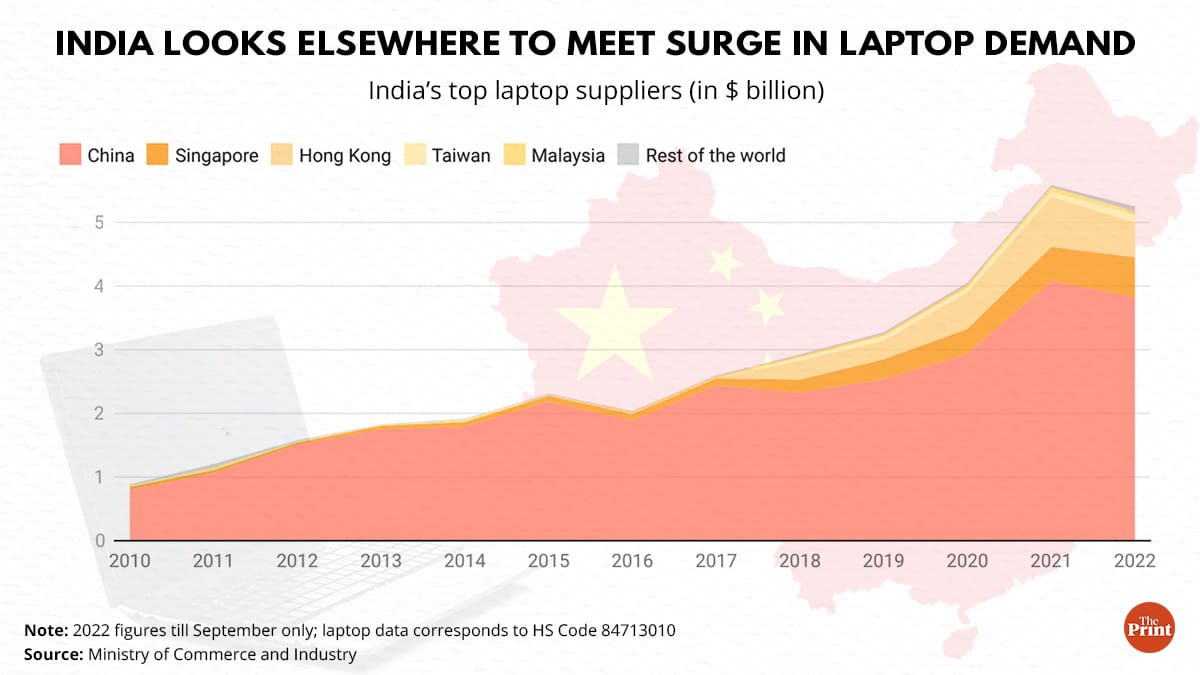

New Delhi: India’s laptop imports surged to $5.24 billion in the first nine months of 2022, and about three-fourths came from China, show the latest statistics released by the Ministry of Commerce and Industry.

According to the data, in the first three-quarters of 2021, India had imported laptops worth $4.65 billion, a figure which rose by 12.8 per cent in the same period this year.

Further, in the first nine months of 2022, India imported about $3.82 billion worth of laptops from China alone. This is 72.9 per cent of India’s total laptop imports so far this year, and about 9 per cent higher than the imports of $3.5 billion worth of laptops from China in the same period of 2021.

ThePrint looked at the specific data for fully manufactured laptops (personal computers, laptops, palmtops) and found that they make up the largest quantity of fully manufactured imported items from China.

Data for the past five years also highlights that since 2017, China has accounted for around 75 per cent of India’s laptop imports.

India imported $23.65 billion worth of laptops from across the world in that period, of which as much as $18.13 billion came from China. In other words, every three in four laptops that India has imported in the last five years have come from China.

China’s share in India’s total laptop imports has, however, been decreasing. In 2017, China accounted for 94.2 per cent of India’s total laptop imports, and the figure has come down to around 73 per cent for the last three years.

So, where are the new territories that India is sourcing laptops from? Most are not very far from China.

India is now getting more and more laptops from Hong Kong ($0.55 billion), Taiwan ($0.12 billion), Singapore ($0.62 billion), and Vietnam. Collectively, these countries account for $1.29 billion or about a fourth of India’s laptop imports in the first three quarters of 2022. Five years ago, in 2017, these countries didn’t even make up 5 per cent of India’s laptop imports.

Also Read: In 1955, India tried ‘mango diplomacy’ with China. The outcome wasn’t really sweet

Rising demand

An analysis of government data reveals that India has long relied on China to meet its demand for personal computers. There are two elements to this situation: why does India need to import these machines, and why are these imports coming from China?

The latter question is easier to answer. The global notebook PC market stood at 160 million units in 2019, up to 90 per cent of which were manufactured in China, according to Market Intelligence & Consulting Institute, a Taipei-based think tank that focuses on information and communications technologies.

Data for subsequent years is unavailable due to the strict lockdown that China implemented in the wake of the COVID-19 pandemic. However, it is unlikely that the country’s share in laptop manufacturing would have dropped by any significant amount in such a short period. It, therefore, makes sense that, if India needs to import laptops, it would import them from China.

At home, demand for portable personal computers has increased in the wake of Covid-19, and the subsequent work-from-home and online learning strategies employed.

