New Delhi: India’s policy of managing the exchange rate’s volatility hasn’t changed, central bank Governor Sanjay Malhotra said, quashing speculation that it was allowing large swings by staying on the sidelines and letting the rupee plumb new record lows this week.

“We don’t think there has been any conscious attempt to change our tolerance to volatility,” Malhotra said at a post-policy press conference after Reserve Bank of India cut interest rates by a quarter point on Friday.

His comments follow the rupee’s slide past the key 90-per-dollar mark to a new record low this week — a move many traders attributed to the central bank’s less aggressive support for the currency. The RBI had defended the record low touched in September for two months before allowing the rupee to test a series of fresh troughs recently.

“We believe that markets, especially in the long run, are very efficient — it’s a very deep market,” Malhotra said, noting that the rupee had weakened to around 88 per dollar in February but recovered to 84 within three months. “These fluctuations, this volatility does happen. Our effort has always been to reduce any abnormal or excessive volatility, and that is what we will continue to endeavor.”

The rupee has declined about 5% this year, making it Asia’s worst-performing currency. It has been hit by punitive US tariffs that have widened the trade deficit to a record high, along with foreigners pulling out money from domestic equities.

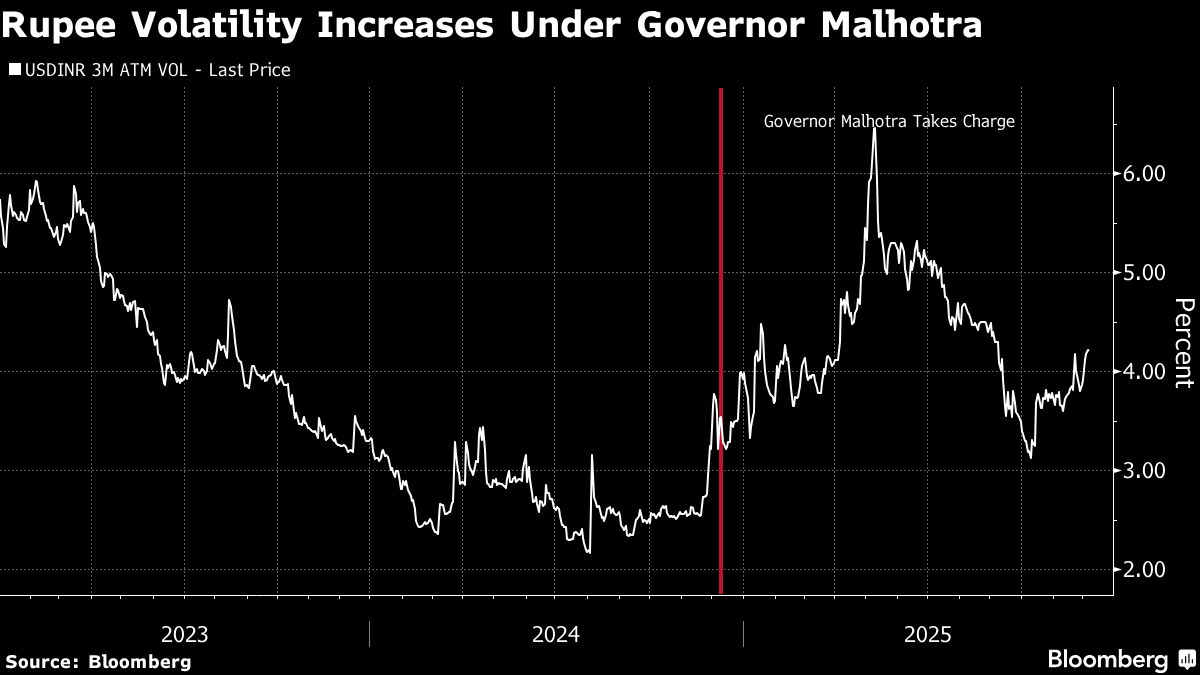

As Malhotra completes a year in office, market participants say he has taken a more hands-off approach to the currency than his predecessor, Shaktikanta Das, who kept the rupee in a tight range.

“Lately, the RBI has been limiting its intervention in the currency market, perhaps allowing rupee depreciation as a line of defense in the face of higher tariffs on exports to the US,” Elara Securities India Pvt analysts, including Garima Kapoor, wrote in a note before the policy. “The RBI’s less active intervention approach has been interpreted as tolerance for weaker rupee, thereby fueling wider trading bands and speculative rupee shorts.”

The RBI’s more measured interventions are also visible in the slower pace of reserve drawdowns. It net sold an average of $1.2 billion in spot reserves per week over the four weeks to Nov. 21, compared with $3.5 billion per week in the preceding four weeks, according to Nomura Holdings Inc.

“Given the strong fundamentals of our country, we should get good capital flows as well, going forward,” Malhotra said. “I think we are in a very comfortable position in so far as the external sector position is concerned.”

Disclaimer: This report is auto generated from the Bloomberg News Service. ThePrint holds no responsibility for its content.

Also Read: India’s strong growth lowers odds of RBI rate-cut, economists say