With the Chinese government ending its one-child policy, the market for fertility services in the country will reach $1.5 billion in 2022.

Hong Kong: For companies in the business of helping women conceive, China is a booming market. Chinese women are fueling a “fertility tourism” industry stretching from Southeast Asia to southern California offering in-vitro fertilization, egg freezing and other services that are often unavailable or unreliable at home.

Now Chinese clinics are looking to keep more of that spending in the country. With the government ending its one-child policy and encouraging married couples to have more children, the market inside China for fertility services will reach $1.5 billion in 2022, more than double the $670 million it generated in 2016, according to BIS Research.

And investment firms have noticed. Warburg Pincus in September became the second-largest shareholder in Sichuan Jinxin Fertility Co., the assisted-reproduction company said in a statement on 12 September Other investors include Sequoia China and CNCB Hong Kong Investment Ltd., a unit of China Citic Bank Corp.

State-owned conglomerate Citic Group controls one of China’s largest fertility centers, Citic-Xiangya Reproductive & Genetic Hospital, which tallies more than 40,000 cases of assisted reproduction a year.

Orient Shiqi, an affiliate of state-owned China Orient Asset Management Co., recently invested in fertility services operator Jinqi (Shanghai) Medical Investment Co., according to a statement on Jinqi’s website.

“China is a society that values offspring,” said Li Yang, manager of the reproductive health department at Beijing AmCare Women’s & Children’s Hospital, a Warburg Pincus-backed operator of 10 hospitals and clinics that started providing in-vitro fertilization services two years ago, when China scrapped its one-child policy.

“People think having children is essential,” Li said.

China’s Restrictions

For now, companies outside China have an edge because the country has a shortage of fertility centers and embryologists. Further, the government restricts many fertility services to married heterosexual couples or women with ovarian cancer, forcing single women and unmarried couples to look abroad.

To better compete in the fertility business, AmCare made its first overseas acquisition last year, buying a clinic in Washington, D.C., for an undisclosed sum. Now AmCare can offer preliminary services at home, enabling clients to spend only a few days in the U.S. for the egg collections, embryo transfers and other in-clinic procedures.

Liberalization of China’s curbs on family size could encourage older women who have one or two children to try for another, providing a fresh boost to the fertility tourism business. Chinese patients spent 7.4 billion yuan ($1.1 billion) on fertility treatments outside the country in 2016, according to the Qianzhan Industry Research Institute.

China had more than 40 million patients with fertility problems in 2016, according to statistics from China’s National Health and Family Planning Commission.

Going Abroad

Amanda Shen, a 32-year-old entrepreneur from Shanghai, illustrates the situation of many women who freeze their eggs: She doesn’t expect to be ready to start a family for years. To improve her chances of conceiving when the time is right, she decided in 2017 to freeze some of her eggs, traveling to Los Angeles because as an unmarried woman she couldn’t undergo this procedure in China.

“I really think egg freezing has opened the gates to a new era for women,” Shen said.

China is likely to ease some of restrictions that cause women like Shen to look abroad, according to Huang Wenzhang, a researcher at the Center for China and Globalization, a think tank in Beijing. The fertility industry has “huge commercial value,” Huang said. “As China moves toward more generous childbirth policies, tolerance for such treatments will grow.”

China’s two-child limit, implemented in 2016, may not last much longer. Pending legislation related to marriage won’t include family planning policies, according to a report in the Communist Party newspaper People’s Daily published 28 August.

