New Delhi: High-end salaries, plum foreign jobs and big growth plans for the industry fuelled the setting up of hundreds of pharmacy colleges in India. But the ensuing glut has seen over 50,000 seats going vacant annually.

The number of pharmacy colleges in India has gone up to 2,694 in 2019-20, from 1,425 in 2012-13, according to data available with the All India Council for Technical Education (AICTE), a central government body.

While there were 1.61 lakh seats on offer in 2012-13, the number rose 72 per cent to 2.77 lakh for the academic year 2019-20. Enrolment, however, has not kept pace.

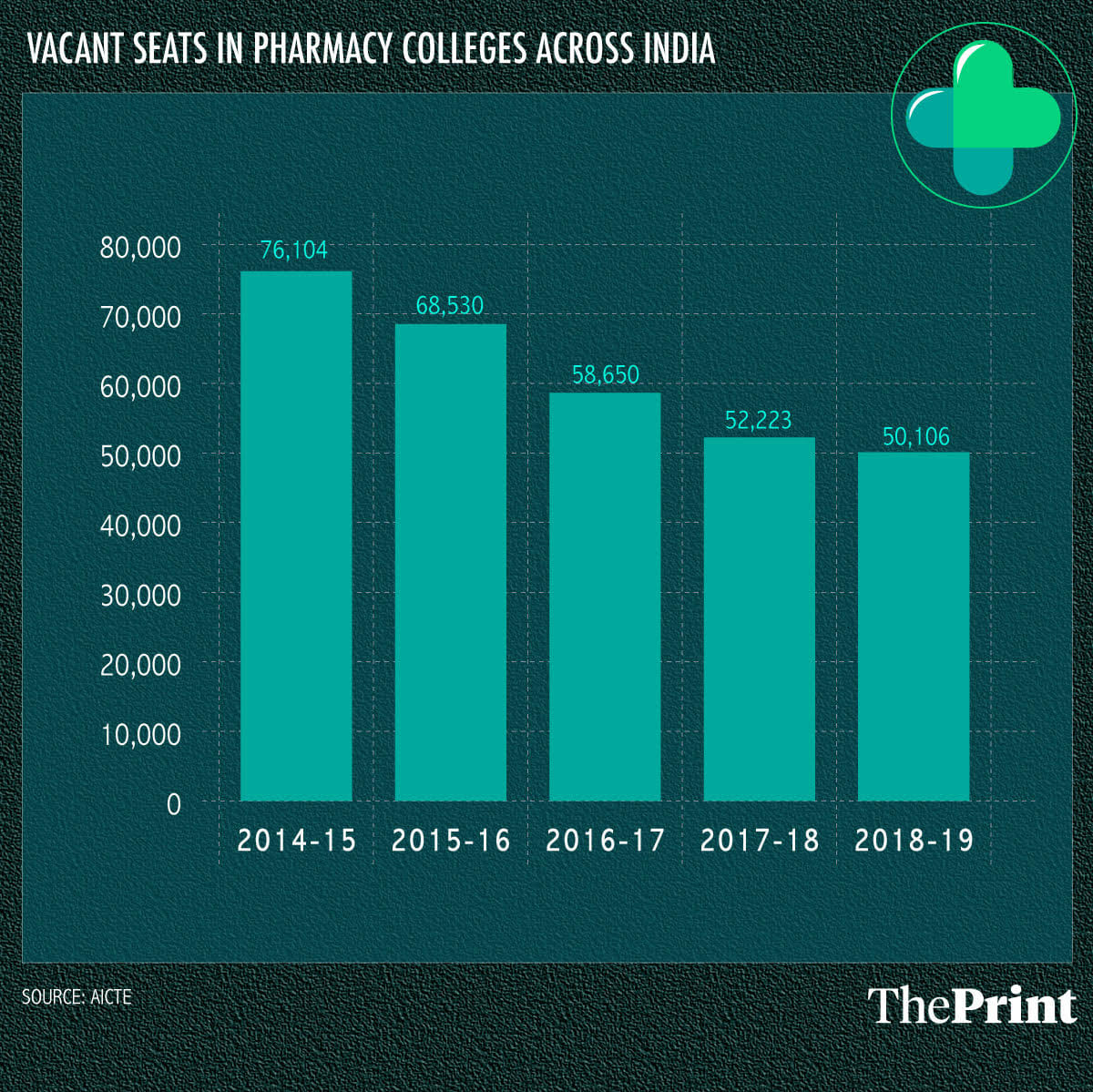

As many as 58,650 seats went vacant in 2016-17, 52,223 in 2017-18 and 50,106 in 2018-19. The enrolment figures for 2019-20 are yet to be released.

