Gurugram/Manesar/New Delhi: Mohammad Miraj, a 49-year-old truck driver, has soot all over his face as he lines up in front of a transporter’s office near Maruti Suzuki’s Gurugram plant.

He has been transporting Maruti vehicles to the Northeast for a long time, but says it has been more than two months since he last got a trip. No trip means no payment from the transporter, as most of the truck drivers are not on the rolls.

“Business has come down by more than half. It’s only 30 per cent of what it was before,” said Miraj, whose wife and five children live in their Bihar home.

“My kids are not able to go to school. They recently dropped out as I have no money to pay their fees. My son stood first in inter (Class XI) and was rewarded by Mahindra, but has now had to drop out,” he said.

“We are hoping for the slowdown to finish. I am wearing less clothes already, now will I have to go naked? I don’t know why this slowdown is happening… Only God or the government knows. If it persists, I will be forced to go home or look for work elsewhere. But all companies are affected, where will we get work?”

His friend and fellow trucker, 50-year-old Mohammad Hidayatullah, is also caught in a similar quandary — whether to stay put in horrible living conditions in the hope of work, or return to his state of Uttar Pradesh. He says he goes to the transporter, who employs around 400 people, asking for a trip every day. “They say there is no work. What can we give you? But that answer will not feed my family back home,” Hidayatullah said.

The drivers are not alone in facing the brunt of the sharp demand slowdown in automobile sales that has led to sharp production cuts across companies.

