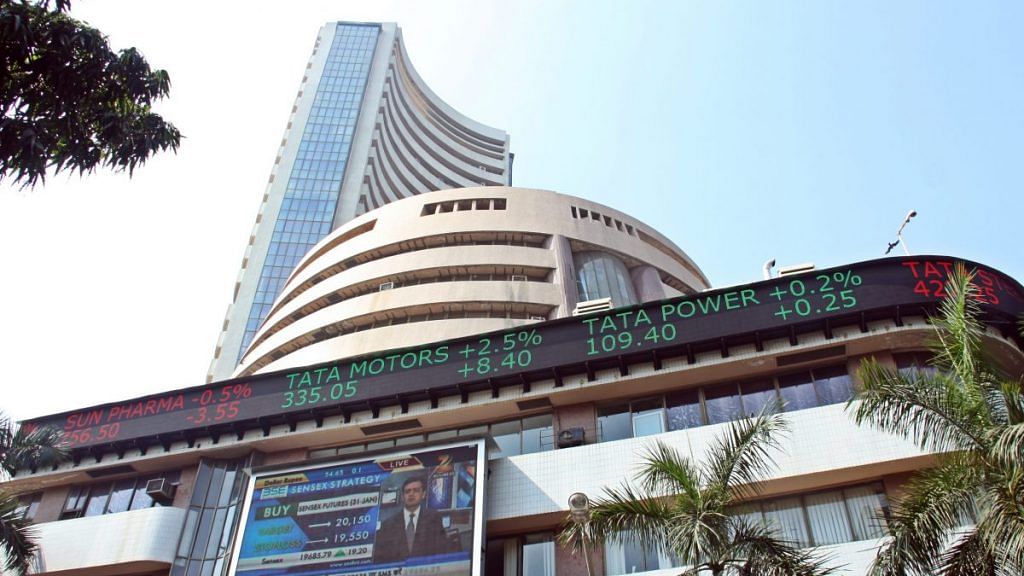

Mumbai: On Monday, 23 March, two days before the nationwide Covid-19 lockdown was imposed, the 30-share Bombay Stock Exchange Sensex had closed at 25,981 points. But now, with the pandemic still raging, the Sensex hit 42,597.43 points Monday — an all-time high.

The 1.6 per cent or 704-point jump by the Sensex was matched by the National Stock Exchange’s NIFTY, which rose 197 points, or 1.6 per cent, to close at 12,461 points, its highest-ever figure too.

The fact that the Indian equity indices surpassed the previous highs they had scaled in January, before the Covid-19 pandemic and the lockdown brought economic activities to a halt, is being seen as a dramatic turnaround.

“The main reason we can say that is in March, one may have overestimated the problem. Now, we find it is not as bad,” said Samir Arora, founder and fund manager at Helios Capital Management, a hedge fund.

Also read: India’s economy to bounce back & emerge stronger from Covid crisis, says FICCI President

Stimulus packages

The pandemic prompted economies around the world to pump in stimulus packages that found their way to various markets, including India, which helped the equity markets touch new highs, said Deven Choksey, managing director of KRChoksey Investment Managers Private Limited.

“One of the important things that has happened in the last six to seven months since March is that the global economy has given a stimulus to the tune of $8 trillion,” Choksey told ThePrint.

“And this money has entered into every economy, every asset class. India has been a favourable destination for most of the people in the world. With the variety of reforms that the country has been carrying out, India has become a favourable destination over China,” he said.

But is the rally purely driven by liquidity and not by strength of companies, or fundamentals?

“There is no concept like liquidity versus fundamentals. Because once you have liquidity, where should it go? Will it go to Reliance or will it go to, say, PSU banks? The liquidity may be there at the backdrop, but then where it goes is based on fundamentals only,” Arora said.

According to Arora, stocks of companies that are hurt by the pandemic are down, while those who have benefitted relatively have gone up.

“It is not that blind a rally that companies massively affected by coronavirus are up. Most banks are down. PVR (the cinema hall chain) is down. Investors have differentiated between the guys who relatively benefited, and who were hit. The market does not look totally wild,” Arora said.

Also read: Higher interest, processing fee — How banks are making hay amid Covid as customers take a hit

Interest rate cut

Apart from liquidity, experts say another factor that helped the markets is the sharp interest rate cut in since March. The monetary policy committee (MPC) of the Reserve Bank of India which sets the interest rate, cut the repo rate by 75 basis points in March, and then by another 40 bps in May. The repo rate is currently at 4 per cent, down 250 bps since February 2019.

“The lower oil prices have basically brought down the import bill and made the economy current account surplus. The lower interest rate has brought down the cost of funds and improved the health of lending institutions,” Choksey said, adding the bumper output of agricultural products also boosted investors’ sentiments.

The US election results have also inspired confidence in investors, since they have realised President-elect Joe Biden may not be able increase tax rates.

“Right now, the people have assumed that Joe Biden will not be able to do the things that he wanted to do,” said Arora.

“He wanted to increase capital gains tax and he wanted to increase corporate tax. So, the market was supposed to go down with Biden victory, but as soon as they realised that he is not winning outright and the Senate will be controlled by the Republicans, the conclusion the market drew is that Biden cannot increase the taxes,” he added.

Maturity of investors

Monday’s surge in the equity indices is an extension of last week’s strong rally, when the benchmark indices went up over 5 per cent. According to Choksey, the maturity of the investors can be gauged from the fact that they are rotating their investments from one sector to another.

“The maturity in this particular rally is that it is basically rotating sector after sector. They are not taking the entire thing in one go. If earlier, the flavour was pharma and chemicals, after that, it became IT, and today, it is banks. You will again see the flavour rotating; banks will be sold and pharma will be brought in. We are likely to see this trend continuing,” Choksey said.

But what are the risks? According to investors, there is an apprehension that the uptick in some high frequency indicators like car sales may not sustain.

“The issue is that the economy is not recovering as much as it looked this month and last month. This is because of festive demand; this is because of pent up demand. So in December, auto sales etc. will not be very good,” said Arora, adding the fear of a second wave of the Covid-19 pandemic could also impact investors’ confidence.

In the short run, however, investors’ sentiments are expected to stay buoyant, with Pfizer and BioNTech Monday saying data indicates their Covid-19 vaccine is more than 90 per cent effective. Global markets surged with the development, and Indian equities are also expected to react in the same fashion.

Also read: India can still become a $5-tn economy by 2024, PM Modi shows hope despite Covid setback