New Delhi: The Enforcement Directorate (ED) has claimed to have unearthed a network of 150 shell companies and 400 mule bank accounts, along with cheque books, used by the technology firm Varanium Cloud to route public funds, as part of its money laundering probe against the firm and its promoter Harshavardhan Sabale.

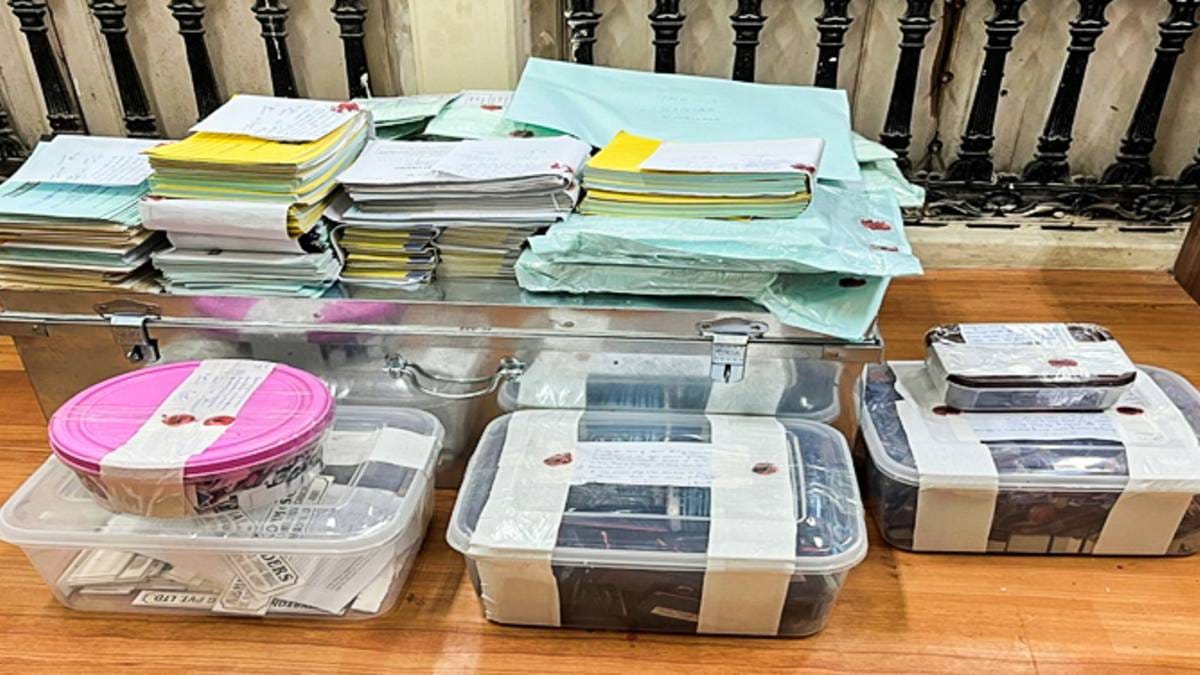

The ED recovered the incriminating documents and devices, including more than 200 SIM cards, related to the misappropriation of funds during raids last month at premises linked to the firm and Sabale in Mumbai.

An agency spokesperson said Tuesday that the company, which was listed through an IPO in 2022, was engaged in a well-coordinated financial racket, operating “drawer companies” from a few small rooms opened with fake identification documents, and used mule accounts to transfer funds illegally.

Varanium Cloud had raised Rs 36.60 crore through the IPO and was listed on the National Stock Exchange (NSE) in September 2022. The spokesperson stated that the company claimed to be a fast-growing technology firm and solicited public investment for the purpose of setting up edge data centres and digital learning centres in smaller towns.

Apart from raising funds through the IPO, it also raised Rs 6.93 crore through the pre-IPO allotment of shares to various shareholders, according to findings of the Securities and Exchange Board of India (SEBI).

The SEBI last year barred both Varanium and Sabale from buying, selling or dealing in the securities market or associating themselves with the market in any manner whatsoever till further orders. Additionally, Sabale was restrained from acting as a director or key office-bearer of any listed company, its subsidiary, or any company that intends to raise money from the public, or any SEBI-registered intermediary.

The company projected itself as a fast-growing technology firm in the fields of digital media, blockchain and EdTech. It roped in prominent personalities to promote the IPO, which was fully subscribed. However, just over three years after listing at Rs 131 per share, the stock price nosedived to Rs 5.85 at the time of closing Tuesday.

