New Delhi: In the first week of August 2020, ICICI Bank alerted a Delhi-based chartered accountant (CA) about a company submitting a 15CB certificate—purportedly issued by the accountancy firm he runs with partners—for an outward remittance. The email raised an immediate alarm, with the CA flagging that his firm had not issued the certificate. He, however, was unaware of the magnitude of what was actually a “money laundering” scam.

Form 15CB is a CA’s certificate verifying compliance with tax laws and mandatory for sending funds to non-resident individuals or foreign firms. Only CAs registered with the Income Tax Department can issue the 15CB document.

Last month, the Enforcement Directorate (ED) arrested Amit Aggarwal, a Delhi-based businessman, after charging him with planning a conspiracy involving forged CA certificates for remittance of funds totalling Rs 700 crore to Singapore and Hong Kong.

Aggarwal was allegedly behind several large remittances disguised as payments for the imports of small goods—for instance, chips—that attract very low import duties, or for unavailed freight services.

With the Supreme Court, in August this year, cancelling his anticipatory bail, earlier granted by the Delhi High Court, Aggarwal has now surrendered before a Special Prevention of Money Laundering Act (PMLA) court.

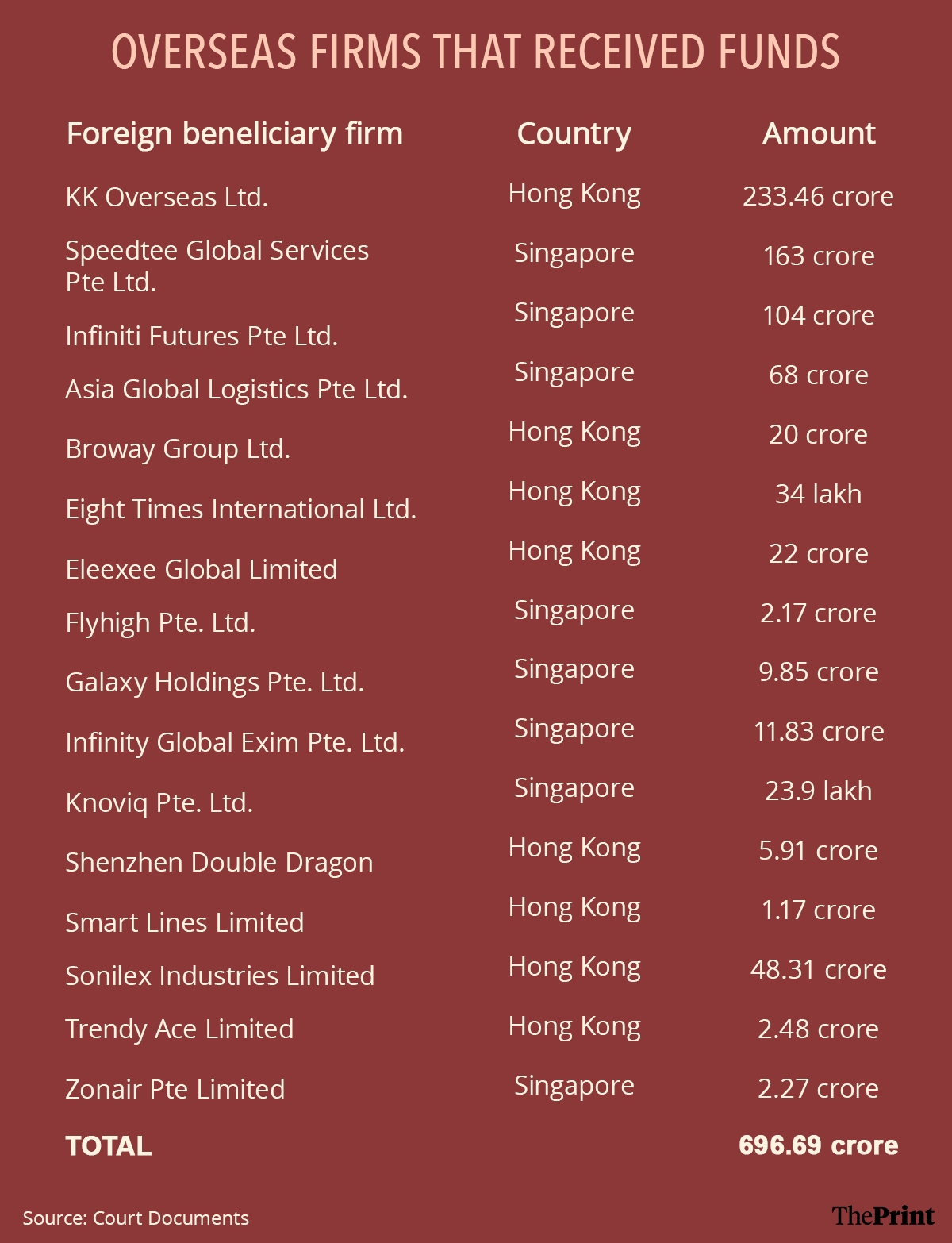

An ED spokesman said, “…a high quantum of funds totalling Rs 696.69 crore was remitted from India to Hong Kong and Singapore in the garb of import of goods and services, and payment towards freight charges. Against these remitted funds, largely no supply of goods and services was made in India, thus, causing loss of foreign exchange to the exchequer.”

After the agency discovered the modus operandi, roughly categorised as “trade-based money laundering”, it alerted the INTERPOL about the scheme, involving shell entities, through India’s nodal agency Central Bureau of Investigation.

Based on findings of the ED investigation, INTERPOL released a Purple Notice, the first-ever issued for a scam any Indian agency reported, on 21 August this year, informing countries about the unique modus operandi. The Purple Notice is one of the eight types of notices that the Interpol publishes, providing member countries with “information on modus operandi, objects, devices and concealment methods used by criminals”.

Also Read: Foreign asset files: How Amarinder & son’s setback in HC could put a ‘frozen’ FEMA probe in motion

ED investigation: Unpeeling the layers

By September 2021, the ED had received the Suspicious Transaction Reports against several of the remittances, allegedly completed by Aggarwal’s syndicate. Also, the chartered accountant, who got entangled in the case, had received the ICICI Bank intimation on one of the transactions. The anti-money laundering agency summoned the CA for questioning under the provisions of the Foreign Exchange Management Act, 1999.

“I was suffering from a fracture in my leg and compromised health, which prevented me from digging deeper into the fraud committed in my name. I first approached the bank and flagged that I have never issued any certificates for the firm it had contacted me about. But I was shocked to gather the magnitude of the forgery when summoned by the ED. I was not aware of it at all. I, however, am relieved that the module was busted,” he told ThePrint requesting anonymity, citing the pending investigation.

