Mumbai: Aditya and Sharada Dalvi booked an under-construction apartment being built by realtor Housing Development and Infrastructure Limited (HDIL) in Mumbai, arranging money for the big purchase by selling off whatever gold they owned, and the flat that they were living in. It has been more than a decade.

Deepa Naik, like the Dalvis, also used all her savings to buy a house in an HDIL property. All she wanted was not to be dependent on her children as she grew older.

Years went by, as did the prime of their lives, but the promised house did not materialise.

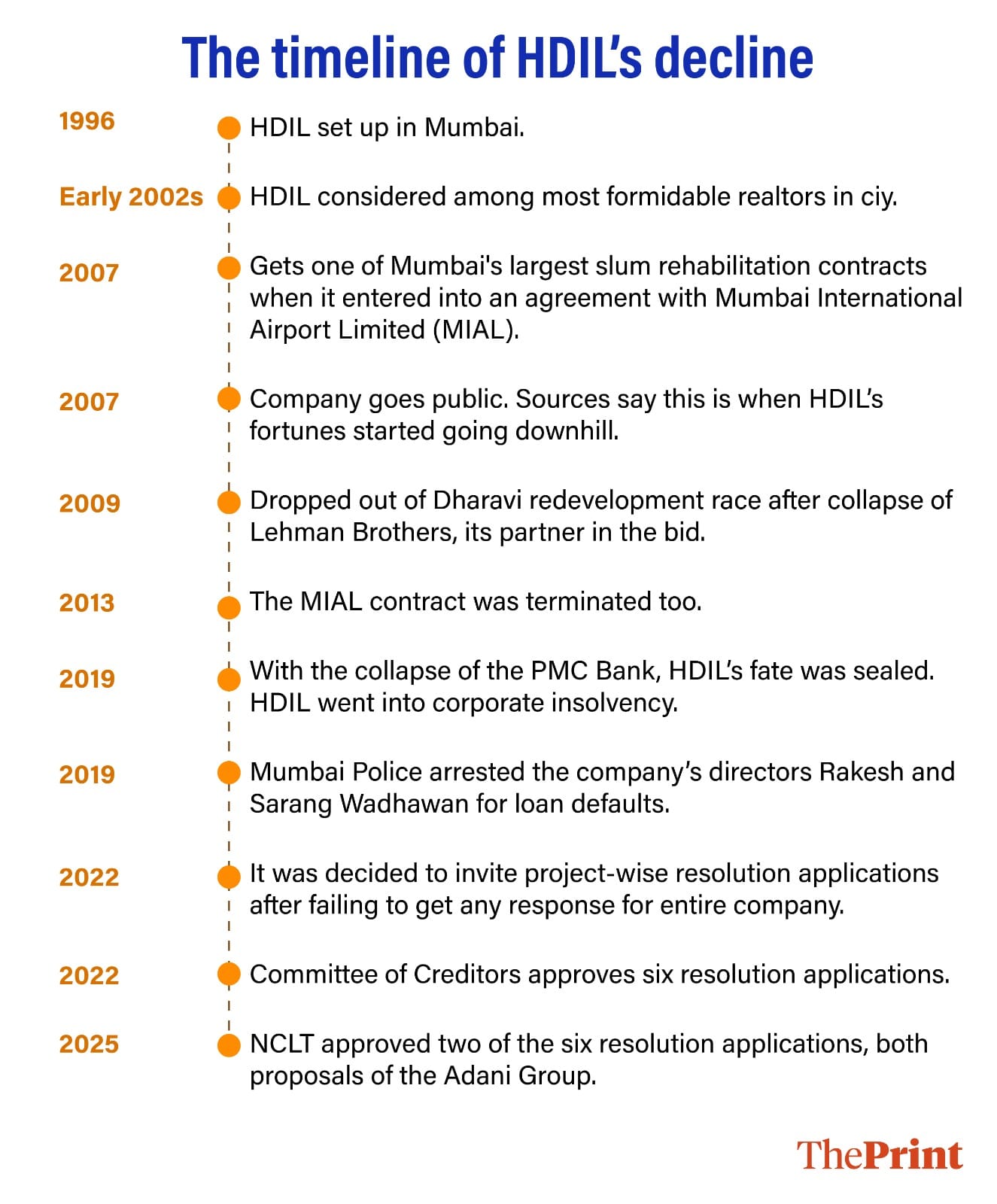

In 2019, the Mumbai Police arrested the company’s directors—Rakesh and Sarang Wadhawan—for loan defaults in the Punjab and Maharashtra Cooperative Bank case. The same year, the company also went into insolvency. It has been six years, but there has been no resolution in sight.