“Subsequent trading patterns showed artificial price escalation followed by heavy offloading of shares, consistent with a ‘pump and dump’ scheme, where the stocks of the company were deliberately inflated through misleading claims and later dumped at high prices, duping the public and causing losses to genuine investors,” the ED spokesperson said Tuesday.

The agency’s money laundering probe stems from two FIRs filed by the Mumbai Police against Sabale.

The first of the two was filed in February last year, based on a complaint from the Chairman and Managing Director of Rolta India, Kamal Singh, who alleged that Sabale duped him and his firms into investing $1.5 million into his firm Streamcast Technologies Holding Limited (STHL), claiming high potential of the firm and financial performance over the years.

Singh stated in the police complaint that STHL had been dissolved without any notice to Rolta Infotech, making the firm’s investment worthless. He also alleged that Sabale had forged email IDs of Mauritius-based Afrasia Bank and used emails from those accounts, as well as documents for the SWIFT MT103 system, to claim payments to Rolta Infotech.

The SWIFT MT103 is a standardised format used for international wire transfers, under which banks carry out international transactions, confirming payment between banks and includes details such as amount, currency, sender and recipient information.

The Mumbai Police booked Sabale in another case based on a complaint from an investment banker who alleged that Sabale had misrepresented himself as the promoter of a technology startup aiming for an IPO, and convinced him to invest Rs 1 crore in the business between 2015 and 2016.

Also Read: ED seizes Rs 1,646 cr in crypto from Gujarat. What is the multinational BitConnect scam

SEBI’s findings

Varanium Cloud reported a significant decrease in promoter holding, as well as pledged shares, between the second and third quarters of fiscal 2023-24. Promoter stake decreased from over 63% to just over 36% in a period of three months.

Spooked by the dramatic change in promoter holding, the NSE raised a query before the firm and sent a reminder seeking clarifications.

After the company did not respond, the SEBI initiated an examination of four aspects of the firm: utilisation of IPO proceeds, “true and fair” view of financial statements, corporate announcements, and issues related to raising capital between the date of listing and the quarter ending March 2024.

In its probe, the SEBI found glaring misuse of public funds and their diversion to other firms managed by Sabale, as well as the lack of installation of data centres, which were declared as the intended use of funds from the IPO prior to its launch in 2022.

The market watchdog found that the firm had received a quotation from one Avance Technologies to establish three containerised edge data centres for Rs 23.40 crore and three Edmission flagship digital learning centres for Rs 8.4 crore.

The SEBI found that Avance Technologies did not have the wherewithal to build these centres, as quotations for the data centres alone exceeded its revenue for fiscal 2022-2023.

Moreover, the watchdog found that Avance Technologies had reported an investment of around Rs 40 crore into Jump Networks. Jump, a listed company, was later renamed as Winpro Industries, and Sabale, the MD of Varanium Cloud, served as its MD between February 2020 and March 2021.

The regulator further found that Varanium had invested around Rs 2 crore in compulsory convertible debentures of Sabale-controlled firm Turmeric Lifestyle Private Ltd (TLPL). The investment was made for the transfer of shares of TLPL to Varanium Cloud despite the former not reporting any revenue for the last five financial years between 2018 and 2023.

It was also found that TLPL was a hospitality firm in North Goa and had its properties listed on Airbnb—suggesting no relationship in nature of business for investment.

The company’s claim about the installation of edge data centres, for which it claimed it had allocated nearly all of its funds, was found to be untrue. The SEBI observed that the firm made disclosures stating it had set up its first data centre in Panaji, followed by the second in Maharashtra’s Sindhudurg district and the third in Mumbai, which was described as “yet to be launched” in December 2023.

In its field verification with the NSE, the SEBI found that neither of the data centres was present at the addresses submitted by the firm. Instead, the company’s registered office was present at the Sindhudurg address. While data centres consume huge electricity, the SEBI found electricity consumption for November and December at the site to be nil and 10 units, respectively.

At the Panaji address, a total of six employees was found at the submitted address, but the data centre listed on paper was nowhere to be seen.

(Edited by Nida Fatima Siddiqui)

Also Read: OctaFx app founder Prozorov who duped Indians of Rs 5,000 cr held in Spain, ED to pursue extradition