New Delhi: Contrary to automakers’ expectations, the demand for automobiles in the 42-day festive period remained muted this year compared to the year-ago period.

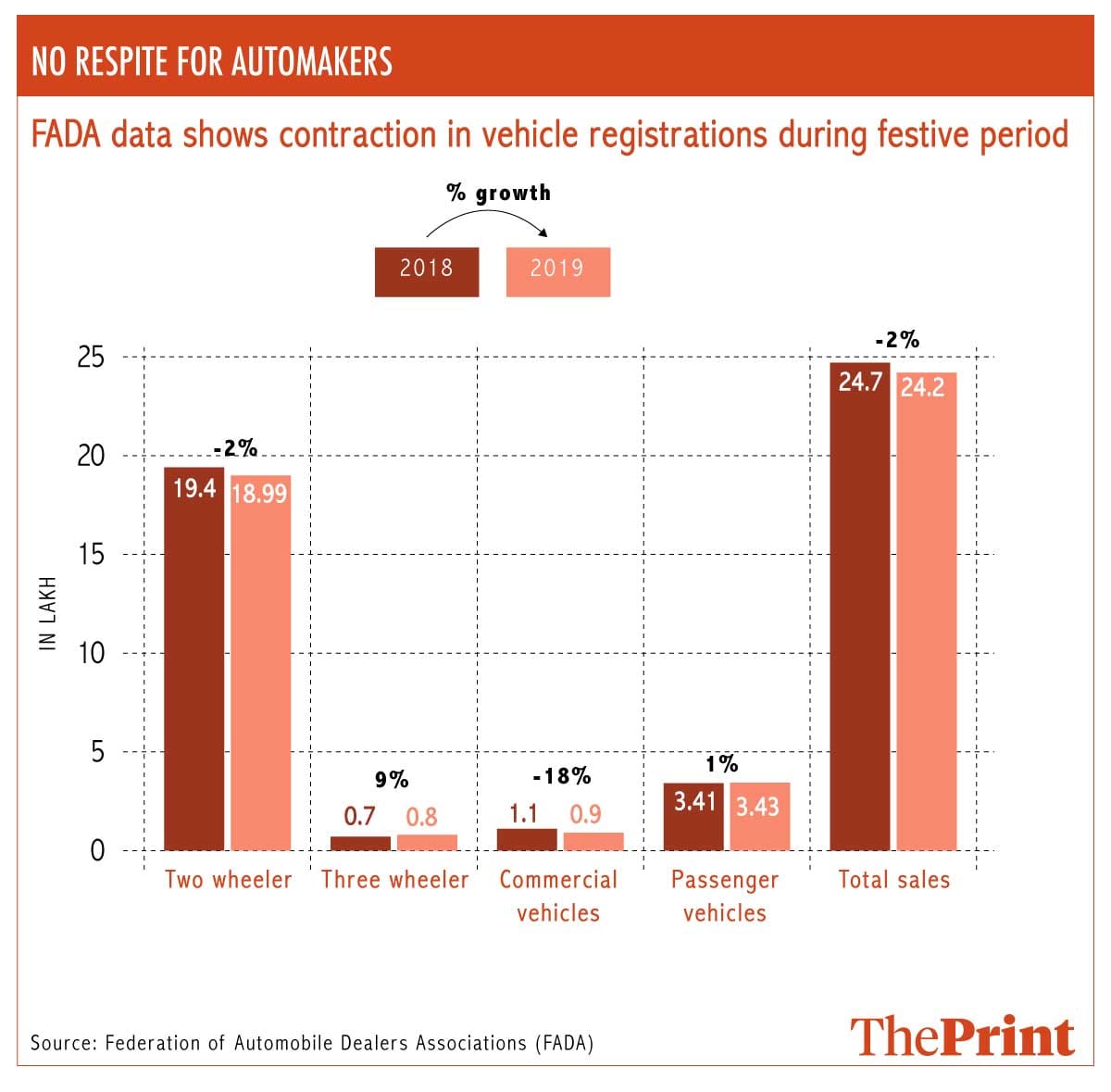

Data released by the Federation of Automobile Dealers Associations (FADA) Tuesday shows vehicle registrations contracted by 2 per cent to 24.17 lakh units in the festive season this year — from 24.7 lakh units a year ago.

FADA calculated the festive period this year to begin from the first day of Navratri (29 September) to 15 days after Dhanteras (25 October).

The auto sector has seen a sharp slowdown in sales this year on account of various factors including price hike due to new safety regulations, uncertainty around transition to BS-VI emission norms and higher insurance and registration costs.

Faced with falling sales, automakers were forced to cut back on production, through plant shutdowns, and to retrench employees. The festive season was expected to provide a much-needed boost to demand but data suggests that a revival could take more time.

Consumer demand has been falling sharply across sectors, adversely impacting India’s economic growth. GDP growth fell to a six-year low of 5 per cent in the quarter ended June and is expected to further decelerate to 4.2-4.7 per cent in the quarter ended September.

Also read: Manmohan Singh says climate of fear & hopelessness created by Modi govt is stifling economy

Cautious outlook

FADA data showed registrations contracted across the two-wheeler and the commercial vehicles segments by 2 per cent and 18 per cent, respectively.

The passenger vehicles and three-wheeler segments reported a marginal growth in registrations at 1 per cent and 9 per cent, respectively.

In a statement, FADA said it remains cautious in its near-term and mid-term outlook after the festive season on account of the BS-VI transition and lacklustre demand from rural areas due to extended and excessive monsoons.

Though the sales during Navratri were not as per expectations, they picked up gradually towards Diwali, noted FADA CEO Saharsh Damani.

In a note dated 12 November, Care Ratings said it expects auto sales to contract 7-9 per cent in the 2019-20 fiscal. It pointed out that the commercial vehicles segment is likely to report a contraction in sales for the full year despite some recovery in the second half.

“The pickup in construction and mining activities along with increased inter-state movement of goods with the streamlining of e-commerce and FMCG and pre-buying of commercial vehicles is expected to provide some cushion for the CV segment,” said Care Ratings.

“However, faced with an intense slowdown in H1FY20 and inventory levels at higher than historical averages, the segment is expected to report a decline in y-o-y growth for the fiscal FY20,” it said, adding recovery could take longer if the economic slowdown continues.

The ratings agency also warned that slowing debt driven consumption and falling household savings are key risks to the return of demand in passenger vehicles and two-wheeler and three-wheeler segment.

Also read: Privatisation creates wealth: Maruti was worth Rs 4,339 cr at sale. Now it’s Rs 2.18 lakh cr

Delusionary definition of middle class in India by all automakers will kill this industry. The marketing consultants were the main crooks.