Demographic Worries

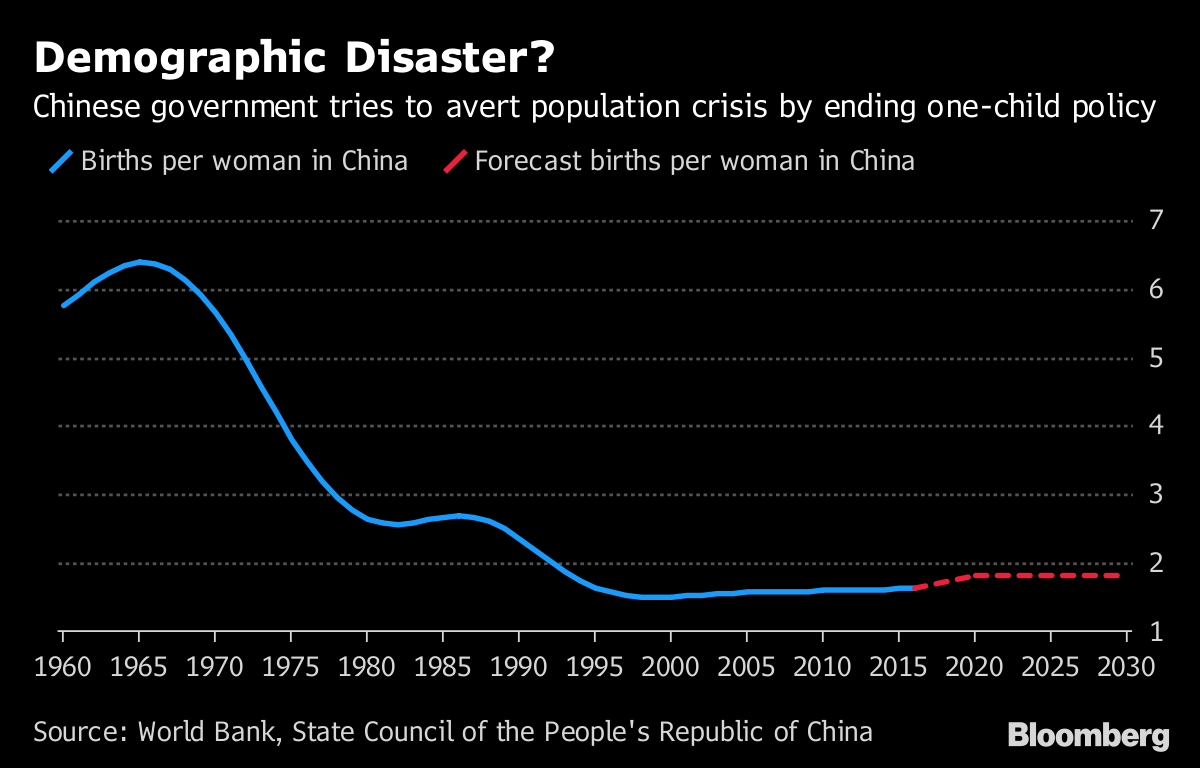

The government is encouraging women to have more children to avert the kind of demographic crisis affecting Japan, where a shrinking population has been a drag on economic growth. China’s State Council last year forecast that about 25 per cent of the population will be 60 or older by 2030, up from 13 per cent in 2010.

Demand is also benefiting from changes in Chinese society as more women delay marriage and pregnancy.

Liu Xiaoman, a 36-year-old former flight attendant, founded a startup, Changjiang Life, two years ago after freezing eggs in the U.S. Her company helps arrange fertility services abroad for Chinese customers, many of whom want to have the freedom to choose when to start a family, she said.

In July, online travel company Ctrip.com International Ltd. said it would offer female executives as much as 2 million yuan to freeze their eggs.

Fertility Investments

Chengdu-based Jinxin is planning an initial public offering in Hong Kong to raise as much as $500 million, with the proceeds possibly helping the company expand its operations in China and make acquisitions in the U.S.

Along with Warburg Pincus, the company recently completed the acquisition of HRC Fertility, which operates clinics in Southern California.

Chinese patients seeking better technology and services will travel to the U.S., said Sunny Dong, chief financial officer of Jinxin Group, the parent company of Jinxin Fertility.

Other companies also are looking to offer services both at home and abroad. We Doctor Holdings Ltd., a health-care service provider backed by Tencent Holdings Ltd., was part of a group that on 31 August announced the purchase of a 90 per cent stake in Genea Ltd., a Sydney-based provider of fertility services that wants to build its business in China.

Chinese fertility companies must improve their services and expertise before the market will be competitive, said Wei Siang Yu, executive chairman of Borderless Healthcare Group Inc., which is developing a center in Thailand to attract Chinese patients.

Over time, though, he’s confident the gap between Chinese centers and foreign ones will narrow. “There will be a new infusion of technology and innovation in this market,” he said.

Still, Alan Copperman, co-director of Reproductive Medicine Associates of New York, is counting on demand in the U.S. to remain strong. RMA in July announced a plan to reach more potential customers in China.

“There will always be people willing to travel around the world if there’s something innovative they can’t get locally,” he said.-Bloomberg