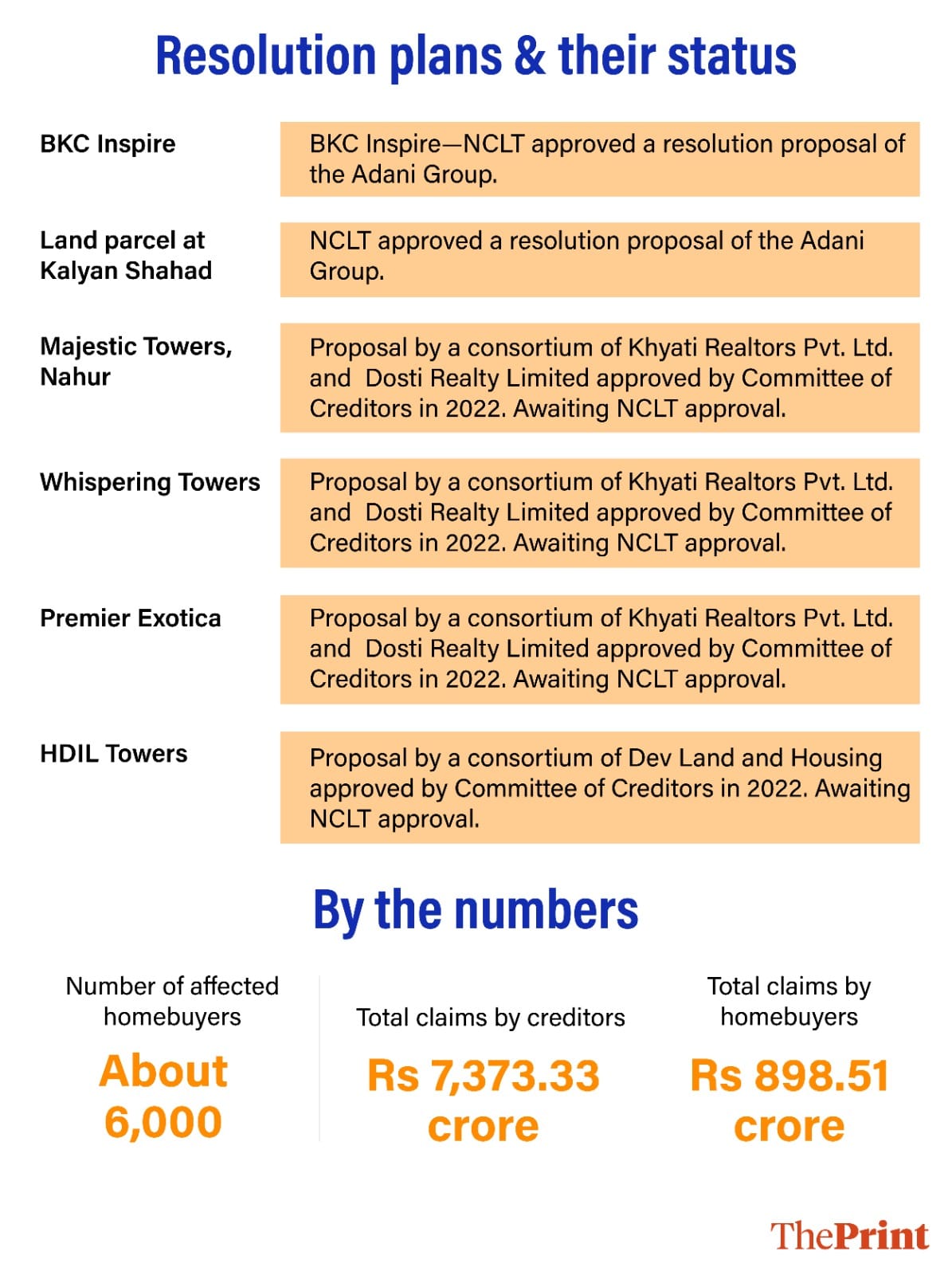

Like the Dalvis and Naik, there are more than 6,000 homebuyers whose life savings are stuck in HDIL’s residential projects. As per a document filed by the Resolution Professional in the case, creditors have raised claims worth Rs 7,373.33 crore from HDIL. Of these, verified claims by homebuyers amount to nearly Rs 900 crore.

There have been a series of hearings in the National Company Law Tribunal (NCLT) and a resolution proposal submitted for three of the largest HDIL residential projects. But homebuyers have been waiting for almost three years now for the formal NCLT approval to the resolution plan.

Meanwhile, the company’s former promoter Rakesh Wadhawan has filed appeals objecting to the resolution plan and asking for a stay on the voting on them.

The affected homebuyers are frustrated with the never-ending wait.

“I have been coming here for every hearing for the past three years, taking time off from work, hoping to get some relief. There is absolutely no clarity on when the resolution plan will get implemented and we’ll get our homes,” 60-year-old Suhas Joshi, who works as an automotive consultant, told ThePrint, outside the NCLT courtroom on Friday.

Joshi had booked an apartment in HDIL’s proposed Majestic Towers at Nahur in 2014 mainly for his children. It was supposed to be a residential colony with a range of amenities such as a swimming pool, a basketball court, a tennis court, a clubhouse, a gym and so on. The apartment cost Rs 1.8 crore, of which Joshi has already paid about 70 percent.

“We had booked the apartment mainly for our children. For them to have a house where they can study and play in peace. Now they are all grown up, we are still paying our EMI, but we still don’t have the house. They are really testing our patience,” Suhas Joshi’s 54-year-old wife, Neha, said.

Also Read: A Rs 33,000 cr ‘banking fraud’: ED’s case against Arvind Dham, Amtek’s web of ‘500 shell companies’

The lengthy resolution process

