New Delhi: The Institute of Chartered Accountants of India (ICAI) has proposed sweeping changes to its existing code of ethics for member firms with the aim to promote domestic consulting and help Indian chartered accountant (CA) firms compete globally.

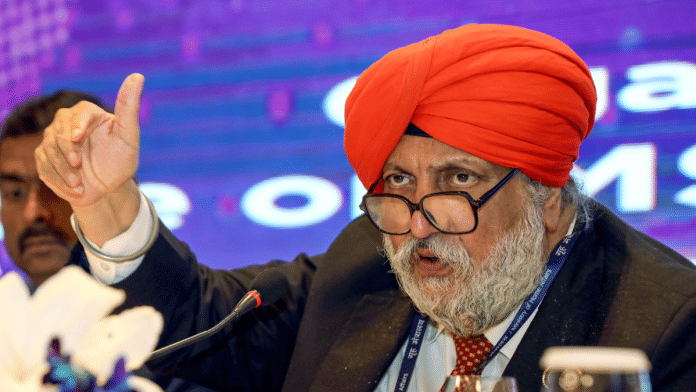

Released by the ICAI on 27 October, the proposed changes include relaxing certain advertising guidelines to align them with the current digital age, granting firms freedom to showcase their services, embracing technology-driven consulting like artificial intelligence, and also ensuring stricter audit independence. “The revised guidelines reflect the ICAI’s vision to empower Indian CA firms to grow and compete globally,” ICAI President Charanjot Singh Nanda told ThePrint. “These changes will help improve visibility, step up clients and stakeholder engagement, and align Indian CA firms with global professional practices.”

The revised guidelines have been put on the ICAI website for public feedback until 26 November. After that, it will go to the ethical standards board for deliberations, and the ICAI council will then release the final guidelines, Nanda added.

The ICAI is a statutory body responsible for the regulation and development of chartered accountants in the country. Currently, it is a key stakeholder in the central government’s framing of regulatory reforms to promote domestic consulting firms.

Also Read: What’s keeping homegrown consulting firms from taking on Big 4? Here’s what ICAI chief has to say

What are the proposed changes

One of the most striking changes proposed is the introduction of the term “contemporary” in the ICAI’s advertisement guidelines, first framed in 2008.

The change, Nanda said, will allow CA firms to adopt more modern and visual modes of advertisements and move beyond text-heavy write-ups prescribed earlier.

Under the revised guidelines, advertisements by CA firms can be in the form of pictures, diagrams, and texts. The font size limit of 14 points has also been dropped. According to Nanda, this will allow member firms to promote their services in a more effective manner.

Apart from advertisements, the ICAI has also proposed flexibility in website guidelines for its member firms. Until now, firm websites could only operate as per “pull technology”—meaning potential clients had to visit the site themselves. The use of “push technology”, which involves pushing updates and information proactively, was restricted.

As per the new draft, CA firms can use “push technology” for services not exclusive to the profession e.g. consulting, IT advisory, among others. This, according to Nanda, is designed to “create a level playing field” for CAs with professionals from other fields.

Expanding horizon of CA profession

The organisation has also proposed to broaden the definition of “Management Consultancy and Other Services” to include new-age services like artificial intelligence consulting, forensic accounting and investigation, and social and CSR (corporate social responsibility) impact assessment.

The Chartered Accountants Act, 1949 specifies the services that a chartered accountant may perform apart from accountancy and auditing. These services are defined under “Management Consultancy and Other Services” under the act.

The ICAI has included artificial intelligence consulting to recognise the importance of technology and data-driven decision-making in today’s context, Nanda said. The ICAI has also launched training initiatives to equip its members with the necessary skills to advise clients on AI adoption and digital governance.

With the inclusion of social impact and CSR assessment in management consultancy, the ICAI has acknowledged the role of chartered accountants in promoting transparency, accountability, and sustainability in business practices.

According to Nanda, the inclusion of services like AI consulting and CSR impact assessment reflects the evolving role of accountants in areas of technology and sustainability.

Strengthening audit independence

Another major proposal in the revised guidelines is to strengthen the independence of CA firms by limiting the non-assurance services, such as tax advisory, consulting, or bookkeeping, that they can offer to their audit clients.

According to the revised rules, a CA firm cannot audit a public interest entity (such as a publicly listed company) if it has already provided any non-assurance service to that client which could create a self-review threat, meaning the firm would be in a position to audit its own work or advice. “The maker and checker must be different,” Nanda said. “An important element in assessing an auditor’s independence is ensuring that an auditor does not review his own work.”

However, as per the guidelines, a firm may proceed with the audit work only if the earlier non-assurance service has ended before the beginning of the audit period.

According to Nanda, the revised guidelines related to independence are in line with the International Ethics Standards Board for Accountants (IESBA) code of ethics and aim to reinforce public confidence in audit integrity.

(Edited by Ajeet Tiwari)

Also Read: Before McKinsey, Bain, India had its own management gurus. Now daughters are taking the lead