Record drop & job losses

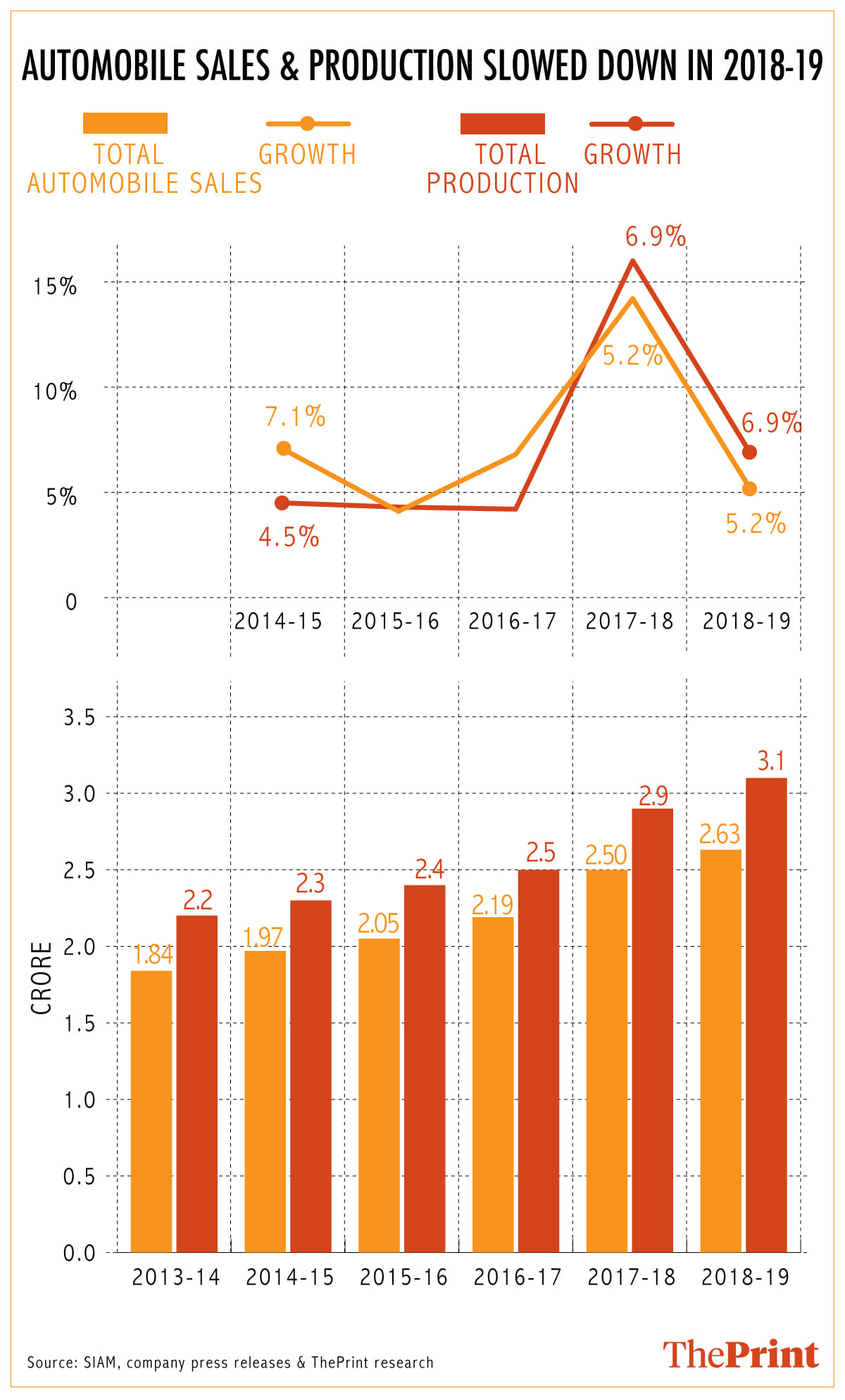

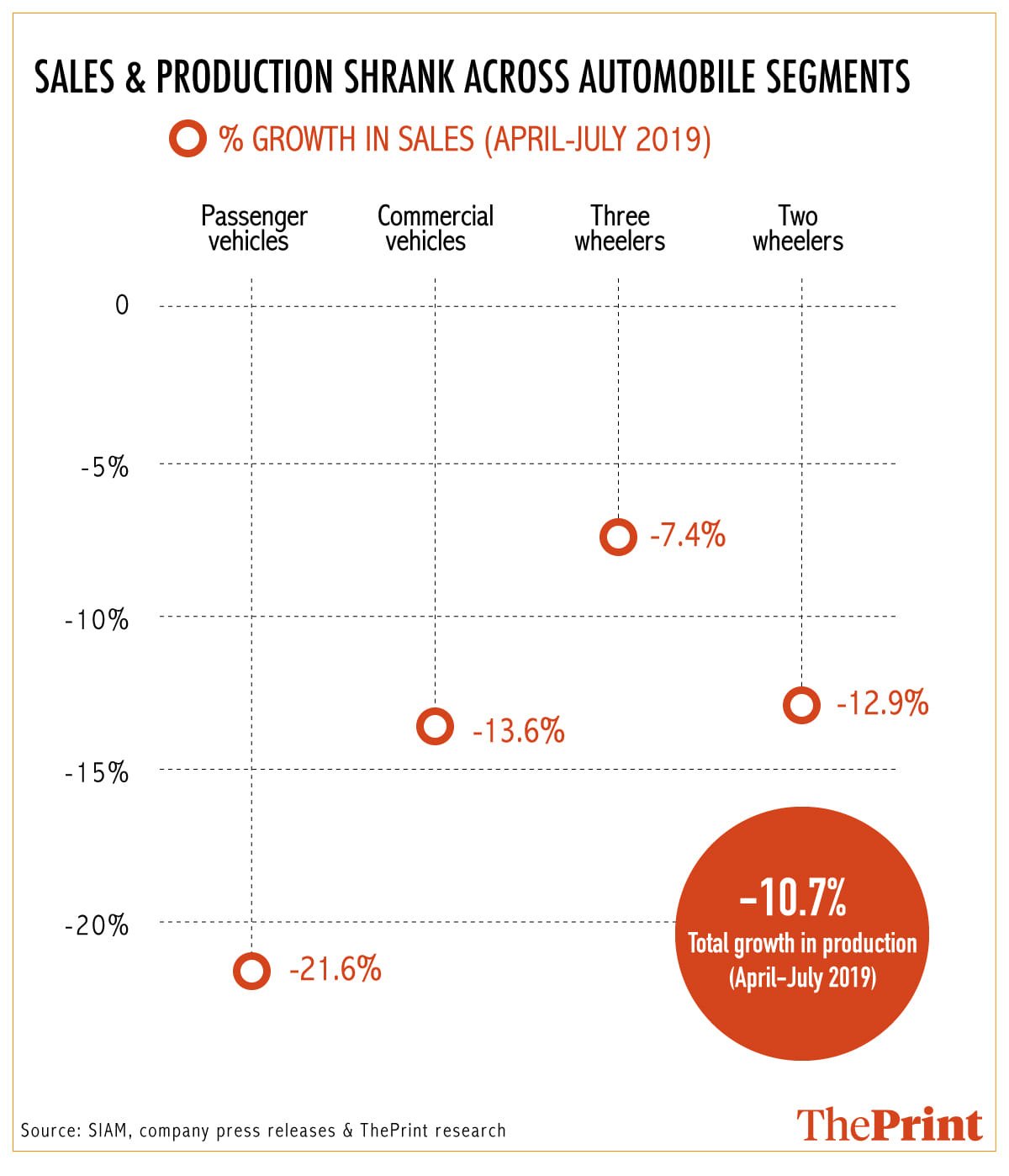

A sharp fall in consumer demand, especially in rural areas, as well as tightened financing conditions that have squeezed lending by non-banking finance companies (NBFCs) has resulted in the automobile industry seeing a record drop in sales over the last few months. The sales in July fell to a two-decade low — contracting by nearly 19 per cent — across most segments and the company numbers trickling in for August indicate the situation has worsened.

