New Delhi: Days after Prime Minister Narendra Modi announced that a new scheme will be launched to help the middle class and urban poor in India own a house in the cities, the ministry of housing and urban affairs (MoHUA) is working out its details. The scheme is likely to be on the lines of the Credit Linked Subsidy Scheme (CLSS) vertical of the ongoing Pradhan Mantri Awas Yojana-Urban (PMAY-U), ThePrint has learnt.

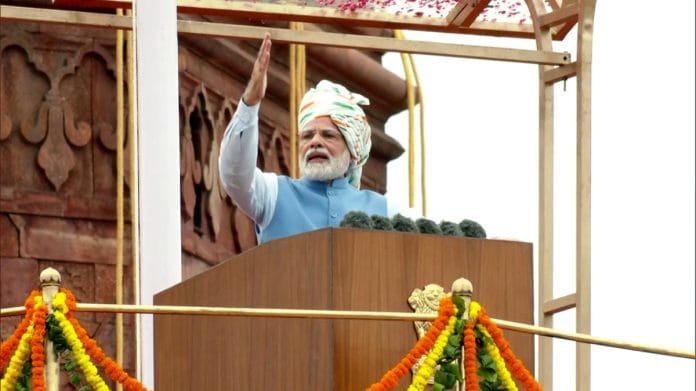

Speaking from the ramparts of the Red Fort on 15 August, the PM mentioned the hardship faced by economically weaker sections (EWS) living in cities, especially when it comes to housing. “Middle-class families are dreaming of buying their own houses. We are coming up with a new scheme in the coming years that will benefit those families that live in cities but are living in rented houses, or slums, or chawls and unauthorised colonies. If they want to build their own houses, we will assist them with a relief in interest rates and loans from banks that will help them save lakhs of rupees,” he had said.

Over the past two weeks, MoHUA officials have been working on the scheme for its quick rollout. A senior ministry official, who spoke to ThePrint on condition of anonymity, said: “Though it will be on the lines of the CLSS component, the details are being worked out. A concept note is being prepared regarding the interest subvention scheme. The plan is to provide interest subsidies to home buyers as announced by the PM.”

The PMAY-U, one of NDA government’s flagship schemes, was launched in June 2015 with an aim to provide housing to all. The CLSS, which was a demand-driven intervention, was one of the four main components of the PMAY-U under which interest subsidy was provided to eligible beneficiaries in the middle-income group and economically weaker class for purchase, construction or enhancement of houses in urban areas.

While the PMAY-U was extended till 31 December, 2024, the CLSS component was not extended beyond March 2022.

According to another senior official, while the modalities of the new scheme are still being worked out, people in the income group of Rs 3 lakh to Rs 18 lakh are likely to be covered under the scheme.

Referring to the high demand for housing in urban areas due to urbanisation, Debolina Kundu, professor at the National Institute of Urban Affairs, said, “It will help people, mostly middle class, who have a regular source of income and an aspiration to own a house in urban areas. The Credit Linked Subsidy Scheme under the PMAY-U helped people from different income brackets get graded interest subsidy on home loans with a loan tenure of 20 years, with the maximum interest subsidy for people in the economically weaker section.”

She added, “As for the urban poor, with no regular source of income, rental housing can be a good option. The Centre had announced the Affordable Rental Housing Scheme during the pandemic for the poor people. There is a need to strengthen the scheme and improve its coverage.”

Also read: Indore wins ‘National Smart City Award’ in Modi govt’s Smart City Mission, MP is ‘best state’

Over 25 lakh beneficiaries of PMAY’s interest subsidy

In CLSS vertical, subsidy was provided under four categories: economically weaker section (EWS), lower income group (LIG), middle income group-I (MIG-I) and MIG-2 (divided into two categories based on household income).

While interest subsidy was provided to EWS and LIG between June 2015 and March 2022, the CLSS vertical was extended to MIGs in January 2017 for a period of one year. It was later extended till March 2021.

“Under the CLSS component, interest subsidy of 3 to 6.5 per cent was given under various categories such as middle income group (3 per cent) and lower income group (6.5 per cent) for a period of 20 years or loan period, whichever is lower. The interest subsidy was given to people with household income between Rs 6 lakh and Rs 18 lakh. The new scheme is likely to be around this,” said another senior official, who didn’t wish to be named.

As per the information available on the PMAY-U portal, interest subsidy of Rs 58,868 crore has been disbursed to 25.04 lakh beneficiaries, including 18.96 lakh beneficiaries from EWS and LIG, till 21 August, 2023. Close to 6.08 lakh MIG beneficiaries were given interest subsidy of Rs 12,885 crore.

(Edited by Zinnia Ray Chaudhuri)

Also read: Expert panel calls for ‘immediate’ registration & possession for homebuyers despite builders’ ‘dues’