New Delhi: The year was 2008. But across television screens in India was playing an advertisement reminiscent of Bollywood tear-jerkers of the 1980s.

Twins Ranjan and Mano, who live with their mother, are taunted throughout their young lives because they don’t have a father. Unable to bear the humiliation, their mother is about to commit suicide one day, when she is stopped by her children, who tell them that their father has arrived.

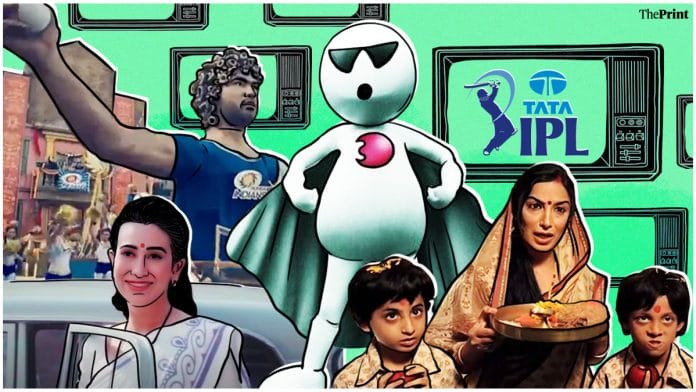

The television screen at their house announces, “Aa gaya manoranjan ka baap” — a clever take on the Hindi word for entertainment. And that is how the Indian Premier League first arrived on our screens, promising the action of sports with a dash of entertainment on top.

Film stars and business moguls became team owners, players from abroad mingled and shared expertise with Indian youngsters, cheerleaders were ubiquitous at every stadium, and India got its first taste of after-parties connected to a sporting event. It became a heady cocktail of money, glamour, sports and showbiz that continues to give cricket fans a buzz 14 years later.

Which of course made it a perfect marketing opportunity for brands.

Most memorable advertisements released during the past IPL seasons have been promotions of the tournament and its broadcasters — ‘Manoranjan ka Baap’ in 2008, the 2009 Sony Max ‘Home of IPL’ ad, the 2014 ‘Kanna keep calm’, the 2016 ‘Fantastic’ promo, which gave the IPL a carnival-like image…the list goes on.

But there were others, ads for Amazon, Pepsi, Jio, Facebook, FMCG brands and consumer durables, centred around the IPL, that captured both minds and hearts.

For example, the Vodafone Zoozoos — cute, egg-shaped characters that became iconic — made their first appearance on Indian screens during the 2009 IPL, played in South Africa due to the scheduling clash with the general elections that year.

Over the years, however, these FMCG and consumer durable brands are slowly being edged out of the IPL ad space by new-age e-commerce brands in the fin-tech, ed-tech, payments, and delivery services segments, such as Cred, BYJU’s and Swiggy.

“There was a time when soft drinks, Lays (potato chips) and telecom used to dominate the IPL ad space. Today, newer companies, especially the ones offering financial services, have taken over,” said Yudhajit Mukherjee, creative director at The Glitch, an advertising agency in Gurugram, about the changing IPL ad landscape.

Mukherjee recalled that during an internal research conducted for a project earlier this month, he found 90 per cent of all service-related ads during the IPL to be in the insurance and finance space.

The reason, according to Mukherjee, is that the digital market space in India is booming and that’s where the potential for growth lies. So e-commerce brands are advertising heavily.

“The shift tells us that India is a big, booming digital market space right now and a lot of money is flowing into these (digital-first) brands. In the next few years, India may become the biggest digital market space in the world,” he said.

With another IPL season well underway — the final is scheduled for 29 May — ThePrint looks at the nitty gritties of the IPL ad space.

Also read: Hotstar’s Kaun Pravin Tambe is the kind of sports film we need. Almost a sequel to Iqbal

Targeting the young, eyeing audience across demographics

Since the IPL enjoys a wide viewership, ads released during the IPL season also target consumers across demographics such as age, gender, location and income groups.

However, though ads catering to all demographics are broadcast, the maximum number target younger audiences, millennial and Gen Z viewers, according to Shreya Sarkar, associate creative director at Magic Circle, an advertising agency in Gurugram.

“After last year’s Cred ad featuring Rahul Dravid went viral, all brands want their scripts to be written for a younger audience; they want scripts with a reshare value on social media,” she said.

According to Sarkar, brands even with a 55 years-and-above target audience, often like to write scripts for a younger bunch, just so their content can be reshared. “The mentality is that even an older audience wants to keep up with trends of the time, so most ads are speaking to people in the age group of 25-35 years,” she said.

