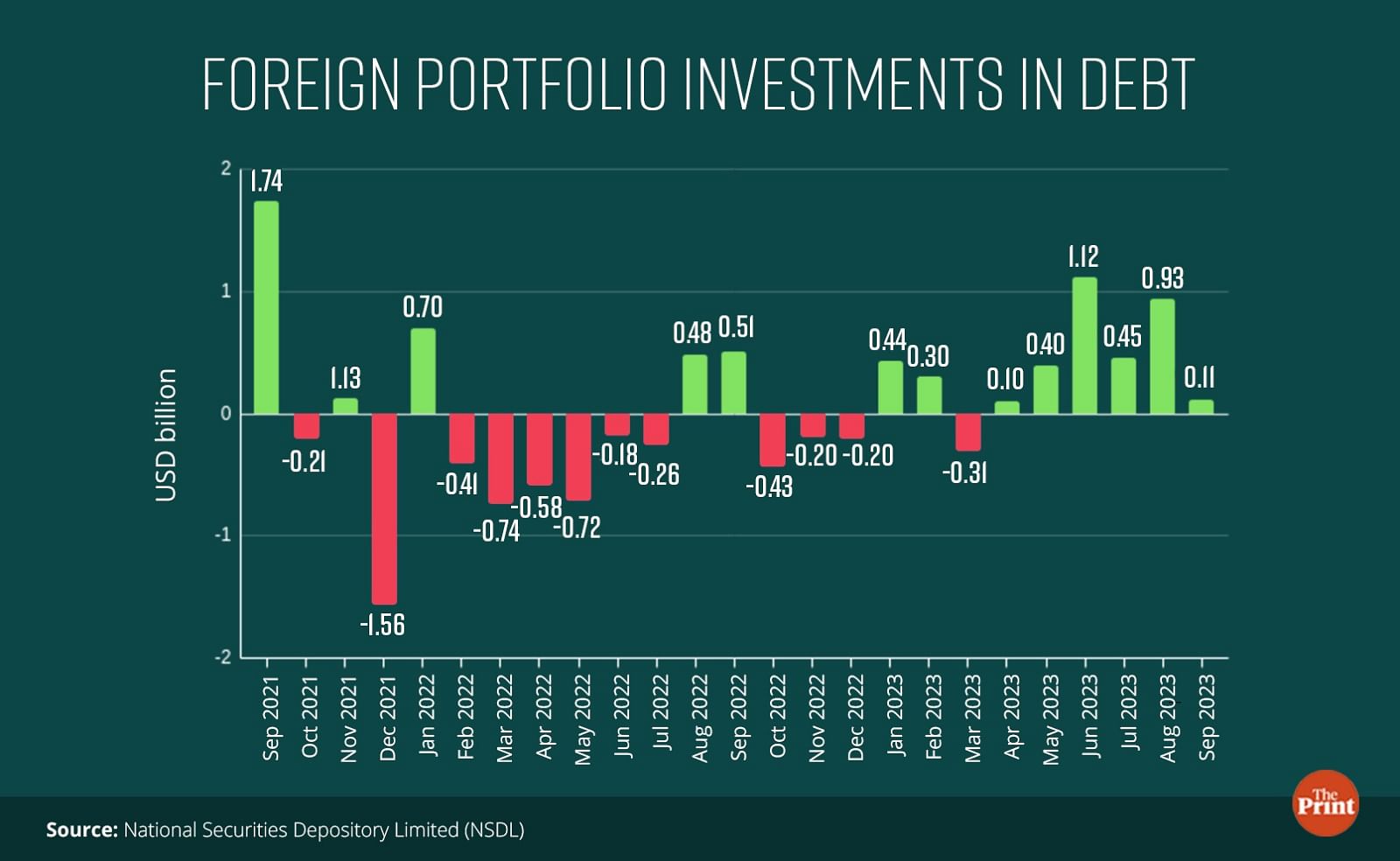

The inclusion could bring in USD 20-25 billion over a period of 10 months into government bonds as India incrementally gets a 10 percent weight in the index.

Crowding in and lower cost of borrowing

With greater participation from foreign investors, domestic financial institutions would be in a better capacity to lend to the private sector. With greater interest from foreign investors, the demand for government bonds could rise, resulting in a lower cost of borrowing. This will aid in lowering the cost of borrowing for the corporate sector as well

Focus on fiscal prudence and macroeconomic stability

The taper tantrum episode showed that countries with fragile external and fiscal balances were particularly vulnerable to sudden exit of foreign funds. India was one of the affected countries when the US Federal Reserve decided to taper its bond purchases.

Pursuant to India’s bond inclusion in global indices, and greater diversification of investor base, one metric that will be critically watched is the government’s fiscal deficit target. While the government is committed to bringing down its fiscal deficit to 5.9 percent of GDP in the current year and 4.5 percent of GDP by 2025-26, deviations from the stated targets could lead to outflows by foreign funds, leading to higher yields.

In addition, the quality of government’s expenditure, the buoyancy of taxes, reliance on off-budget liabilities and the entire fiscal framework would be subject to greater scrutiny.

The inclusion of government bonds therefore needs to be followed up with reforms to make the fiscal framework more transparent and accountable. An essential first step is to amend the Fiscal Responsibility and Budget Management (FRBM) legislation to communicate a clear fiscal glide path to investors. An amended FRBM would also provide clarity on how the government plans to reduce its debt in the next few years.

India’s balance of payments and current account position would also face greater scrutiny from foreign investors. Thus, India should continue to focus on improving its macro fundamentals.

Challenges could emerge in managing the impossible trinity

Inflows of foreign funds in the rupee denominated government bonds would put the spotlight on the RBI’s management of the ‘impossible trinity’. With greater foreign flows, the demand for rupees will increase. This will put an appreciation pressure on the rupee. If the RBI chooses to manage the exchange rate and prevent rupee from strengthening, it will absorb dollars and supply rupees, risking liquidity and inflation. It will then need to use tools to mop up the excess liquidity. Exchange rate management alongside inflation and liquidity management may become challenging and give confusing signals to the market.

The inclusion of Indian government bonds in the global bond indices holds immense potential for India’s financial market. Focus on macro-stability and fiscal prudence needs to continue to navigate the associated challenges effectively.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Households are saving less and borrowing more, but that’s not necessarily a bad thing