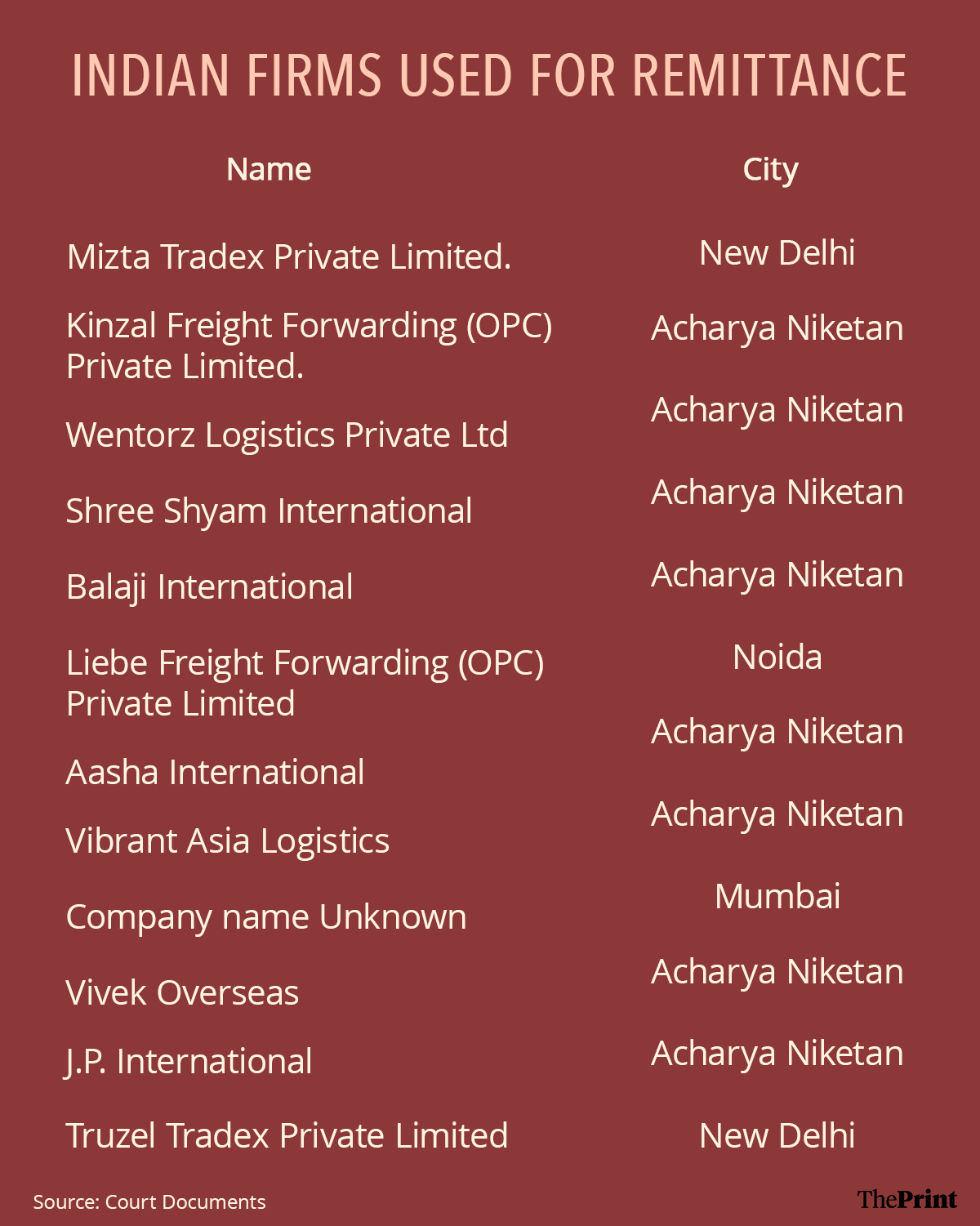

The ED confronted him with copies of 15CA/CB certificates, purportedly issued by his firm and submitted to banks by companies, like Kinzal Freight Forwarding (OPC) Pvt Ltd, Balaji International, Shree Shyam International, and Wentorz Logistics Pvt Ltd. By then, the ED had traced remittances of Rs 300 crore by the firms via ICICI Bank.

With the ED flagging the gross misuse of Form 15CB issued in his name, the CA decided to dig further into the forged forms and allegedly found several discrepancies. By March 2022, he had identified the origin of the fraud and approached the Delhi Police Economic Offences Wing (EOW) to file a complaint against the firms involved, especially Ravi Mehra of Wentorz Logistics Pvt Ltd.

In the police complaint, he alleged that upon examining the certificates, he found the same Unique Document Identification Number (UDIN) on all the forms. However, the Indian Institute of Chartered Accountants (ICAI) generates a unique UDIN for each remittance, he noted in his complaint. A UDIN is an 18-digit identifier issued by the ICAI to authenticate documents certified by practising CAs. He also submitted to the EOW that he issued seven 15CB certificates for Wentroz Logistics Pvt Ltd, but the other firms were not in his registry.

“For the last quarter of March 2019, I asked for GST details, bank statements, and tally data from the [Wentroz Logistics] management for preparation of financial statements, but they did not provide me with anything, and then, they stopped visiting me,” the CA alleged.

