Melbourne: Traders are rushing to price in a higher peak to the rate cycle in emerging Asian markets, as they anticipate that central banks will have to hike faster and more aggressively.

Central banks raising rates from India to Malaysia have spurred bets in swap markets, with traders raising terminal rate expectations in the South Asian nation by more than 75 basis points in recent weeks. Even countries in the region, like New Zealand, which have been ahead of others in policy normalization, are raising the peak rate forecasts.

Those who have bet that rates hikes have been largely priced in are increasingly at risk of being proven wrong. Inflationary pressures are refusing to ebb across the globe as oil trades near a three-month high while European inflation data for May topped economists’ forecast.

“Risks of higher terminal rates in Asia are certainly there, although compared to the start of the year, market pricing of terminal rates has already moved up by a lot,” according to Duncan Tan, a rates strategist at DBS Group Holdings Ltd. in Singapore.

Here is how rate expectations have moved in four markets in the region.

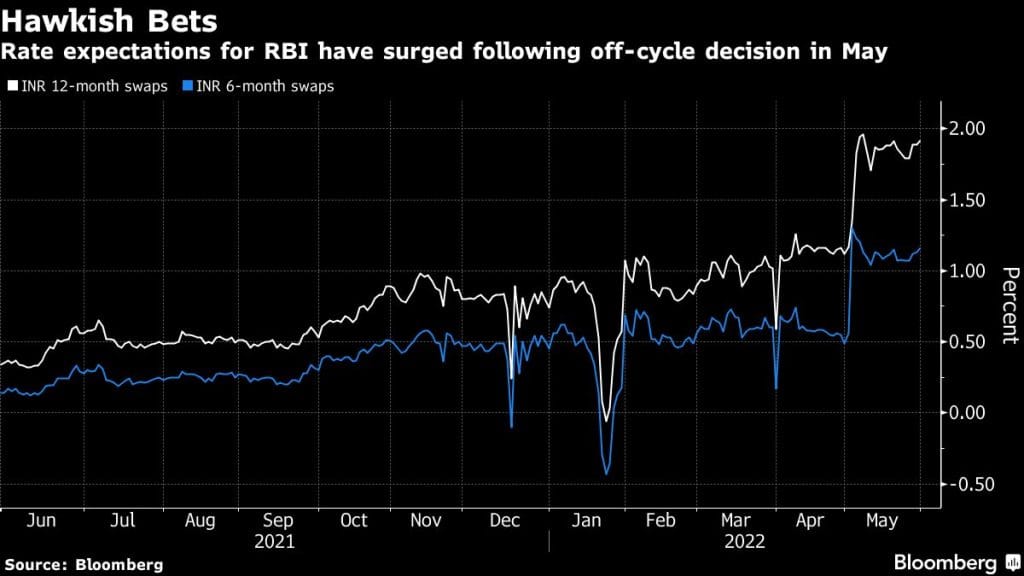

1. India

Rate expectations have surged following an off-cycle surprise hike on May 4, with rupee overnight indexed swaps now pricing nearly 190-basis points of tightening over a 12-month horizon, up from 112 basis points at the end of April. Nomura Holdings Inc. expects front-loaded hikes, and for policy rates to rise to the terminal level of 6.25% by April 2023, economists including Sonal Varma wrote in a May 22 note.

The Japanese firm’s projection is above consensus expectations for a terminal rate of close to 5.90% by the second quarter of next year, as suggested by a median of economists surveyed by Bloomberg. RBI’s next policy meeting is slated for June 8.

2. Korea

At last week’s policy decision, the Bank of Korea raised its inflation forecast for this year to 4.5%, from a 3.1% projection made in February, as its new governor emphasized prioritizing inflation over growth. Investors were quick to frontload rate expectations, with won swaps pricing in nearly three quarter-percentage-point hikes in the next six months to 2.50%. Over the 12-month horizon, won swaps mostly held, still pricing rates to rise to the 3% level.

3. Malaysia

Bank Negara Malaysia’s unexpected decision to hike policy rates on May 11 accelerated hawkish bets, with swaps pricing in for rates to rise as high as 3.8% over the 12-month horizon before easing. This has buoyed local bonds, which have offered total returns of 1.8% in May to dollar-based investors, the highest in emerging Asia.

4. Philippines