New Delhi: Several household commodities like cooking oil and vegetables saw inflation during the festive season, but the Narendra Modi government has managed to rein in the prices of pulses, which had been soaring for months, via free imports and stock-limit options.

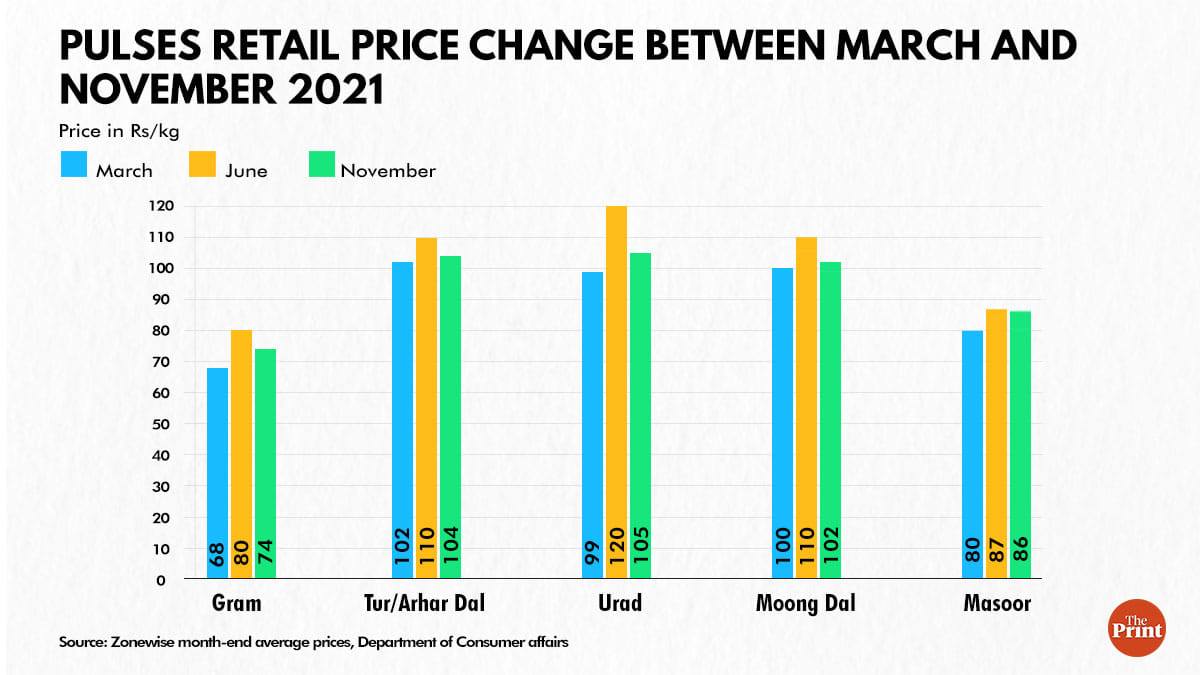

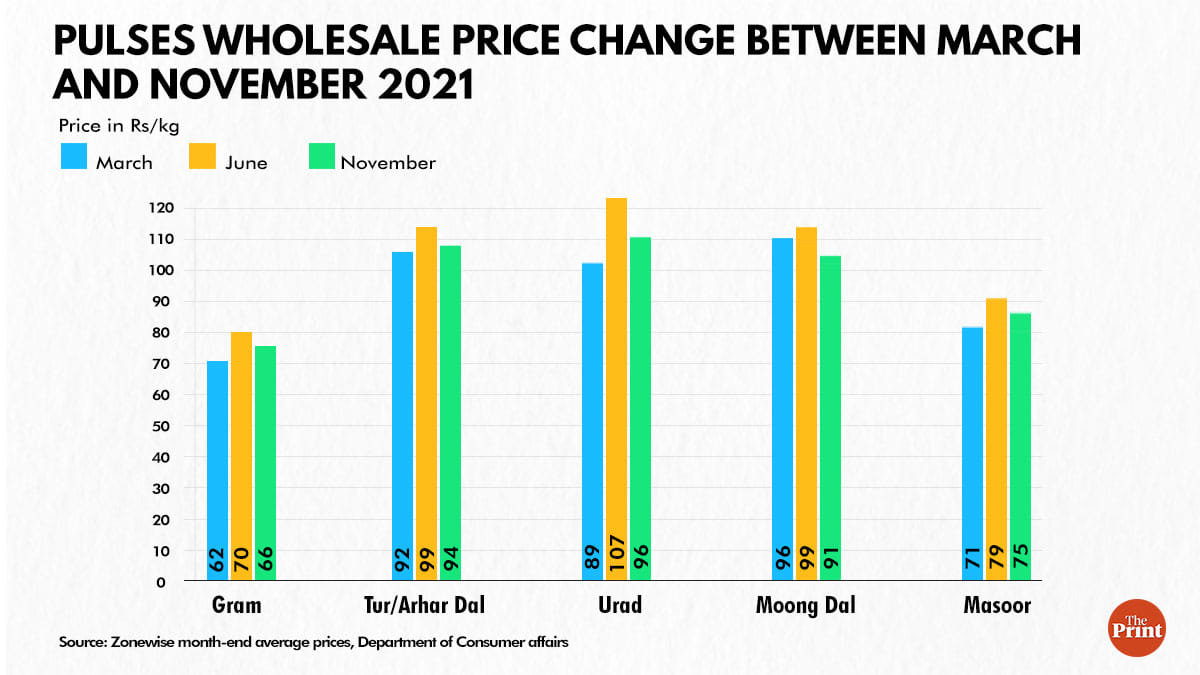

According to data from the Department of Consumer Affairs, the prices of pulses like tur/arhar, urad and moong are currently hovering near the Rs-100/kg mark in retail as well as wholesale markets.

This is nearly 10-15 per cent lower than the peak prices in June this year, when the rates had touched around Rs 120/kg.

The retail prices in June were 21 per cent higher than the March prices, when the inflationary trend in pulses kicked in in the domestic markets. Similarly, in wholesale markets, the prices of pulses touched Rs 107/kg in June, 20 per cent over the March rates.

The inflation in pulses had turned severe enough for the Centre to even abandon free pulses distribution provision in its flagship pandemic food aid scheme, as ThePrint reported.

However, two major interventions by the Modi government ahead of the October-November festive season brought down the wholesale as well as retail rates in domestic markets.

On 15 May, the Ministry of Commerce and Industry allowed free imports of tur, moong and urad. The order allowed any party to import any amount until 31 October with consignment being cleared until 30 November, as long as it was billed before October. It was the first time since August 2017 that such an order had been made.

Then the government enforced a stock limit on pulses from 2 July-31 October for all pulses except moong, varying up to different amounts for different stakeholders such as wholesalers, retailers, millers and importers. The figures were slightly revised later.

Meanwhile, the government also slashed import duty on masoor dal to zero while reducing agri-cess levied on it by half. It also allowed the import of the commodity for the first time in six months.