“I am afraid that, in the past three to four months, when this company [Wentroz Logistics] was my client, documents shown to me for the issue of 15CB forms may also have been forged,” the CA added in his complaint, which was the basis of an FIR in March 2022.

The 2022 FIR slapped sections 420 (cheating), 467 ( forgery of a valuable security), 468 (forgery for the purpose of cheating), 471 (using as genuine a forged document) and 120B (criminal conspiracy) of the Indian Penal Code on the accused. ThePrint has seen a copy.

Weeks after the FIR, the ED opened an Enforcement Complaint Case Report (ECIR), thereafter finding illegal remittances of roughly Rs 700 crore.

Some remittances were via ICICI Bank accounts, so the ED scoured the documents submitted for opening the ICICI Bank accounts. In the KYC documents, the ED identified a bank account belonging to Rashmi Dwivedi and a mobile number associated with it.

In the next step, the agency found that the mobile number actually belonged to Chitra Pandey. She is a director in two firms, Mizta Tradex Pvt Ltd, and Truzel Tradex Pvt Ltd, under the pseudonym Rashmi Dwivedi.

In her statement to ED, Pandey claimed she earlier worked as a relationship manager for TATA AIA Life Insurance. Subsequently, Rahul Kumar, working with IndusInd Bank, offered her a job as an accountant. Since both had their offices on Delhi’s Barakhamba Road, they met often. In February 2019, Rahul offered her a job, and the two firms now remain incorporated under her name, with their registered office on Barakhamba Road, according to the ED prosecution complaint.