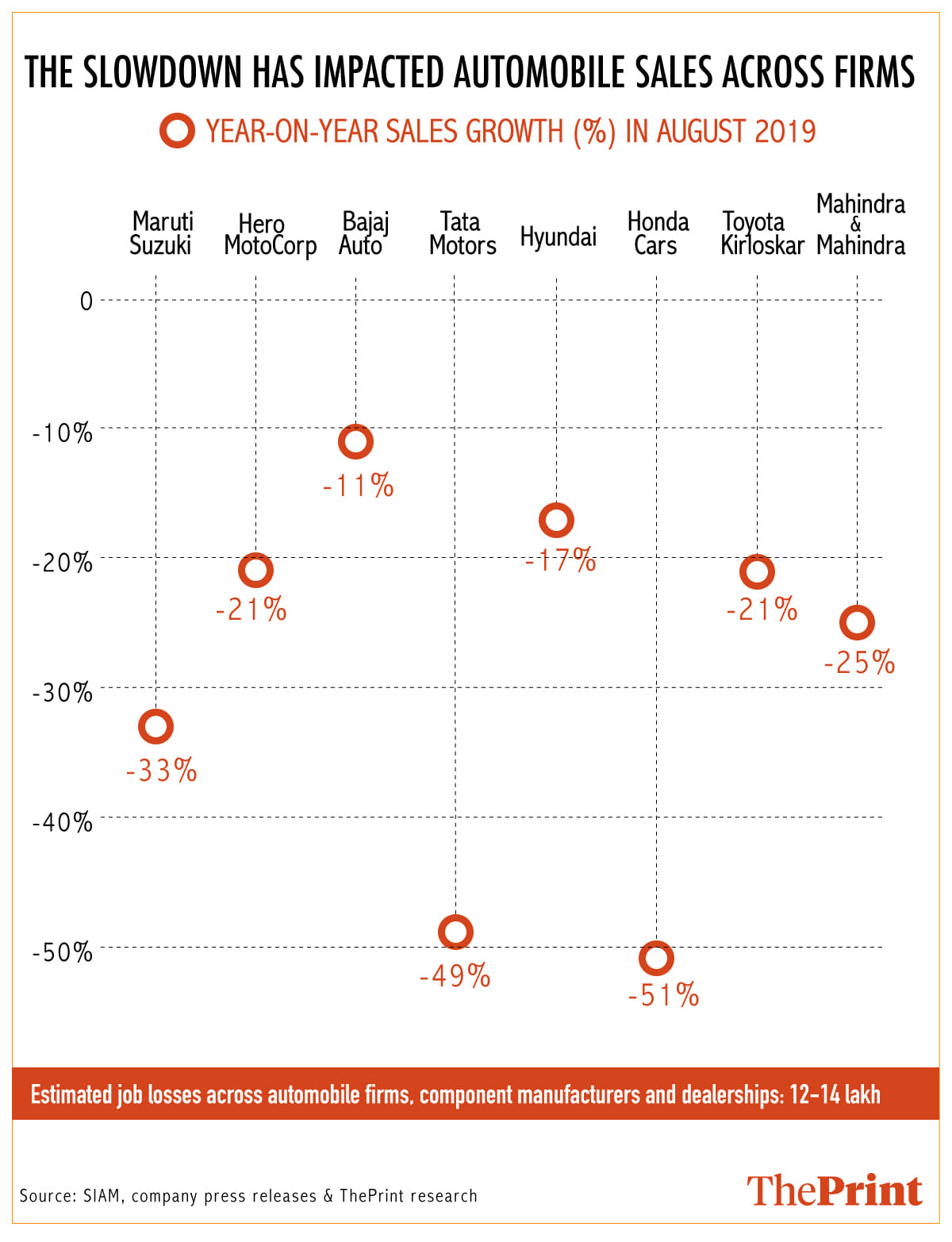

Maruti Suzuki announced a 33 per cent fall in sales in August, while for Tata Motors, the number was 49 per cent. Hero Motocorp’s sales fell 21 per cent, Mahindra and Mahindra’s 25 per cent, and Toyota Kirloskar 21 per cent.

This has resulted in massive job losses, not just for automobile manufacturers but also for component makers and dealership firms as auto companies have cut back on production. Industry body Automotive Components Manufacturers Association of India (ACMA) estimates that production has been cut by up to 15-20 per cent by manufacturers, adversely impacting component manufacturers that could potentially lead to 10 lakh job losses.

Another industry body, the Society of Indian Automobile Manufacturers (SIAM), estimates that there have been 15,000 job losses so far, which could increase if the slowdown persists. Nearly 3 lakh more people have lost jobs due to auto dealerships shutting down, because of falling demand, piling inventory and reduced financing, according to estimates of the Federation of Automobile Dealers Associations.

Job losses in the largely informal transport segment remain undocumented.

Putting together all these numbers, around 14 lakh jobs could be phased out in the coming months if the slowdown persists.

Companies said new entrants into the workforce, with little or no experience, are the first in the firing line as companies reduce hiring from industrial training institutes or do not renew one-year contracts of the new workforce.

These rising unemployment numbers among India’s youth represent the massive challenge facing the Narendra Modi government in its second term. Generating jobs for the youth at a time when economic growth is tottering at 5 per cent will be an uphill task for the Modi government, especially as unemployment rates among the youth are already high.

Also read: Maruti Suzuki’s car sales in India drop to lowest in seven years

Palpable fear

At Manesar’s Industrial Model Township (IMT) that houses many big automobile and component manufacturers, including Maruti Suzuki, Honda Motorcycle and Scooter India Ltd, Denso India and Bellsonica Components, the fear of job losses is widespread as many of the companies have announced production cuts followed by an initial round of job cuts.

With contractual employees outnumbering permanent employees by 2 to 1, the fear around job security is palpable.

“I have been employed for nearly eight years under the thekedaari system (contractual system which gets renewed every year). As of now, the new joinees have been asked to leave after they finish their one-year contract. But one never knows what will happen if the slump in demand persists,” said a Honda employee as he was about to start his afternoon shift.

The employee, who did not want to be named, said only 50 employees are made permanent every year.