On Friday, homebuyers streamed into the NCLT’s premises at Cuffe Parade once again, as they have been doing every few weeks for the past six years. There was a hearing scheduled. The homebuyers hoped for some development that will bring them a step closer to their coveted houses, but knew in their hearts that not much is likely to change.

As tribunal judge Lakshmi Gurung gave time to different parties concerned to file rejoinders, and started looking at the calendar to realise that the next possible date for the hearing could only be in November, 42-year-old Pooja Bhalla, an affected homebuyer, rose to her feet and asked for permission to speak.

“Please Madam,” she told the judge. “Put yourself in our shoes. We have waited very long. Our lives have gone by, our children have grown up, some home owners have even died without ever getting to live in their new houses.”

The Bhallas had booked a 2BHK flat in HDIL’s Majestic Towers with her husband in November 2009. They were hoping to start their family in their new house. Now their two children are 13 and 7.

The next hearing was eventually set for 16 October, and the NCLT decided to take up two particular interlocutory applications, which if taken to their conclusion, have the potential to resolve the woes of 80 percent of the affected homebuyers. These pertain to resolution applications for Majestic Towers in Nahur and Whispering Towers in Mulund.

Judge Gurung, however, said, “We understand, but we cannot pass orders based on sympathy. We will have to deal with legal issues first. Without considering their applications, if we pass an order, it will be stayed in a higher court.”

The legal issues, however, have been myriad and complex.

HDIL filed for corporate insolvency after lender Bank of India went to the NCLT for the recovery of Rs 522 crore in 2019. As per company documents filed by Resolution Professional Abhay Manudhane, who was appointed for the job in January 2020, there were “several operational issues in compiling financial details of the company and finalising accounts”.