CA form forgery, 28 firms & masterminds

Initially, the ED came upon a USD 7,68,470 payment from the bank account of Wentorz Logistics into another bank account linked to a Singapore-based firm, Infiniti Futures Pvt Ltd, as payment towards freight charges.

On overall scrutiny, the ED found that Infiniti Futures received USD 11,861 from nearly 18 shell companies. Overall, the ED submitted a list of 28 companies—12 in India and 16 across Singapore and Hong Kong—used for funds parking in foreign currency.

In November 2022, ED arrested Manpreet Singh Talwar, the controller of Infiniti Futures. His mobile phone led the agency to another suspect in the illegal remittance racket.

The latest suspect, Navin Kejriwal, was controller of Singapore-based firms, Speedtec Global Services Ltd and Infinity Global Exim Pte Ltd, as well as Hong Kong-based KK Overseas Ltd.

The ED found that Kejriwal received USD 5,59,32,695 in his foreign-based companies between August 2019 and May 2020. He, however, was absconding with a non-bailable arrest warrant pending against him.

Talwar was further liable for investigation after the ED found that the bank account of his firm, Infiniti Futures, received USD 7,68,470 from Wentorz Logistics via the ICICI Bank account used to forge the 15CB certificates and fake the airway bills.

Similarly, the ED arrested Sanjay Jain, the director of Singapore-based Galaxy Holding Pte Ltd, which received Rs 9.85 crore from Truzel Tradex, incorporated by syndicate masterminds Rahul Kumar and Amit Aggarwal.

The transactions took place in four tranches from 22 to 28 July 2020. Although Jain resigned as director of the firm on 24 July, the ED alleged he might have done so only to avoid criminal liability. The firm had already received Rs 4.92 crore between 22 and 23 July 2020, the ED submitted.

The ED further arrested Rahul Kumar in December 2022, identifying him as one of the masterminds, who played a key role in incorporating shell companies based on forged KYC documents, such as voter ID cards, PAN cards, and Aadhaar cards.

The agency found that the racket incorporated 12 shell companies in India and used fake airway bills and 15CB certificates to remit nearly Rs 700 crore into 16 companies in Singapore and Hong Kong—a majority of which dealt in electronic items, such as semiconductors, chips, LED, and photovoltaic cells.

These products attract very little duty on import, and hence, the real cost of remitting money abroad in the name of their fake import was not expensive for the syndicate.

In the next step, the accused told investigators that goods imported from overseas were later sold to firms in Dubai where payments got stuck over arbitration. “When confronted about the absence of credit from overseas firms in exchange of the goods exported, they [the accused] claimed that the firms had rejected the goods alleging substandard quality and that payments are stuck in arbitration proceedings,” an ED official told ThePrint.

The ED probe showed that some beneficiary firms were merely on paper, worked as taxi companies, and ensured the flow of funds to all the beneficiaries. The probe also took the ED officers to Gaurav Sharma, who allegedly confessed to having been appointed as a director in Wentorz Logistics by Amit Aggarwal on the promise of a commission of five paise per dollar remitted via the company in Indian Rupees.

Similarly, Rahul Kumar confessed to having worked with Amit Aggarwal and purchasing two companies, Truzel Tradex Pvt Ltd and MS Mizta Tradex Pvt Ltd. He further revealed that they used to pay people in their syndicate a commission of 20 paise per dollar for document forging, necessary for the KYC process.

All these forgeries aimed at camouflaging the real identities of the directors, the ED said.

According to ED sources, Aggarwal orchestrated the entire scheme, and he and Rahul Kumar incorporated several firms using pseudonyms of individuals, who acted as directors of the respective shell companies and opened bank accounts with their forged identities.

“Amit Aggarwal was instrumental in the collection of cash and in arranging RTGS (Real-Time Gross Settlement) entries against such cash deposits. After obtaining the RTGS entries, it was Amit Aggarwal, who determined the foreign companies and corresponding bank accounts to which the funds were ultimately remitted,” an ED official told ThePrint.

As Aggarwal’s name started coming up again and again in the probe, he moved an anticipatory bail application in a Delhi court. Later, he challenged the dismissal of his plea before the Delhi High Court.

The Supreme Court, in August, quashed the protection from arrest given to Aggarwal by the HC in February last year, instead ordering him to surrender, citing the necessity for his custodial interrogation by the ED.

The source of these funds, however, remains unclear, with the Delhi Police EOW yet to file a chargesheet in the 2022 case filed based on Mohpal’s complaint.

(Edited by Madhurita Goswami)

Also Read: As HC upholds his arrest, a look at Congress ex-MLA Dharam Chhoker’s saga of legal tussles with ED