Indian shadow lender Shriram City Union Finance Ltd. is building a so-called super app to offer various financial products on a single digital platform, joining other major non-bank finance companies in taking on growing competition from fintech firms.

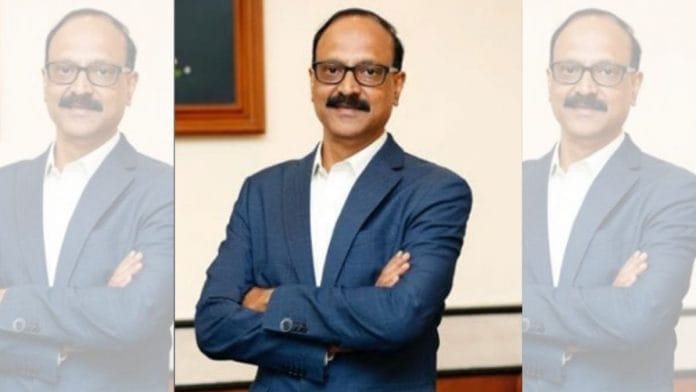

“We already are in the process of building a super app,” Y.S. Chakravarti, chief executive officer of the company, said in an interview Monday on Bloomberg Television. “In 18-20 months from now, the super app should be ready, offering every financial product that a customer needs.”

The move follows another major shadow lender Bajaj Finance Ltd., which has also been working on its consumer app, as the sector tries to play catch up after undergoing a crisis that saw a number of finance companies fold up. India’s central bank superseded the board of Reliance Capital Ltd., Srei Infrastructure Finance Ltd. and Srei Equipment Finance Ltd. in recent months, citing governance concerns.

Several Indian fintechs, including One 97 Communications Ltd., already offer most financial products on their apps, luring in customers in the country that is traditionally under banked but is increasingly turning to digital forms of transactions.

Last month, Shriram Group said it would merge Shriram City Union Finance with Shriram Transport Finance in a restructuring that will create the largest shadow lender to consumers in the country. The revamp comes when India’s retail lending is picking up with consumers wanting to splurge on everything from two-wheelers to homes as a recovery takes hold in the country after the pandemic-induced slump.

The merger, which will see Shriram Finance Ltd. manage 1.5 trillion Indian rupees ($20.2 billion) worth of assets, would help the group bring together all its lending products under a single roof and cross-sell products. On a rough estimate, about 30% of the Shriram Transport customers could be interested in Shriram City’s products, Chakravarti said.

“Five years from now, I would like 30% of my disbursements to come from either tie-ups with fintechs or through our digital growth,” Chakravarti said. – Bloomberg

Also read: RBI gets more power to regulate India’s struggling shadow lenders