New Delhi: The Union Finance Ministry has informed the Parliament that on 30 June 2025, banks in India held Rs 67,000 crore in unclaimed deposits. The public sector banks held the bulk, at 87 percent.

On Monday, in a written response to a question by Lok Sabha MP M.K. Vishnu Prasad from the Congress, Minister of State for Finance Pankaj Chaudhary informed the Parliament that under the Depositor Education and Awareness Fund Scheme, 2014, the Reserve Bank of India (RBI) is responsible for managing unclaimed deposits held by banks.

Unclaimed deposits refer to the money in bank accounts inoperative for a decade and term deposits no person has claimed within ten years of maturity.

The RBI guidelines mandate the transfer of all unclaimed deposits with banks to the Depositor Education and Awareness (DEA) Fund.

Both private and public sector banks are to follow the guidelines, whereas Non-Banking Financial Institutions (NBFCs) remain exempted. On June 2015, the public sector banks held Rs 58,330 in unclaimed deposits, according to data released by the ministry.

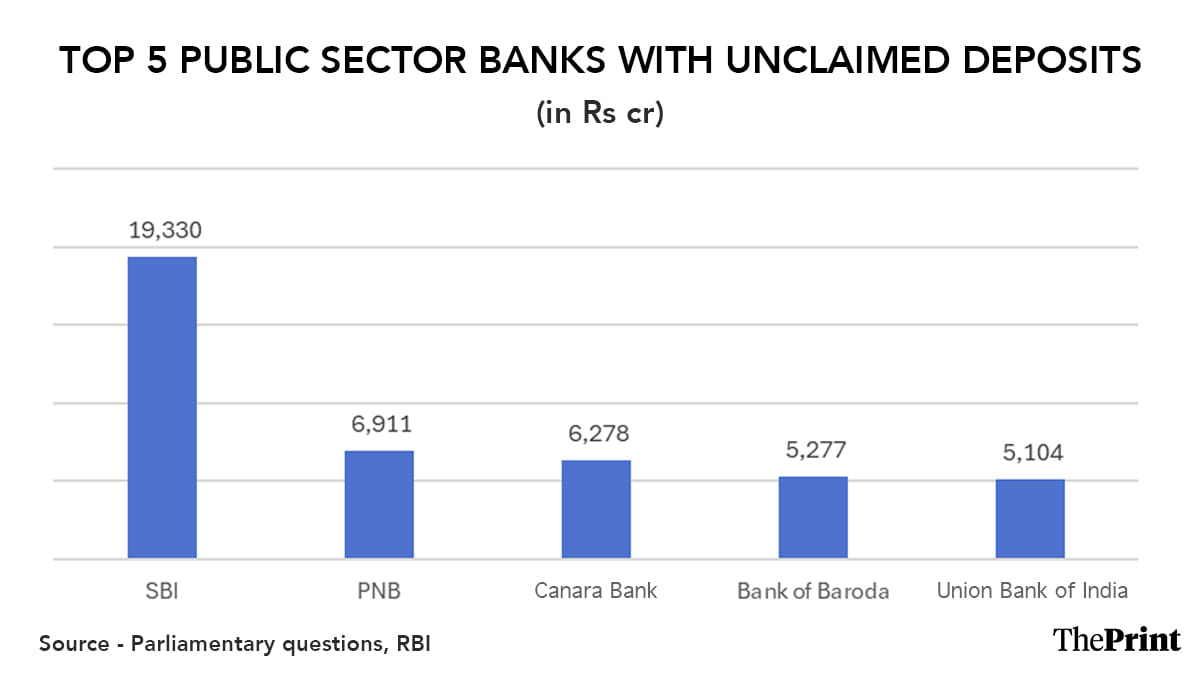

With the most extensive network, public sector bank State Bank of India (SBI) led the charge, holding Rs 19,239 crore worth of unclaimed deposits—26 percent of the abandoned money in the public banking system. Punjab National Bank and Canara Bank followed SBI, with unclaimed deposits of Rs 6,911 crore and Rs 6,278 crore, respectively.

