New Delhi: Net foreign direct investment (FDI) inflows to India fell to a 12-year low in the April to October period of this financial year, in comparison to the same periods of previous years. This decline in the net amount is driven by a surge in the amount of money companies are taking out of the country accompanied by a stagnation in the gross amount they are putting in.

Further, an analysis of data from the Reserve Bank of India (RBI) by ThePrint shows that foreign investments made by Indian companies have also grown sharply in this financial year so far.

According to economists, both trends—of foreign companies taking their money out and Indian companies investing abroad—are driven by the relative attractiveness of the US economy as compared to India’s, especially during a period of global uncertainty.

The RBI so far has data for the April to October 2024 period, and therefore, the comparison with previous years has also included only this period of those years.

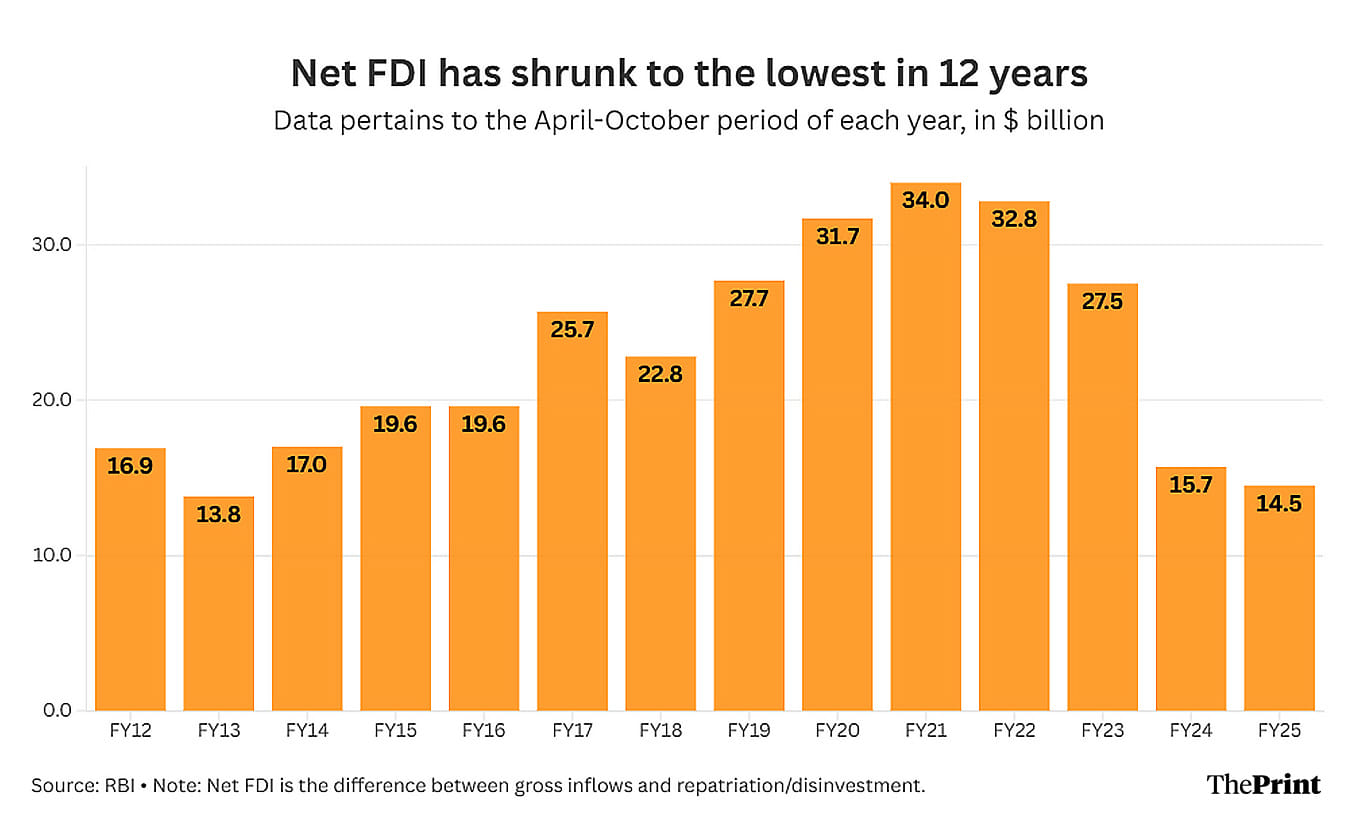

The data shows that, in April-October 2024, net FDI flows into India slumped to $14.5 billion, the lowest since 2012-13, when it was $13.8 billion. The data also shows that net FDI, from 2012-13 to 2023-24, has been slowing year after year since the pandemic.

That is, while net FDI during the April to October period of the pandemic year 2020-21 was $34 billion, it fell to $32.8 billion in 2021-22, $27.5 billion in 2022-23, and $15.7 billion in 2023-24.

Also Read: Politics, influence, caste — the murky loan dealings of Gujarat’s cooperative banks