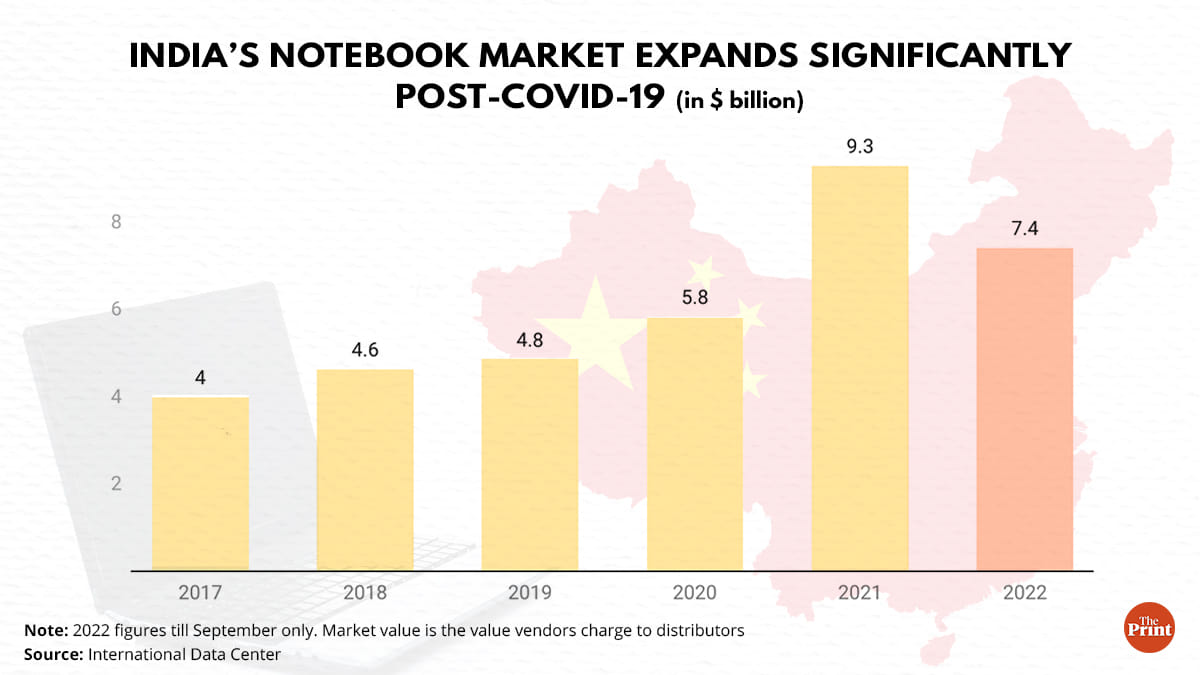

Analysis of data shared especially with ThePrint by the International Data Centre (IDC), a US-based telecom and consumer tech marketing intelligence company, shows that India’s notebook market has more than doubled in the last five years. Most of this was during the height of the pandemic, in 2020 and 2021.

According to statistics by the IDC — which uses the word “notebook” for laptops in its nomenclature — India’s notebook market was worth $3.97 billion in 2017, which grew by 16 per cent in 2018 (to reach $4.6 billion) and 5 per cent in 2019 (to $4.8 billion).

In 2020, India’s notebook market swelled by 19.5 per cent, reaching $5.8 billion. However, it was in 2021 that the market saw a real surge, growing by almost 60 per cent to $9.3 billion.

These amounts represent the sum the import vendors charge to national distributors, who are the first recipients of shipments imported to the country.

This year, too, the market size for notebooks in the first three quarters (nine months) is estimated to be $7.4 billion. This puts it on track to cross $10 billion at the end of the year for the first time, if past trends continue.

Why not make in India?

Bharath Shenoy, senior market analyst at IDC India, told ThePrint that local manufacturing of laptops continues to be low, although things are likely to change.

“The government provides incentives to firms to localise their resources and manufacture laptops in India, but the fraction of locally produced laptops remains minimal,” Shenoy said. “We are expecting the results of these schemes to (come to) fruition in the coming years, but not at a mass scale at the moment.”

The reason, he said, was that in order to mass-produce laptops, the country also needs labour skilled specifically for that.

“We do have some assembly lines working on low-end laptops, but for the premium segment, we have to rely on imports,” he added.

India’s inability to adequately manufacture its own laptops also lies in trade agreements it has signed in the past.

In 1997, India signed the World Trade Organization’s (WTO) Information Technology Agreement (ITA). By doing so, India agreed to not impose any tariffs and duties on fully manufactured laptops imported into the country. At the time, it was envisaged that such a policy would benefit developing countries who could gain from the trade of IT products.

However, as the Indian government has subsequently been saying, our experience from this agreement has not been a positive one.

In 2012, at a symposium on the 15th anniversary of the ITA, India tabled a presentation explaining a “developing country’s experience”, in which it stated that the agreement had, in fact, created tech monopolies, led to a rise in India’s trade deficit, hindered innovation, and made it extremely difficult for new entrants to enter the market.

In 2015, the WTO invited countries to sign up for ITA 2, which expanded the range of IT products for free trade. India decided not to sign up for this.

“India’s experience with the ITA has been most discouraging, which almost wiped out the IT industry from India,” the Ministry of Commerce and Industry’s website says on the matter.

“The real gainer from that agreement has been China, which raised its global market share from 2 per cent to 14 per cent between 2000-2011,” it adds.

“In light of recent measures taken by the government to build a sound manufacturing environment in the field of Electronics and Information technology, this is the time for us to incubate our industry rather than expose it to undue pressures of competition,” the ministry says. “Accordingly, and also keeping in view the opinion of the domestic IT industry, it has been decided not to participate in the ITA expansion negotiations for the time being.”

(Edited by Nida Fatima Siddiqui)

Also Read: India-China military talks have run their course. Live with status quo or sign a new agreement