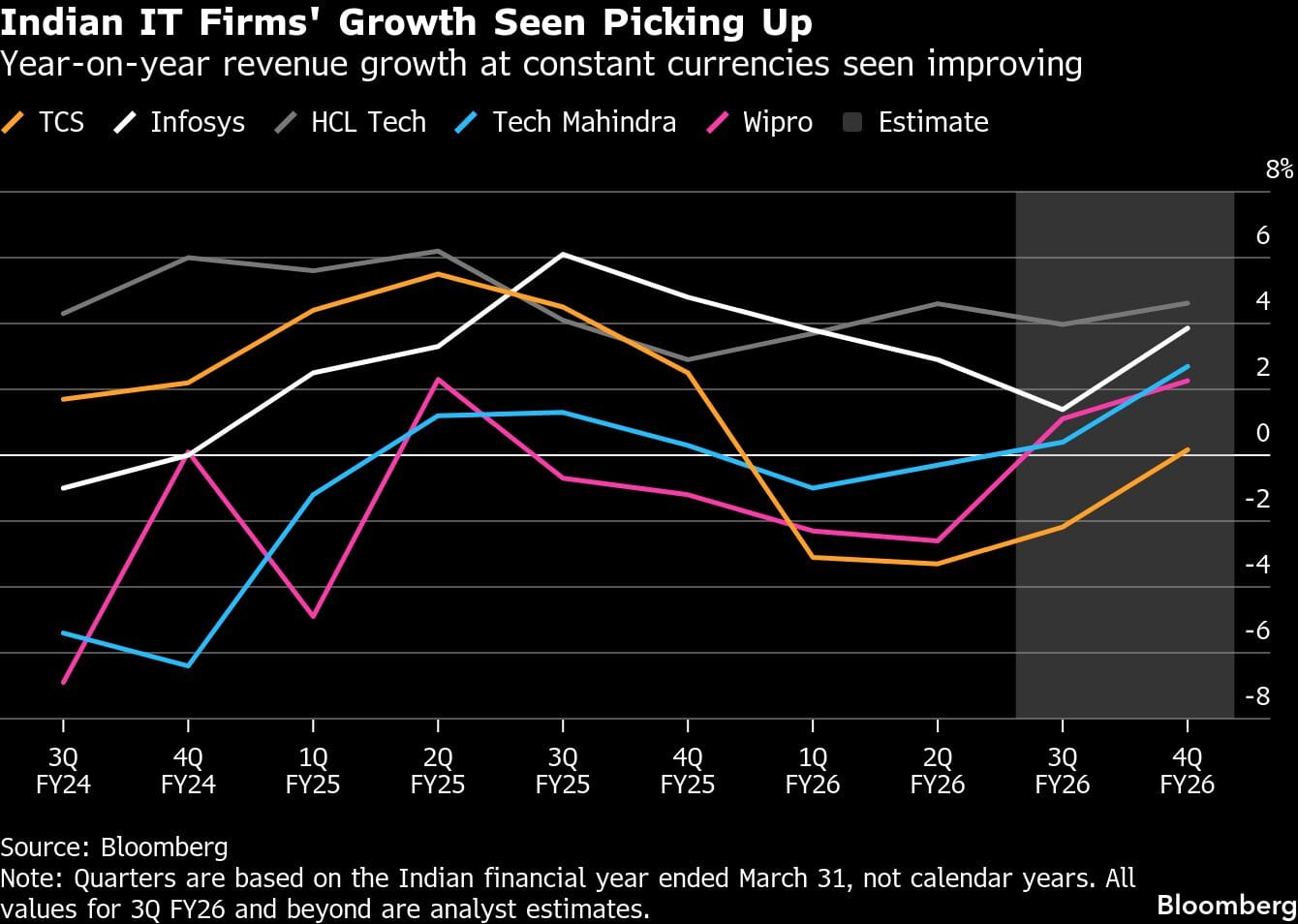

Tata Consultancy Services Ltd. and Infosys Ltd. will give clues on how clients’ 2026 budgets are shaping up as the sector heads into another muted earnings season.

The October-December quarter is typically weak for Indian IT companies because of fewer working days and furloughs, which weigh on both revenue and margins. Investors will look for signs that client budgets for 2026 indicate better deal wins. Estimates point to headcount growth at most firms, a signal that companies are positioning for better demand.

“We expect to hear some positive sector commentary for next year,” HSBC analysts said in a note. Options positioning in the sector also point to expectations that earnings are more likely to surprise on the upside.

IT firms appear to be firming up artificial intelligence strategies as TCS and Coforge Ltd. have acquired smaller firms for their AI expertise. AI services demand may begin to improve from mid-2026, Motilal Oswal analysts said, and markets will watch for more such acquisitions.

Taiwan Semiconductor Manufacturing Co.’s earnings will serve as a growth barometer as investor enthusiasm for AI continues. Analysts increased price targets for the chipmaking giant on improved revenue prospects and expanding profit margins.

Highlights to look out for:

Saturday: Avenue Supermarts’ (DMART IN) growth strategy will be in focus as it continues to lose market share to quick commerce apps. Revenue rose 13% from the firm’s latest quarterly update, the lowest in the last 20 quarters according to Citi. Its store count also rose 11%.

Monday: Tata Consultancy Services (TCS IN) is set for a 2.2% revenue contraction in constant-currency terms, although reported revenue may see a lift on rupee depreciation. Its AI strategy from December left markets optimistic as it outlined plans to be the world’s largest AI-led tech services firm. Watch for commentary on its recent acquisitions of ListEngage and Coastal Cloud, Motilal Oswal said.

- HCL Technologies’ (HCLT IN) 4% constant-currency revenue growth will be led by its software vertical, which is less affected by furloughs and typically cushions margins during seasonally weak quarters. HCL Tech is expected to retain its full-year revenue growth outlook, with AI commentary and the demand outlook in focus, Jefferies said.

Tuesday: No notable earnings.

Wednesday: Infosys (INFO IN) is expected to maintain its 2%-3% revenue growth guidance for the year. A slight decline in headcount may have helped preserve the operating margin, Bloomberg Intelligence said, though hiring plans will be in focus for signs of a rising demand.

Thursday: TSMC’s (2330 TT) fourth-quarter net income likely rose 23%, with a bullish outlook in 2026 as the firm solidifies its lead in the AI sector. Macquarie analysts expect the firm will scale up capex through 2028 to accelerate advanced-node capacity required to meet soaring AI demand.

Friday: Tech Mahindra’s (TECHM IN) third-quarter net income may rise about 40%, thanks to higher revenue contributions from its IT and business process services businesses. The company may need to make adjustments if it misses its growth plan target, including spending less on subcontractors, Citi said. Tech Mahindra is seeking sequential margin improvement, aiming for 15% for the 2027 financial year, Citi added.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.