Also read: Centre clarifies India has not signed up for COP26 action agenda on sustainable agriculture

‘Policy interventions yielded positive results’

According to stakeholders, the government’s moves allowed breathing space for the consumer and reduced pressure on the market.

“Policy interventions by the government to allow the import of key pulses have yielded positive results for the consumer. There’s also a liquidity crisis in the market, putting downward pressure on prices which have now levelled off to the advantage of the consumers,” said Bimal Kothari, vice-chairman, India Pulses and Grains Association.

“The prices have reduced by 8-10 per cent from August levels and have remained stable during this festive season. Prices for tur have dropped by Rs 6-7/kg while urad and masoor prices have dropped by Rs 5-6/kg,” he added.

According to Department of Consumer Affairs data, the urad prices saw the sharpest drop, with an over 12 per cent fall in retail rates between June and November. Urad had seen the highest jump in pulses, shooting up over 20 per cent in both retail and wholesale markets between March and June.

Other major pulses such as tur, moong and gram also saw substantial drops during the festive season. According to experts, the prices of pulses are expected to remain suppressed owing to the interventions.

“Even after stock limits have been removed, there is a slowdown in the pulses markets across the country as traders still fear that if there is an uptick in commodity prices, the government will enforce stock limits again… leading to further demand slump and pressure on prices,” said Rahul Chauhan, a researcher at commodity market research firm IGrain India.

“The new crop will also start to arrive in the next 20 days after milling and processing. All the stockists will release their old carry overstock before the arrival of the new crop which will push down prices in the coming days. Even NAFED has had to cancel multiple tenders of gram due to its low price bidding in the market,” Chauhan added.

(Edited by Amit Upadhyaya)

Also read: Govt’s plan to tackle edible oil price rise: Push for domestic rice bran oil production