The trend mirrors India’s experience with engineering colleges, which mushroomed by the dozen as the promise of big salaries and a cultural affinity for the profession drew thousands of students to opt for it.

There was a constant increase in the number of seats in engineering colleges until 2014-15, but they began to shrink amid low enrolment and questions about the quality of education on offer.

The number of seats rose from 2.69 lakh in 2012-13 to 3.18 lakh in 2014-15, but almost half the seats remained vacant.

Following feedback from experts about the colleges churning out unemployable engineers, the central government shut many down.

By academic session 2019-20, the number of seats was down to 2.53 lakh.

Come 2020, a moratorium will kick in on setting up new engineering colleges or adding more seats.

To prevent a similar situation from arising in the pharmacy sector, the central government has also stopped the setting up or expansion of pharmacy colleges until the academic year 2021-22, as reported by ThePrint last month.

“In the past, a huge number of engineering colleges were opened which later found no takers, we do not want pharmacy to go the same way, this is why opening of new pharmacy colleges has been banned,” said AICTE chairman Anil Sahasrabuddhe.

“We want only quality pharma graduates coming out of the existing colleges,” he added.

A senior official in the Pharmacy Council of India, a government body that regulates education in the field as well as the profession, said the existing institutes “are enough to produce the required number of graduates who will cater to India’s demands of the pharma industry and take care of global healthcare needs”.

“If the number of seats is increased, quality will fall. A number of low-quality pharma colleges have already come up in recent times, which is why seats remained vacant,” the official added. “The government cannot afford to take the numbers beyond that.”

Also read: Major Indian drugmakers receive FDA warning over quality issues, tainted supplies

Jobs boom in pharmacy

Several reasons have contributed to the growing interest in pharmacy over recent years.

They include increased employment opportunities as the Indian pharma industry hopes to grow to $120-130 billion by 2030 from $38 billion now, according to the Indian Pharmaceutical Alliance (IPA), an industry body that represents top domestic drugmakers like Sun Pharma and Lupin.

Other factors are employment opportunities from Gulf countries and the government’s Jan Aushadhi scheme, they added.

A fresh B. Pharma graduate can hope to get Rs 50,000 per month for a job with a reputed firm in the country and Rs 1 lakh per month abroad.

“The growth is not majorly in retail pharmacies, but mostly from pharma companies employing more and more pharmacy graduates in their R&D labs and manufacturing, distributions departments,” said Rajiv Singhal, general secretary at pharma market research organisation AIOCD.

Singhal added that Indian pharmacists were being offered good job opportunities in Gulf countries like Oman, UAE, Egypt and Kuwait. Another local player, Saudi Arabia, reportedly has plans to become a pharma hub.

“Due to high salary packages, Indian pharmacists are seeing good job opportunities in these countries where pharmacies and pharmaceutical companies are both expanding… Indians have better expertise,” said Singhal.

PM BJP also contributes to growth

Part of the boost can also be attributed to Prime Minister Narendra Modi’s flagship Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PM BJP), under which the central government sells medicines at cheaper rates. The number of stores under the scheme has gone up from 99 in 2014 to 5,000.

“Apart from just the mandatory requirement of hiring one pharmacist at every Jan Aushadhi outlet, pharmacists are also involved by us in storage and logistics of the medicines,” said Sachin Singh, CEO of BPPI, an agency that executes PM BJP.

“It means there are approximately 6,000 pharmacists who have been working under the scheme.”

Also read: Indian pharma is not sub-par, it is ensuring the world doesn’t face a healthcare crisis

Like engineering pharmacy college should be checked