There’s something for almost everyone here.

So while Fogg — marketed as a pocket-friendly deodorant — put out an advertisement this year which shows two women discussing flirting with a man, catering to a young audience of 18-24 years, ads for Tata Punch eyes a relatively older target group of ‘go-getters’, fantasy gaming app Gamezy — endorsed by Lucknow Super Giants skipper K.L. Rahul — speaks to a tier-2 city audience, and a new Swiggy Instamart ad revolves around a young couple living in a metropolitan city.

E-commerce brands have reportedly been one of the biggest spenders on ads so far this year, and held 30 per cent of ad volumes in the first five matches of this, the 15th IPL season. Of these, 17 per cent ads were by online gaming companies.

“This country is a booming digital economy. So it’s not really surprising that e-commerce has taken over smartphones, telecom, and FMCG, because that’s where the future is,” said Mukherjee. “The competition is stiff, so brands need to establish differentiators there.”

As the female viewership has increased (43 per cent of total IPL viewers were women in 2020, according to a report by television rating agency TAM), so have ads targeted towards them. In 2020, advertisements targeting women jumped by a record 57 per cent.

High revenues, brand recall

Just as the popularity of the IPL makes it a lucrative marketing opportunity for brands, ads are a major source for revenue for those connected to the tournament.

In 2021, Star — which bagged a five-year contract to be IPL’s television broadcaster in 2019 — reportedly garnered Rs 3,200 crore in ad revenue, and is eyeing earnings of Rs 4,000 crore this year. A 10-second ad spot during the IPL costs advertisers approximately Rs 16 lakh, while a 30-second ad during breaks in the match for the duration of the tournament costs Rs 37 crore.

The IPL is often referred to as India’s Super Bowl, in terms of its advertising worth. The comparison is apt because the Super Bowl is the culmination of American Football’s NFL, and each edition of it sees the launch of the biggest ad campaigns for the coming year.

Start-ups, especially in the quick loans, e-commerce and ed-tech spaces, have been among the most visible advertisers for the ongoing IPL season. Fogg deodorant, Swiggy, BYJU’s, Vimal Pan masala, Cred, RuPay, Dream 11, Slice, Tata Neu, Lays and Gamezy are some of the brands noticed by ThePrint.

More than 100 brands will reportedly share ad slots on Star Sports and Disney+ Hotstar, the official television and OTT broadcasters of the IPL. Fintech, hyperlocal delivery services, payment platforms and streaming giants, are among the new age services interested in the IPL slots.

“The kind of attention the IPL gets is incomparable,” said Khurram Haque, group creative head at Ogilvy, Mumbai, to explain why relatively smaller, newer businesses are advertising during the IPL despite high rates.

“IPL gets (advertisers) the maximum eyeballs from the right kind of young, tech-savvy audience who are open to trying new products. Companies also think advertising during IPL gives them a stature and credibility like no other. And that matters because a lot of these companies are first time advertisers,” Haque added.

The frenzied advertising during the IPL often mean brands spend a big chunk of their media budget during this time. “For some, it is the only time of the year they advertise. Many companies spend a majority of their media budget for the year within these two months,” said Haque.

Newer brands, but IPL charm intact

Cred made a splash with its ad campaigns during the IPL in 2020. The next year, an especially memorable one featured an angry Rahul Dravid.

Cred’s campaign this year — ‘play it different’ — a ‘hatke’ take on iconic ads from the past, includes one that features Karisma Kapoor in a rehash of an old detergent ad.

Slice Super Cards, which allow users to split their bills, have also been heavily advertised on digital as well as the television media this year. It has managed to grab potential customers’ attention too.

“I was looking to buy a laptop, but as a 22-year-old professional just entering the workspace, I was facing trouble financing it. When I saw an ad for Slice cards during the IPL, I instantly applied for one and got one,” said a brand manager at an ed-tech firm, requesting anonymity.

Smaller brands are also edging out bigger ones, because the IPL is the only time they get wide attention, added Mukherjee.

“The market has evolved since 2008. Now, in the world of OTTs, where consumers are fragmented on different platforms, IPL is arguably the only single platform that has the attention of so many consumers at once. So a lot of brands vie for these expensive slots,” he said.

(Edited by Poulomi Banerjee)

Also read: India’s women cricket needs push from sponsors and audience alike. Visibility is a two-way street