Mumbai: Producers of household items have been India’s best stock market bets for years. But the consumption slowdown in the world’s fastest-growing major economy is rubbing the sheen off these shares.

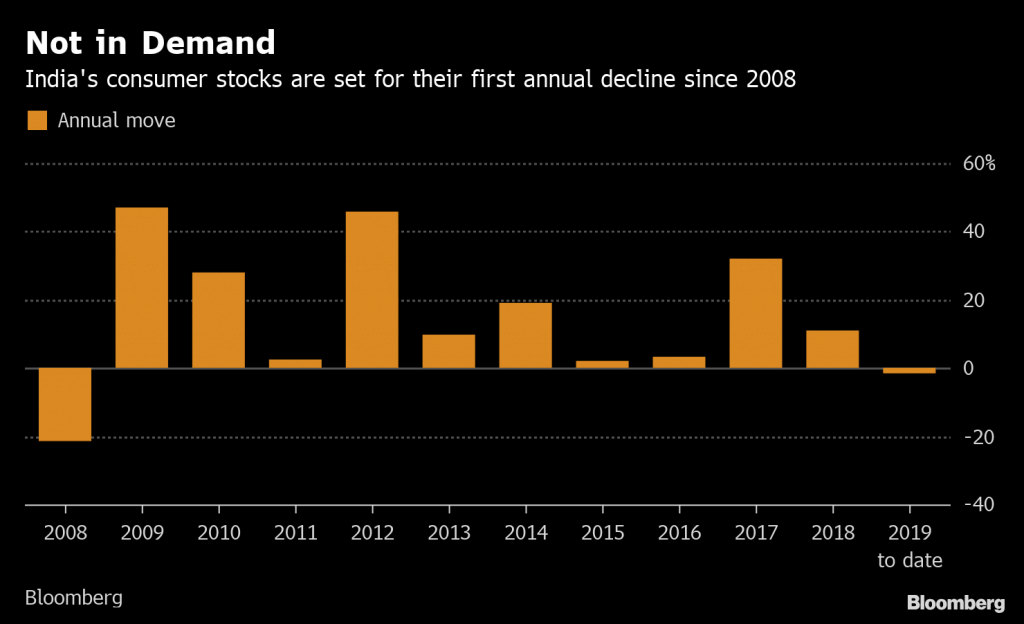

The 74-member S&P BSE Fast-Moving Consumer Goods Index, which has had only one down year since 2006, has bucked the gains in the nation’s benchmark measure. And some of the biggest names in the gauge have accumulated double-digit losses five months into the year.

India’s consumption engine is sputtering as the cash crunch caused by the crisis in the shadow-banking sector has curbed spending even on staples after hurting demand for cars and homes. Hindustan Unilever Ltd., whose soaps and detergents are used by nine out of 10 Indian households, in an analysts call Friday pinned the deceleration on weak rural demand and said it is unable to say when the buoyancy of the past would return.

“When a generally-measured management like Hindustan Unilever’s uses the term ‘recession’ in its comments in the post-result presser, it generally isn’t a one-quarter blip,” analysts led by Rohit Chordia at Kotak Institutional Equity Research wrote in a note on the weekend.

The company’s volume growth slowed to 7 percent in the March quarter after five straight quarters of double-digit expansion. Growth for Dabur India Ltd. during the period was 4.3 percent compared with about 8 percent a year earlier. Britannia Industries Ltd. grew 7 percent, versus 11 percent, and Godrej Consumer Products Ltd. posted a 1 percent increase in its domestic branded-business volumes.

Also read: Housing finance regulator NHB comes in for tougher oversight to prevent liquidity crisis

The market is repricing the growth outlook. Hindustan Unilever has declined 5.8 percent in 2019, Godrej Consumer 21 percent, Britannia 15 percent and Dabur 11 percent. The S&P BSE Fast-Moving Consumer Index trades at a 12-month blended forward price-to-earning of 32, higher than its five-year average, signaling potential for further contraction in values.

“The sector isn’t a bad place to be in but the high price-earnings ratios are a challenge,” Pashupati Advani, president of Advani Group, said by phone. “The explosive growth we saw in the past has disappeared. It is difficult to say when the economy will revive.”

The slowdown may not be cyclical, according to a separate report by Kotak Institutional Equities, which cites insufficient income growth as the reason for the weak demand. Lower property purchases by households from fiscal 2013 through 2018 helped sustain consumption, which is cooling off now as incomes fall, according to the note co-authored by Sanjeev Prasad.

As India’s on-going general elections enter the last stretch, the task for the new government is cut out — take steps to revive economic growth. Prasad has three suggestions:

- Reform land and labor laws

- Review pricing policies to boost FDI in key infrastructure sectors

- Raise foreign ownership limits in government bonds to boost inflows

“In our view, a combination of the three — not just one or two — can kick-start economic growth,” Prasad wrote.

Also read: Services sector output drops to 7-month low in sign of weak growth