Money coming in stagnates, while outflows accelerate

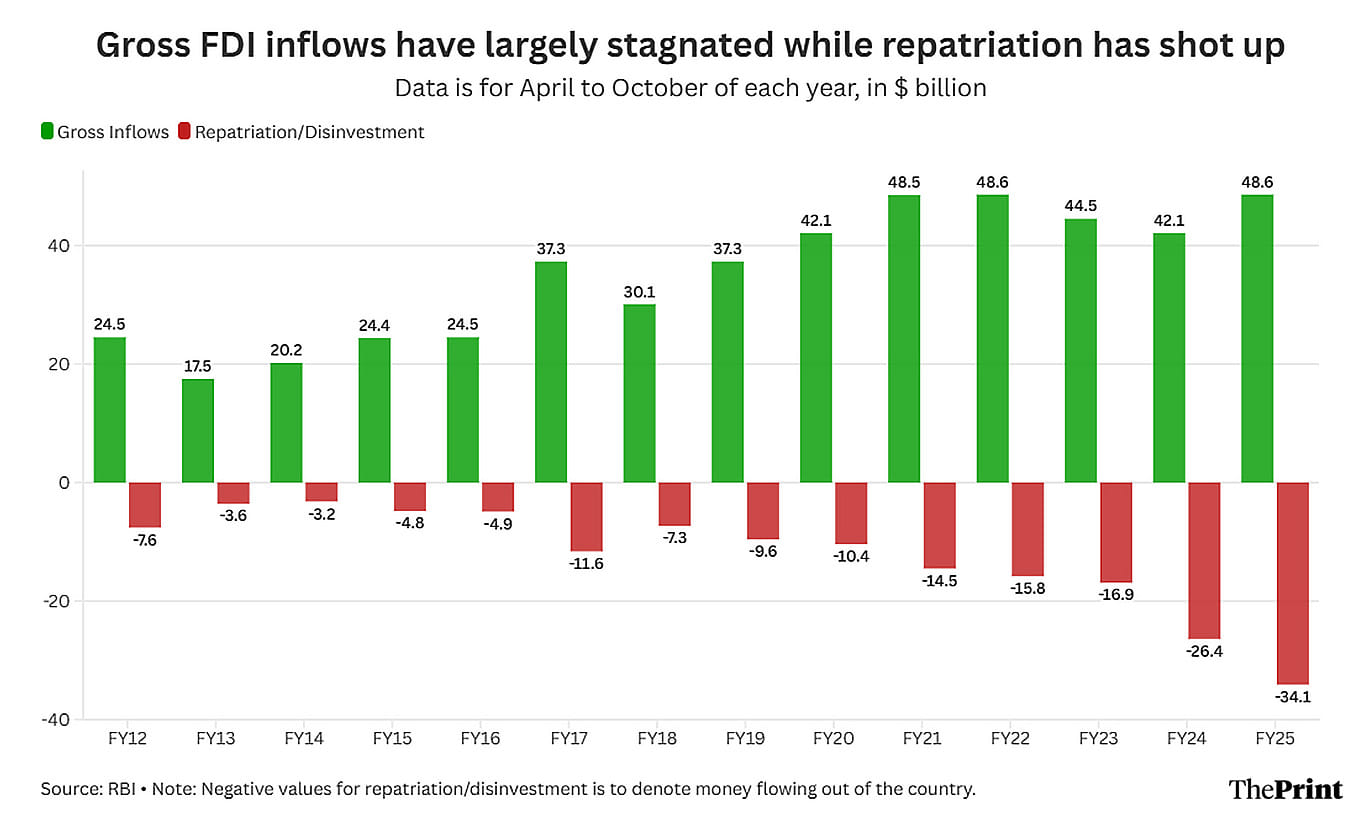

The net FDI flows are the difference between the gross flows into the country and the repatriation and disinvestment these foreign companies conduct, which involve money leaving the country.

It is important to note that gross FDI inflows into the country stood at $48.6 billion in the April-October 2024 period, the joint-highest since at least 2011-12, the earliest year for which the RBI provided the disaggregated data. This figure is largely the same as it was in the same period of 2020-21 and 2021-22.

The reason for the fall in net FDI is because outflows have surged. The money flowing out of the country as repatriation and disinvestment by foreign companies jumped to $34.1 billion in the April-October period of this financial year, up from $26.4 billion in the same period of the previous year. This figure has been increasing since 2017-18.

“The slowing gross domestic product (GDP) and poor corporate profitability has a bearing on this, but that’s a more short-term consideration since that trend is recent,” D.K. Srivastava, chief policy adviser at EY India, told ThePrint.

“But there is a more general sense because of the ongoing conflicts and so on, that global trade would not help India,” he added. “We would have a very difficult scenario as far as exports, petroleum prices and supplies are concerned, whereas the only economy that is expected to be in comfort is the US economy.”

Rishi Shah, partner at New Delhi-based professional services firm Grant Thornton Bharat, also pointed to the global scenario as the reason for money flowing out of India.

“The ongoing geopolitical uncertainty along with the US electoral cycle have translated into a more circumspect stance by investors and the trend of money moving into more dollar denominated assets has continued,” Shah said.

He added that this trend has played out among foreign portfolio investors—who invest in the securities markets—but is also visible in direct investments into real assets like plants and factories.

Official data shows foreign portfolio investors pulled out Rs 2.5 lakh crore from Indian markets during the April-December 2024 period of this financial year.

Indian companies are looking abroad too

While foreign companies appear to be increasingly looking away from India for investments, it looks like Indian companies, too, are doing the same.