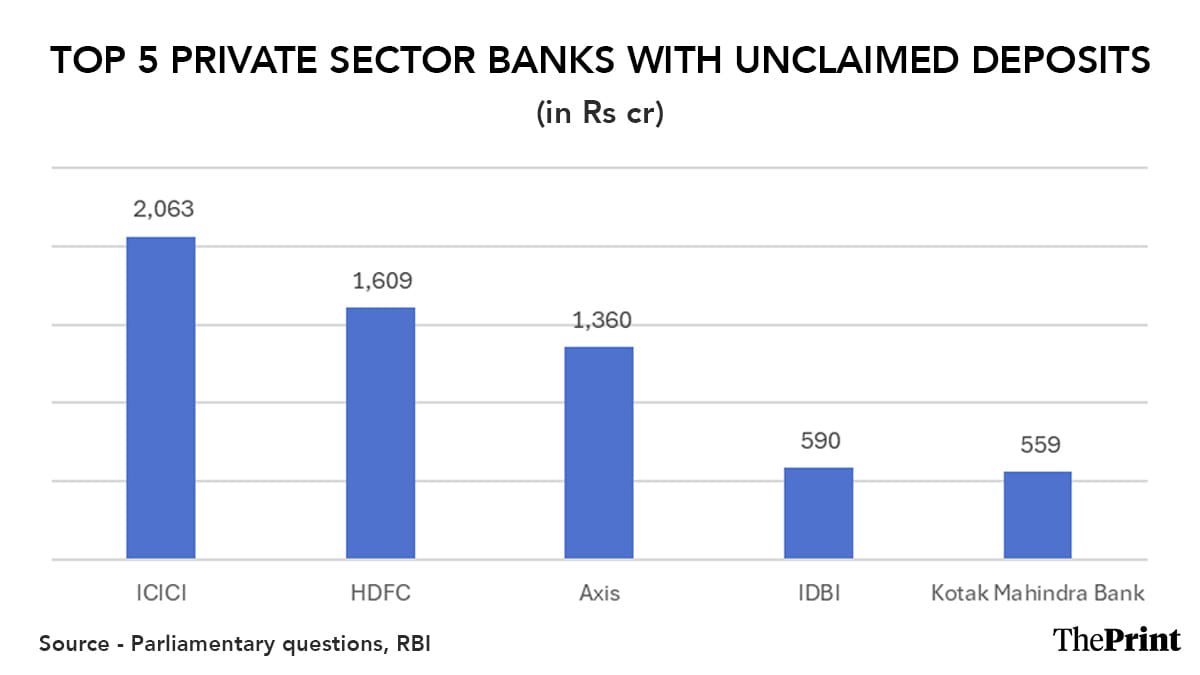

On the other hand, 21 private sector banks, together, held Rs 8,674 crore in unclaimed deposits. ICICI Bank led among them, holding Rs 2,063 crore, or nearly 24 percent of the abandoned money in the private sector banking system. Following ICICI, HDFC Bank held the second-highest amount, Rs 1,609 crore, and Axis Bank Rs 1,360 crore.

The RBI does not maintain state-wise level data, the Union Finance Ministry’s response clarified.

Measures by RBI to manage unclaimed deposits

In October 2023, the RBI launched an application, UDGAM, i.e., Unclaimed Deposits Gateway to Access Information, to simplify the identification of unclaimed deposits. UDGAM helps users search unclaimed deposits in one place rather than searching multiple banks. As of July 2025, the UDGAM portal had registered 8,59,683 users.

Additionally, the RBI has asked banks to display the list of unclaimed deposits on their respective websites. Banks also have instructions to find the whereabouts of customers concerned or their legal heirs, so that the money reaches the rightful claimants.

Also, banks should establish grievance redressal mechanisms to resolve complaints, maintain records of unclaimed deposits, and conduct periodic reviews to update their records.

Under the depositor fund scheme mentioned earlier in this report, a committee would eventually administer the funds to promote the interests of depositors in line with the RBI specifications.

(Edited by Madhurita Goswami)

Also Read: Rs 580 cr lost to digital payment frauds in last 5 yrs, only 43% recovered—govt to Parliament