Another contractual worker at Honda’s Manesar plant said though jobs of employees who have worked longer are secure, one never knows about the fate of the contractual employees if the demand slowdown persists. “If there is no demand, the company also is left with little choice but to ask employees to go,” he said.

At Maruti’s Manesar plant, the apprehension is even more palpable after the company announced a two-day stop in production at its Gurugram and Manesar manufacturing units on 7 and 9 September. Though the company did not say why, workers attributed the decision to piling stocks.

“Car sales have fallen and this is obviously impacting the production. Our jobs are safe for now, but one never knows what will happen in the future,” said a worker in the maintenance department at Maruti’s Manesar plant who did not wish to be named.

The fear is not unfounded. With permanent workers constituting less than 30-40 per cent of the total staff employed, companies find it easy to let go of contractual employees. Last month, Maruti Suzuki chairman R.C. Bhargava said it had let go of 3,000 temporary workers and not renewed their contracts.

Kuldeep Jhangu, general secretary, Maruti Udyog Kamgar Union, said this is the sharpest slowdown that has hit the industry in 19 years.

“At least 1.5 lakh to 2 lakh contract workers have been forced to go home in the Gurugram-Manesar auto belt. The worst hit have been those working with the auto component manufacturers and transporters,” he said.

Jhangu said Maruti had reduced hiring from Industrial Training Institutes, and that production shifts had been reduced for some models.

Also read: Financial sector needs bold reform to fix slowdown. Modi govt has time & numbers to do it

Reasons for the slowdown

Speaking to ThePrint, Shashank Srivastava, executive director at Maruti Suzuki India Ltd, said the slowdown has been happening for the last 12 months, but the last quarter was especially bad.

“Financing, slowdown in the economy and prices of the vehicles going up because of regulatory recruitments of emission and safety are some of the reasons (for the slowdown),” he said, adding that there was also an increase in insurance costs and registration taxes.

“States have increased road taxes. There is confusion over BS-IV and BS-VI norms. The expected growth in sales has not happened. And the production plan is based on the sales. The production resources have to be adjusted,” he said. “We have a certain percentage of people who are in the temporary workforce, and if the demand is not there, you don’t renew the contract.”

An employee at Hero Motocorp’s Gurugram plant said the production and demand for workers is much lower than what it was last year in the run-up to the festive season. He said neither hiring nor firing is happening, but blamed the various changes in the labour Acts brought about by the Modi government for the current plight of workers.

Component makers and local businesses’ woes

Production cuts by the big manufacturers are having an even bigger impact on component makers who supply them.

“The OEMs (original equipment manufacturers) have announced around 15,000 job cuts. This translates to roughly 1-1.2 lakh jobs for the auto component sector. And this would primarily be trainees,” said Ram Venkataramani, managing director of India Piston Rings and president of the ACMA, adding that he hoped for an improvement.

The surrounding ecosystem has also been adversely impacted. Business has dropped around the plants in Manesar and Gurugram, and most shopkeepers, such as tea-sellers and paan-shop owners, talk about a 50 per cent reduction in sales.

Sharad, a 40-year-old manning a tea stall in IMT Manesar, said many of his regular customers have gone back home. “They come from neighbouring states like UP and Rajasthan or from Bihar and Odisha. They rent small houses in nearby villages like Dhana but do not stay on as they can’t afford to live here without any wages. They all go back home hoping for a recall after the situation improves,” he said.

Hope for the future

The government has announced some steps to alleviate the problems faced by the auto industry, but all eyes are on the upcoming festive season to see if there will be a boost in demand.

The government announced a deferment of the increase in the one-time registration fees, and easier flow of bank credit. But the industry is still hoping for a sharp cut in goods and services tax in the next GST Council meeting later this month. GST on cars is levied at the highest slab of 28 per cent, with a cess on luxury cars over and above the GST.

A cut in rates, if agreed upon by the states, will mean the GST rates are reduced to the next slab, 18 per cent.

Also read: Auto stocks have lost $42 billion in 16 months & suddenly become India’s worst sector

September would be more bad

Lekin aayenge toh Khattarji hi …