Mumbai: Traders in India are pinning their hopes on the central bank stepping in to manage bond-market liquidity at this week’s policy review as the market confronts record debt supply.

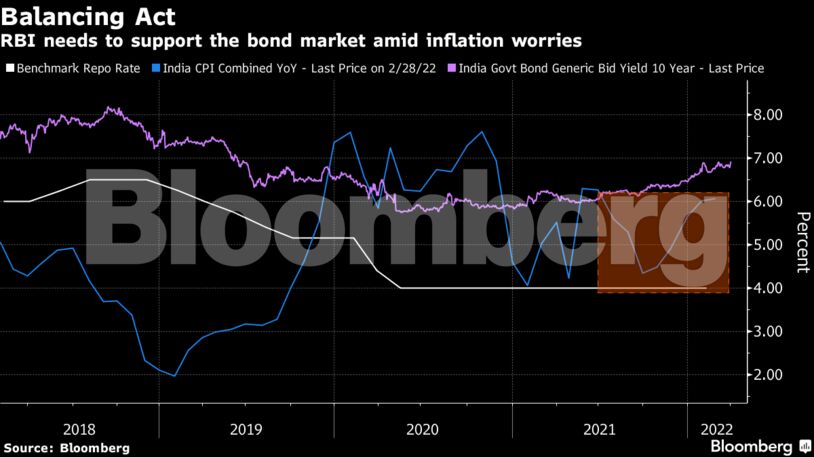

The Reserve Bank of India faces the challenge of keeping bond yields in check as the government kicks off an unprecedented 14.31 trillion rupees ($190 billion) of annual borrowing in April. At the same time, surging oil prices threaten to accelerate inflation, putting pressure on policy makers to hike rates.

“Support from the RBI in the form of open-market purchases is crucial to keep yields contained, given the large borrowing program and an environment of rising global yields,” said Gaura Sen Gupta, an economist at IDFC FIRST Bank Ltd.

Benchmark 10-year bond yields have risen nearly 50 basis points this year, though India has been relatively insulated from an increase in global rates due to an absence of supply in March and a dovish RBI. Yields jumped sharply higher to 6.90% on Monday.

The impact of heavy supply and faster global policy normalization should push the 10-year yield to a peak of 7.40-7.50% in the fiscal first half, in the absence of central-bank intervention, said Upasna Bhardwaj, an economist with Kotak Mahindra Bank Ltd.

Here’s what traders say the RBI may consider on April 8:

Operation twists

- Given that that RBI has started draining liquidity from the banking system, it’s unlikely to announce direct bond purchases. But it may well use open-market operations and liquidity-neutral Operation Twists, in which it buys longer bonds and sells shorter-dated notes, according to Deutsche Bank.

- The RBI halted announced bond purchases in October. It bought 2.2 trillion rupees of bonds last fiscal year.

Headroom for banks

- The RBI may make leeway for banks to increase debt purchases by allowing them to hold more securities under a system which exempts bonds from losses from market fluctuations.

- Currently, banks can hold 22% of deposits in government bonds under the so-called held-to-maturity portfolio. The RBI may raise that to 23%, said Shailendra Jhingan, chief executive at ICICI Securities Primary Dealership Ltd. Alternatively, the RBI may also consider extending the 22% relaxation, according to Citigroup Inc.

FX swaps

- The central bank has announced a second $5 billion dollar-rupee sell/buy swap, where is takes out rupee liquidity by selling dollars. That may help create space to conduct open-market bond purchases, according to IDFC FIRST Bank Ltd.

- The RBI will have to provide 2–2.5 trillion rupees of open-market support in first half of the fiscal year, according to Citigroup Inc.

FX sales

- The RBI has been supporting the rupee with dollar sales in the currency market. As this intervention leads to a draining of rupees from the banking system, the RBI can resort to aggressive FX sales, creating room for bond purchases, according to Kotak Mahindra. –Bloomberg

Also read: Govt begins inspection drive to curb hoarding of edible oils, oilseeds: Food secy