India is considering allowing foreigners to own stakes as large as 49% in state-run banks as policymakers seek to fund growth without fully giving up control.

“We need credit-to-GDP ratio to increase to 150% from 56% currently,” Federal Banking Secretary M. Nagaraju told reporters on Monday. “We need to see if we should have additional capital or deploy existing capital more effectively or whether we should take a look at capital adequacy ratio. All of this require a calibrated approach.”

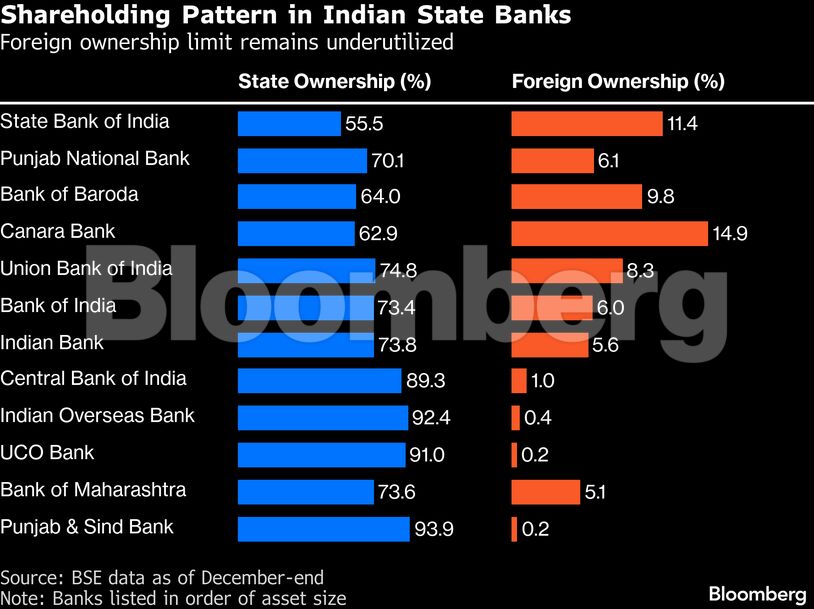

Foreign ownership in State Bank of India – the country’s largest lender – and 11 other state-owned banks is capped at 20%, a legacy restriction rooted in the government’s desire to retain strategic control of the financial system. The limit is far lower than the 74% foreign investment allowed in private-sector banks and the 100% foreign direct investment allowed in local insurers.

A spate of billion-dollar deals for Indian banks has thrust the country’s financial sector into the global spotlight. International investors are scouring for opportunities in India, building on momentum from prior years to invest in lenders, insurance and fintech players.

The Nifty PSU Bank index – a gauge tracking state-run banks – pared a decline of as much as 2.4% to trade 0.3% lower on Monday.

| Read more on India financial stories: |

|---|

| India Needs ‘Eight to 10’ Large Banks, Axis Bank CEO Says

India’s Big-Bang Financial Reforms Target Foreign Money

|

The government is keen for banks to finance large scale private investments to help drive the rapid growth that is needed to transform India into a developed economy by 2047, a target set by Prime Minister Narendra Modi.

India aims to have three-to-four big banks capable of financing growth in the world’s fastest growing major economy, Nagaraju said. Currently, only SBI and HDFC Bank Ltd. rank in the world’s top 100 lenders by total assets.

Bigger banks will be able to handle bigger risks and give out bigger loans, Nagaraju said. “None of the banks today can do that alone,” he said. “We don’t have the financial capacity to lend big amounts.”

A higher foreign limit could potentially drive up operational efficiency in public sector banks, given that increased foreign capital leads to investor activism that helps increase overall competitiveness of the organization, said Vivek Ramji Iyer, a partner at Grant Thornton Bharat.

The ownership cap applies to all overseas holdings combined, including foreign institutional investors, pension funds and other non-resident shareholders. While portfolio investors can buy shares of state-owned banks freely within the cap, any breach would require regulatory intervention, effectively constraining demand from global funds even as India’s equities gain weight in international benchmarks.

In practice, foreign shareholding in state-run banks has remained well below the threshold, leaving untapped room for overseas capital. The government owns more than 51% stake in each of India’s 12 state-owned lenders.

This report is auto-generated from Bloomberg news service. ThePrint holds no responsibility for its content.