New Delhi: Unified Payments Interface (UPI) has made possible digital payment transactions worth trillions of rupees since it was first launched in India five years back, said Ritesh Shukla, Chief Executive Officer of NPCI International Payments Ltd (NIPL), Tuesday. Such has been the ease of transaction that UPI payments have grown at an annual rate of about 200 per cent since its launch in the country, he added.

Shukla was speaking at the Global Technology Summit (GTS) 2021 organised by think tank Carnegie India and the Ministry of External Affairs. ThePrint is a digital partner.

“In the year 2020, UPI as a platform achieved about $457 billion worth of commerce, which is about 15 per cent of India’s GDP,” said Shukla.

He added: “Compared to the first year of our operation, that is 2017, where we had $8 billion worth of commerce on the platform, we have grown at a compound annual growth rate (CAGR) of over 200 per cent in a short span of time.”

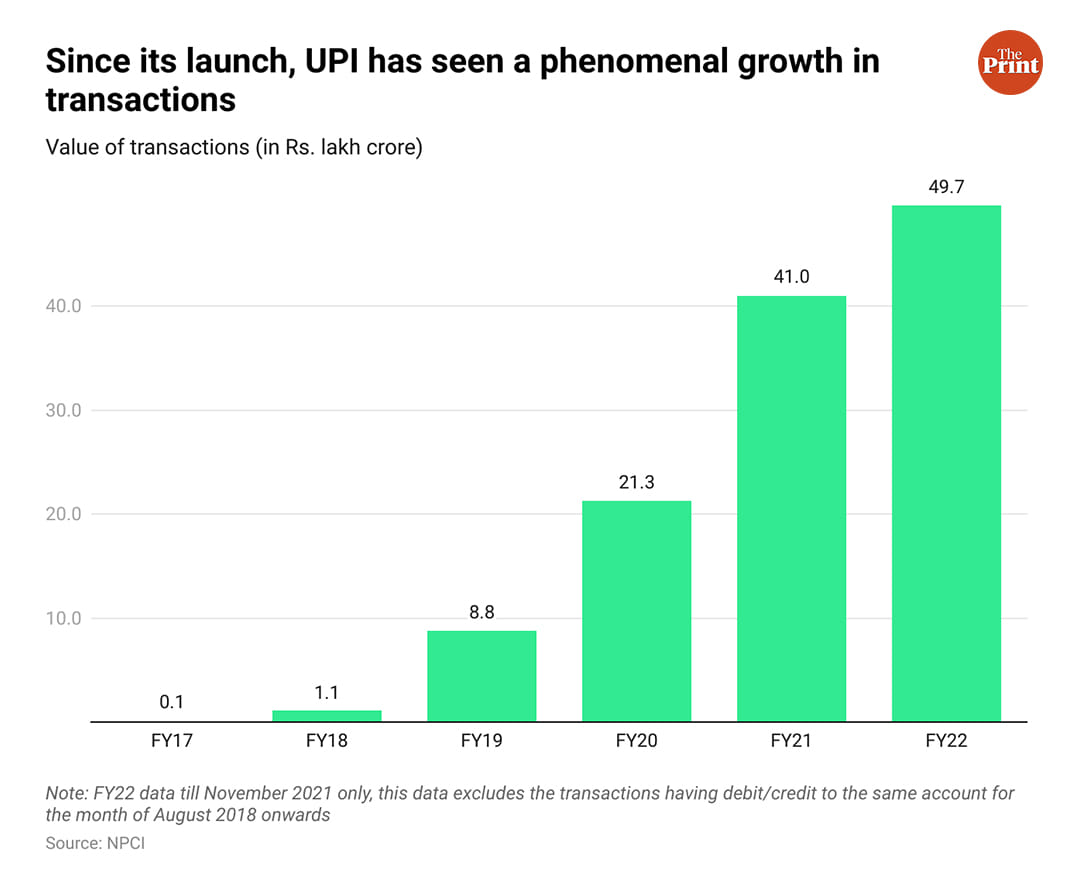

The data available on the NPCI portal shows that even before the beginning of the Covid pandemic — which gave a boost to online transactions — UPI payments over apps like Google Pay, PhonePay, QR codes, or even sending money to individual users not connected with any business, had grown phenomenally.

Also read: Five years after demonetisation, cash transactions are down but not gone, survey says

Ready for collaborations

In the financial year 2016-17, when UPI was launched in India, it recorded 1.8 crore transactions worth Rs 6,900 crore, which jumped to Rs 1 lakh crore in the next financial year (2017-18). In 2018-19, the value of UPI transactions rose by roughly 700 per cent, crossing Rs 8.76 lakh crore and reached Rs 21.3 lakh crore in 2019-20.

In the year that followed, which also saw the onset of the Covid pandemic, the value of UPI transactions boomed to a whopping Rs 41 lakh crore and in the current financial year — with four months left to go — India has already recorded 2.6 thousand crore transactions, worth Rs 49 lakh crore, on UPI.

“UPI has played a very important role in enabling digital payments in India. The ecosystem has been built on the platform that covers the entire country, be it rural landscape or even locations where there is no data connectivity. It is being used by 120 million merchants in the country, that’s the power UPI is driving the country with”, Shukla said.

He added: “Armed with what we have achieved in India, coupled with the knowledge that we have gained while running the platform, we are ready to collaborate with other countries in the world. Our intent is to drive digital public good (making this technology accessible by all) and make a difference in the areas of financial inclusion, cash displacement, citizen welfare and FinTech incubation, because that is what will create jobs.”

(Edited by Poulomi Banerjee)

(This report has been updated to reflect that Ritesh Shukla is the CEO of NPCI International Payments Ltd (NIPL) and not NPCI. The error is regretted.)

Also read: Why India’s stagnated law for digital payments must be redesigned