New Delhi: The Enforcement Directorate Tuesday conducted searches at four locations in Mumbai in connection with a ‘dabba trading’ and online betting case. The agency’s action is part of its probe into an alleged dabba trading and online betting being executed through unregistered financial platforms.

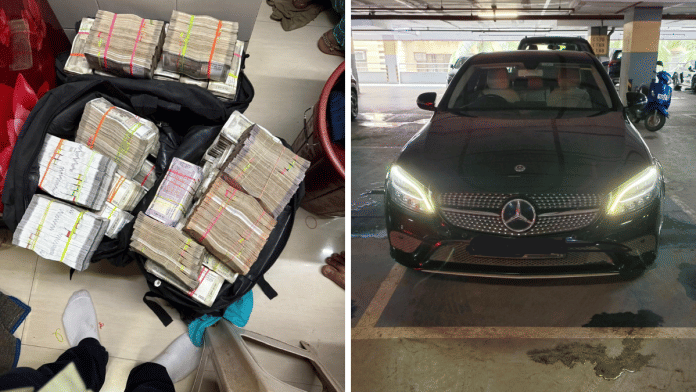

The raids led to the seizure of Rs 3.3 crore of unaccounted cash, jewellery, foreign currency, luxury vehicles and watches. Sources said that cash counting machines were also found.

‘Dabba trading’ refers to an illegal and unregulated form of trading in securities outside of recognised stock exchanges. Traders indulging in ‘dabba trading’ place these deals, whether stocks or other financial instruments, without the trades being executed on official stock exchanges recognised by the Securities and Exchange Board of India (SEBI).

They are then settled internally by these illegal ‘dabba’ operators off market without any regulatory framework. The SEBI categorises dabba trading as illegal.

Dabba trading apps—such as VMoney, VM Trading, Standard Trades Ltd, IBull Capital, LotusBook, 11Starss, GameBetLeague—are currently under the ED’s investigation.

As per the agency, the online betting platforms operated through white-label apps—ready-made betting software offered by a third-party and readily available to be used by organisations and entities—and the app admin rights exchanged on a profit-sharing basis.

Moreover, sources said that hawala operators and fund handlers have been identified, and the digital and financial records are being analysed.

The investigation under Prevention of Money Laundering Act (PMLA), 2002 was initiated on the basis of a First Information Report (FIR) lodged at Indore’s Lasudia Police Station 9 Januaryunder sections for cheating and cheating by personation.

According to the sources, investigators have found that Vishal Agnihotri, the beneficial owner of VMoney and 11Starss, acquired admin rights of LotusBook betting platform on a 5 percent profit-sharing arrangement.

He then allegedly transferred these rights to Dhaval Devraj Jain, retaining 0.12 percent profit while Jain held 4.875 percent.

“Dhaval Jain, along with his associate John States alias Pandey, developed a white-label betting platform and supplied it to Vishal Agnihotri for running 11Starss.in. Mayur Padya alias Padya, a hawala operator, handled cash-based fund transfers and payments for the betting operations,” the source said.

(Edited by Ajeet Tiwari)