New Delhi: The Reserve Bank of India Wednesday announced a fourth consecutive rate cut in key policy rates, but this time by 35 basis points, to revive flagging growth.

The committee has cut repo rates by 25 basis points each in the previous three successive monetary policy meetings in February, April and June.

The repo rate now stands at 5.4 per cent.

With this, beginning February, the six-member monetary policy committee has cut key policy rates by a total of 1.1 percentage points. However, banks have passed on less than half of this in rate cuts to final borrowers leading to criticism over the effectiveness of monetary policy transmission.

The rate cut comes at a time when the economy is in the midst of a slowdown, and investment and consumption indicators are not showing any signs of revival.

The full-year growth for 2019-20 was also revised downwards to 6.9 per cent from 7 per cent projected in the June monetary policy.

Data from the Centre for Monitoring Indian Economy (CMIE) shows that capital expenditure in the economy on new projects has fallen for the second consecutive quarter in June to Rs 0.7 lakh crore. It was Rs 2.44 lakh crore as of March end and Rs 2.5 lakh crore as of December end.

Bank credit to industry is also growing at around only 6 per cent with micro, small and medium enterprises struggling to access credit.

Consumption has also slowed down sharply as reflected by the falling sales of automobiles and consumer durable items.

Also read: 3 rate cuts by RBI this year have done little to boost lending and spur growth

‘Addressing growth concerns highest priority’

The RBI committee said that addressing growth concerns remains the highest priority as domestic economic activity continues to be weak, with the global slowdown and escalating trade tensions posing downside risks.

“Private consumption, the mainstay of aggregate demand, and investment activity remain sluggish. Even as past rate cuts are being gradually transmitted to the real economy, the benign inflation outlook provides headroom for policy action to close the negative output gap,” the monetary policy statement said.

“Addressing growth concerns by boosting aggregate demand, especially private investment, assumes the highest priority at this juncture while remaining consistent with the inflation mandate,” statement added.

Four members of the committee voted for a 35 basis points rate cut, while two members favoured a 25 basis points rate cut, according to the statement.

India’s growth slowed to a five-year low

India’s growth slowed to a five-year low of 5.8 per cent in the January-March quarter led by a slowdown in both investment and consumption.

The full-year growth figure for 2018-19 came in at 6.8 per cent, marking the second consecutive year of slowdown. India’s economy had grown at 7.2 per cent in 2017-18 and 8.2 per cent in 2016-17.

At the same time, inflation based on consumer price index has remained at less than 4 per cent in June at 3.18 per cent, providing the central bank space to cut rates to support growth. However, the monsoon movement will add to the uncertainty around food prices.

Also read: How govt of India and RBI can manage the risk of foreign currency borrowing

See the graphs. All the silicone implants from the statisticians are not helping. So much exceptionalism in the claims.

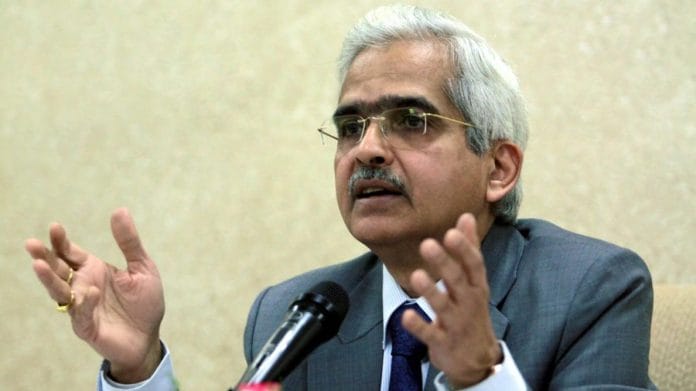

There used to be a Greenspan put. Call this the Das cut.