In the documents, he has said there was a mass exodus of key employees related to finance, accounts and banking. Also, no information could be gathered from the management as they were in judicial custody. Further probes by multiple agencies, the alleged non-cooperation of employees, the Covid-19 pandemic and the subsequent lockdown further slowed down the process.

Manudhane did not respond to ThePrint’s calls, text messages and email for a comment. The report will be updated if and when a response is received.

The documents further say that as reported by forensic auditors, there were several misstatements and errors in the financial statements of previous years that could not be rectified due to lack of accurate information.

The total financial claims from creditors amount to Rs 7,373.33 crore. This includes Rs 898.51 crore by homebuyers, Rs 593.58 crore from government authorities, Rs 11.57 crore from employees and Rs 305.48 crore from other creditors. The documents also note that the balances in the books of accounts are different from the claims lodged.

In February 2020, the Resolution Professional invited Expressions of Interest from bidders to submit a resolution plan for HDIL as a whole, but it drew a blank.

So in January 2021, there were discussions on exploring a project-wise resolution for the company instead of looking for a plan for the entire firm. But, initially, a majority of the Committee of Creditors voted against it. Following this, the same year, the Committee of Creditors passed a resolution to liquidate HDIL.

Multiple associations of homebuyers objected to the liquidation process, and the matter eventually landed in the National Company Law Appellate Tribunal (NCLAT), which emphasised that liquidation should be the last resort, and directed the NCLT to allow time to explore project-wise resolution.

The project was divided into 10 clear verticals and the Resolution Professional invited resolution plans for these.

No resolution in sight

Fifty-four-year-old Sheetal Kharat had booked two connecting flats in Majestic Towers in 2009, with the promise of delivery by 2013. She had paid over 70 percent of the total consideration by the time the work stopped around 2013-2014.

“After 2-3 years, they started some work again, raising our hopes that we might get the house in 2016 or so, but from then till now there has been no construction on the site. Whatever had been constructed already is in ruins now,” Kharat said.

Kharat’s daughter was five when her family purchased the two flats thinking she can enjoy the benefits of a gated community—the swimming pool, clubhouse, lots of children her age.

“Now, she will be married in a couple of years,” Kharat said. “I have a very big family, and we thought we would all stay together. We invested our lifetime’s worth of savings.”

So, in November 2022, three years after HDIL went into insolvency, when the Committee of Creditors approved resolution plans for six of the 10 verticals, it came as a ray of hope for Kharat like many others.

A consortium of Khyati Realtors and Dosti Realty had submitted resolution applications for three verticals—Majestic Towers, Whispering Towers and Premier Kurla. It was among the proposals that had received the Committee of Creditors’ nod and now just needed the formal approval of the NCLT.

Other than accepting these, the Committee of Creditors had also accepted two resolution applications from the Adani Group, one for commercial building Inspire BKC and another for land parcels at Shahad in the Thane district.

In June this year, the NCLT approved two of the six resolution applications, both proposals by the Adani Group. The company’s resolution plan for the Inspire BKC project is valued at Rs 3 crore with Rs 2.85 crore to the creditors and Rs 15 lakh for the insolvency process. For the Shahad lands, the Adani Group will have to pay Rs 63.75 crore for the project for the financial creditors and the insolvency resolution costs.

Meanwhile, Kharat’s wait for that ray of hope turn into a definite luminous light as the other four proposals, including the one pertaining to Majestic Towers, still await the NCLT’s nod.

Subsequently, homebuyers of HDIL’s Paradise city project in Palghar also organised themselves and submitted a resolution application to complete the project, which the Committee of Creditors did not approve as it did not get the required votes.

“We are about 3,500 homebuyers who have completed stamp duty and registration and are stranded. We were told we will get possession in 2013. We want to come forward, put in money and complete the project and have filed an application in the NCLT now to allow us to do that,” 48-year-old Rakesh Nalawade, who works with an IT company, told ThePrint.