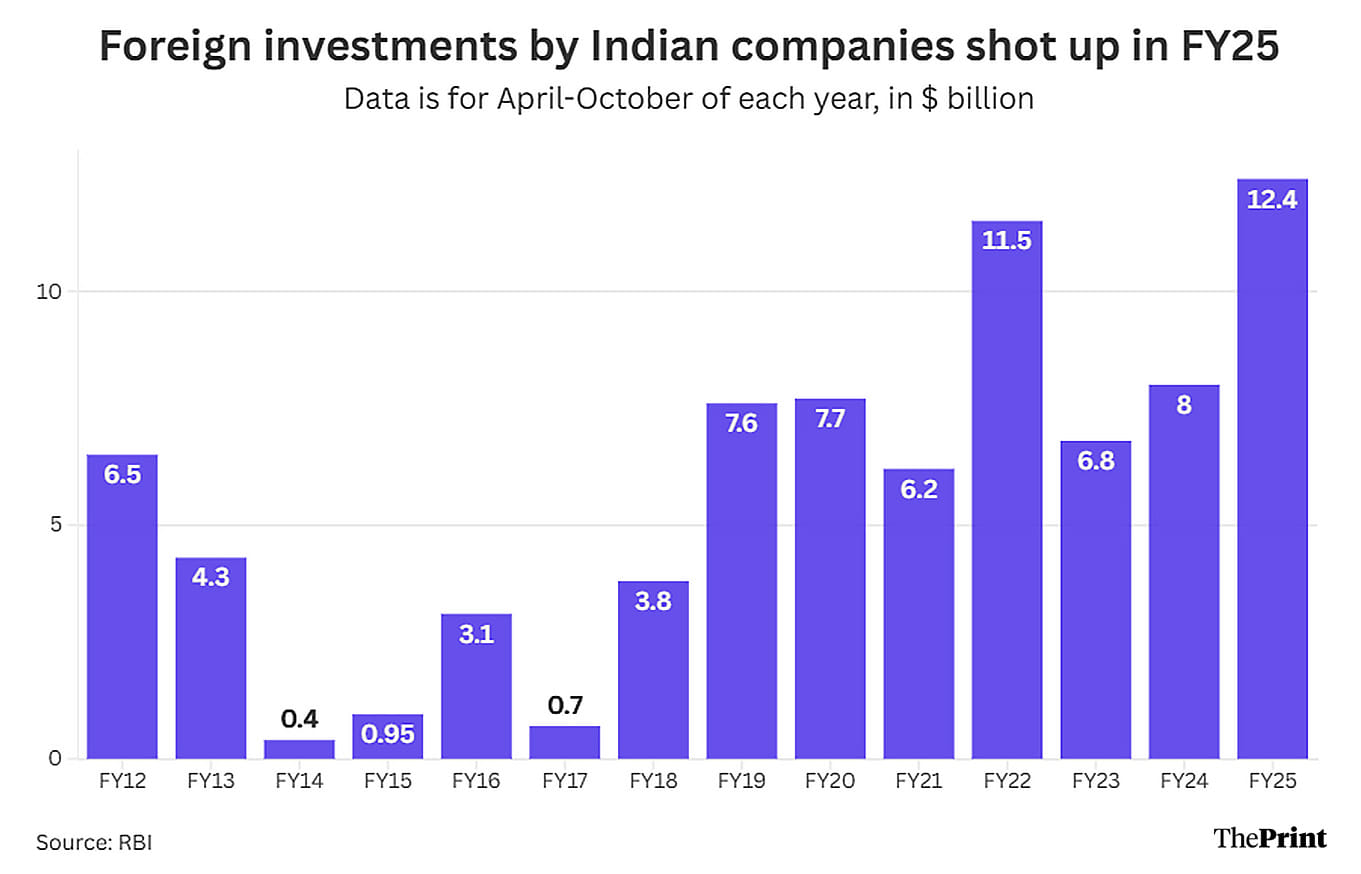

Foreign investments by Indian companies jumped to $12.4 billion in April-October 2024, the highest since at least 2011-12, and a 55 percent increase over the same period of the previous year.

“Indian companies are mostly investing abroad rather than in India,” Srivastava pointed out. “I think the expectation is that, in the presence of global uncertainty everywhere else, the whole thing becomes a race between India and the US. China is not attractive, nor is Europe. What investors anticipate is that the US would do well, and much better than India, particularly in the short run.”

In other words, he said, domestic investors in India are finding that it is not as attractive to invest in India as it is to invest in the US.

“Given the situation, countries looking to attract investment, like India, need to assess if they have a compelling enough story to get long term productive capital,” Shah added.

Shah, however, also highlighted that Indian companies could be investing abroad for strategic purposes, in order to secure their supply chains and speed up trade.

“One of the reasons for Indian companies investing abroad seems to be for strategic purposes,” he said. “A control on ports and shipping lines has enabled them to cut down shipping times substantially.”

(Edited by Radifah Kabir)

Some years ago, a lot of interest was taken in India’s ranking in the World Bank’s Ease of doing business index. Not heard of much nowadays. The fact remains that small and medium enterprises continue to face a regulatory maze, struggle with compliances. At the upper reaches of business, it is not a level playing field. Serious foreign investors are remarkably well informed about the environment for business.