India’s pioneering digital payments startup Paytm is gradually regaining the confidence of some analysts after it had one of the worst debuts by a major technology company less than three months ago.

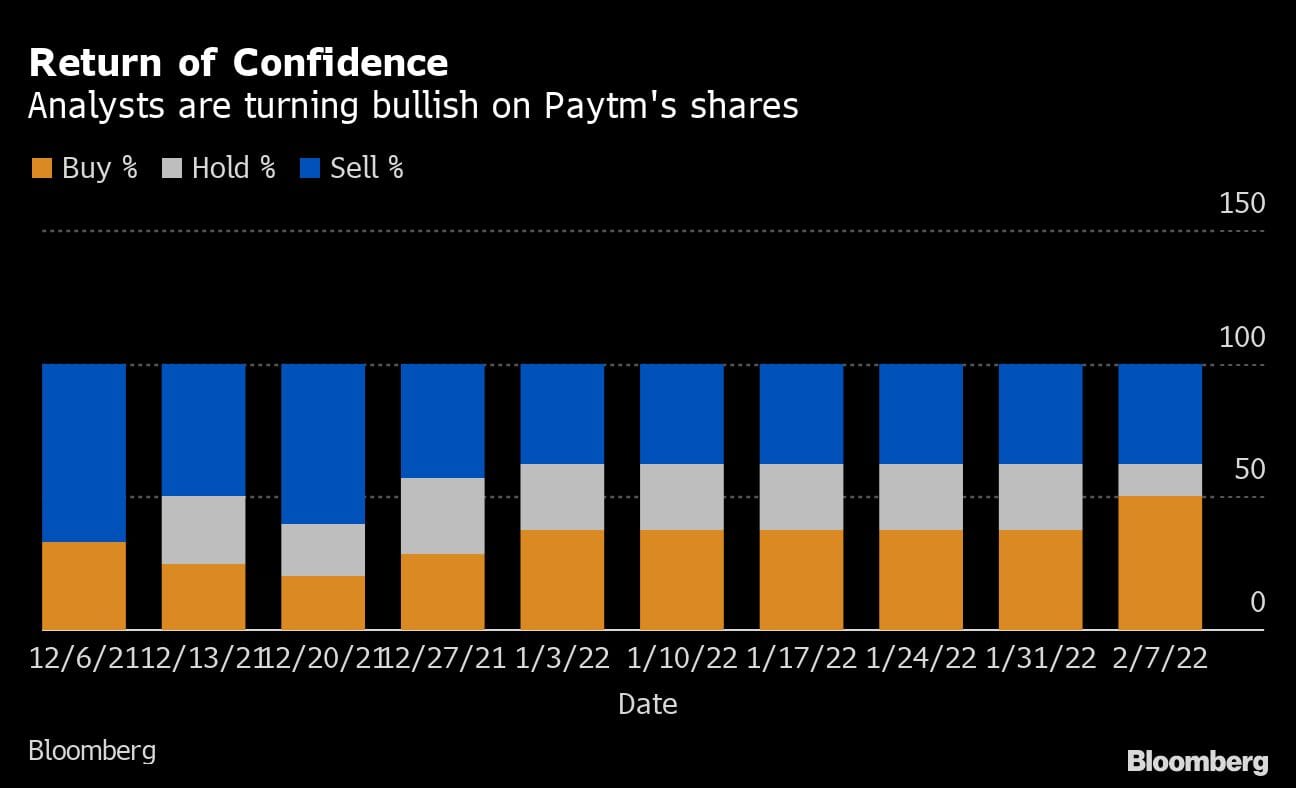

Buy recommendations on One 97 Communications Ltd., the operator of Paytm, climbed to four this week, up from just two at the start of the year, while sell ratings have remained unchanged at three, according to data compiled by Bloomberg. It’s the first time bulls outnumbered bears since the company’s disastrous initial public offering in Mumbai during November.

In the most-recent vote of confidence, Goldman Sachs analysts led by Manish Adukia raised their rating to buy from neutral, after Paytm’s December quarter revenue surprised the market. The investment bank’s target price of 1,460 rupees implies a gain of more than 50% from Monday’s close.

Still, the shift in analyst sentiment may provide little comfort to investors who have seen Paytm shares lose more than half of their value since listing. The stock is this year’s worst performer on the S&P BSE’s index for new shares, after online food delivery platform Zomato Ltd. –Bloomberg

Disclosure: Paytm founder Vijay Shekhar Sharma is among the distinguished founder-investors of ThePrint. Please click here for details on investors.

Also read Gautam Adani overtakes Mukesh Ambani as Asia’s richest person