He said that at the meeting of the Committee of Creditors, they could not get the required 66 percent votes as the Unity Small Finance Bank, with which the PMC Bank was merged, did not vote.

“We are trying to show to the NCLT that there’s no debt of the PMC Bank on our property. We will come forward and pay the resolution costs to the best of our abilities, but allow us to complete the project. If our project goes into liquidation, no one knows what will happen to our investments,” Nalawade added.

The rise & fall of Wadhawans

There are multiple obstacles for the resolution plans—even those approved by the Committee of Creditors—that the NCLT needs to deal with before giving its go-ahead.

The first is that the Brihanmumbai Municipal Corporation (BMC) has claimed pending property tax of Rs 895 crore, which also includes some period before the corporate insolvency resolution process started. As per the NCLT, the resolution professional has already admitted pending property tax claims of Rs 289.29 crore till 31 March 2020. The tribunal has asked the resolution professional to verify the claim and include it in the resolution cost.

In the last hearing on 26 September, judge Gurung said, “The amount that the civic body is asking will have to be paid first. Under the Insolvency and Bankruptcy Code (IBC), CIRP (Corporate Insolvency Resolution Process) costs have to be paid. There is a new proposed amendment where the BMC may not be treated as a secured creditor. This will benefit the homebuyers,” the judge said, asking homebuyers to wait for the amendment without giving a specific timeframe.

The second most prominent obstacle is that the Wadhawans have filed multiple interlocutory applications in the case. They want the NCLT to stay the votings in the resolution plan and also reject the resolution plan submitted by Khyati Realtors.

Founded in 1996, HDIL was considered among the most formidable realtors in Mumbai by the early 2000s. In 2010, promoter Rakesh Wadhawan and his family had even featured in a Forbes’ list of Indians with a net worth of over $1 billion. His son, Sarang Wadhawan, and Sarang’s wife Anu were known for their lavish parties attended by the cream of Mumbai’s glitterati.

HDIL was among the major players in Mumbai’s slum redevelopment and had also shown early interest in revamping Dharavi, Asia’s largest slum sprawl, in 2009. It, however, dropped out of the race after the collapse of its partner in the bid, Lehman Brothers.

In 2007, HDIL got one of the city’s largest slum rehabilitation contracts when it entered into an agreement with the Mumbai International Airport Limited (MIAL) to resettle over 80,000 slum dwellers encroaching on 276 acres of airport land in exchange for development rights of over 40 million square feet to be used elsewhere. HDIL was supposed to complete the rehabilitation by the end of 2011. The contract coincided with HDIL going public in 2007.

Sources in Mumbai’s real estate market say this is when HDIL’s fortunes started going downhill. The company started facing financial troubles and failed to deliver on the large airport slum redevelopment contract.

The MIAL ultimately terminated the contract in 2013, after which the two parties were embroiled in a three-year long arbitration process before they decided to mutually end their dispute in 2016 and withdraw any claims and counterclaims.

Then in 2019, with the collapse of the PMC Bank, HDIL’s fate was sealed. The bank was said to have a rather cozy relationship and a massive debt exposure to HDIL despite its precarious finances. Multiple agencies opened probes, while HDIL’s Rakesh and Sarang Wadhawan had to swap their posh residences for the infamous Arthur Road jail. The father-son duo walked out of prison in April last year after the Bombay High Court granted them bail.

The homebuyers have been running pillar to post, writing to the President, Prime Minister and even the Maharashtra chief minister asking for their intervention.

Meanwhile, the residential properties that were supposed to be their homes are lying abandoned, decaying.

B.M. Shetty, a retired septuagenarian, had booked a 2 BHK apartment in Whispering Towers in 2013. The project seemed ideal for him. It was coming up close to where he used to live and had all possible amenities.

“When I used to walk my children to school, I would point at the construction and say, see this is going to be our new house. Now my grandchildren are asking where the house is. I can’t even point out the property to them, and say, some day. It’s turned into a dumping yard,” he said.

(Edited by Ajeet Tiwari)

Also Read: What’s behind bond yields’ logic-defying spike? The market’s concern over the future