Mumbai: Global investors are starting to fall out of love with Narendra Modi.

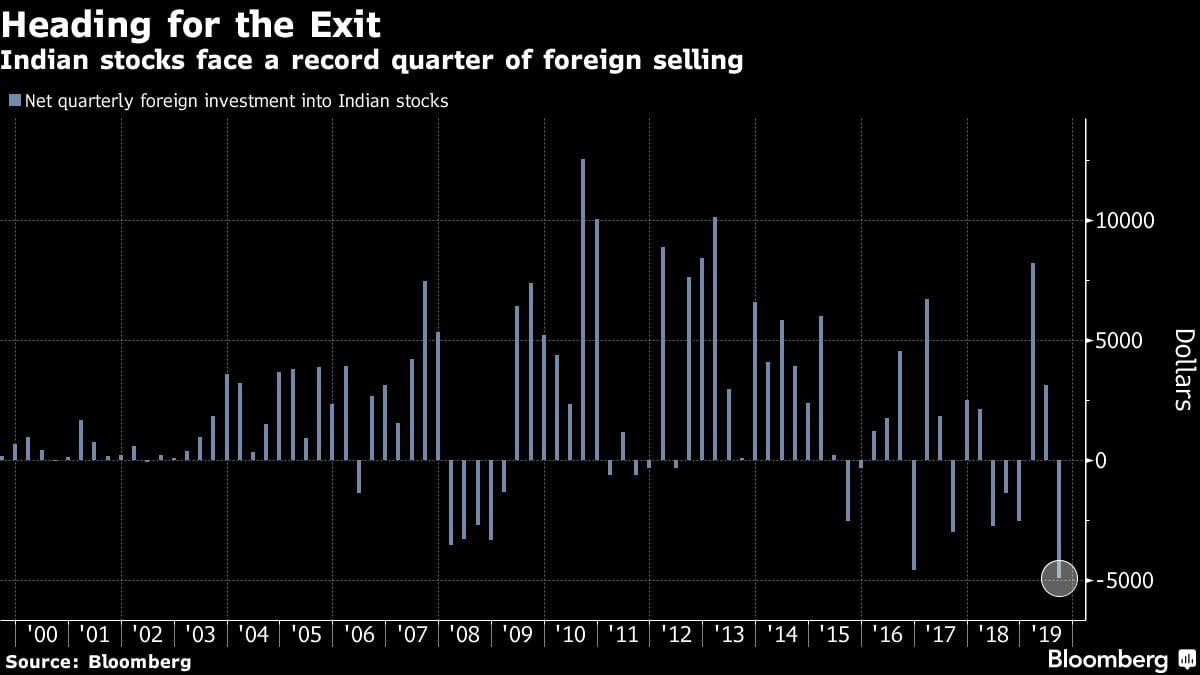

After pouring $45 billion into India’s stock market over the past six years on hopes that Modi would unleash the country’s economic potential, international money managers are now unwinding those wagers at the fastest pace on record. They’ve sold $4.5 billion of Indian shares since June, on course for the biggest quarterly exodus since at least 1999.

“The euphoria around Modi before 2014 has tapered off,” said Salman Ahmed, the London-based chief investment strategist at Lombard Odier Investment Managers, which oversees about $52 billion.

It’s hard to fault investors for losing faith. India’s economic growth has decelerated for five straight quarters to the weakest level since early 2013, one year before Modi became prime minister. And the 5% headline number for the second quarter may actually understate how painful the slowdown has become. Car sales are sinking at the fastest pace on record, capital investment has plunged, the unemployment rate has surged to a 45-year-high and the nation’s banking system is hamstrung by the world’s worst bad-loan ratio. Monday’s oil-price spike adds yet another headwind for a country that imports most of its crude.

While Modi isn’t sitting idly by as the economy weakens, investors say he’s been slow to act on a long list of needed reforms that includes selling stakes in state-owned companies and revamping the nation’s labor laws. The growing worry is that India could be headed for a structural slowdown that pummels the country’s $2 trillion stock market, throws a wrench into growth plans of international companies from Amazon.com Inc. to Netflix Inc., and makes it increasingly difficult for Modi’s Bharatiya Janata Party to deliver jobs for the millions of young Indians who enter the workforce every year.

Subramanian Swamy, a BJP lawmaker, spoke bluntly about the risks of inaction in an interview with BloombergQuint published Sept. 5: “If the economy is not rectified, Modi has about six more months till people start challenging him.”

Representatives from the prime minister’s office, finance ministry and BJP didn’t respond to requests for comment. India is an attractive investment destination, offering a massive market as well as local talent, political stability and a corruption-free, reform-oriented government, Technology Minister Ravi Shankar Prasad said at an industry event on Monday. Despite the recent outflows, foreigners’ net stock purchases of $6.8 billion this year is the highest after China among Asian markets.

While many of India’s problems pre-date Modi, critics say his handling of the economy has been disappointing. His 2016 decision to invalidate 86% of the country’s currency in circulation is widely regarded as a growth-sapping boondoggle, and his 2017 goods and services tax reform — passed with bipartisan support — has since been panned as far too complicated. Modi’s early attempts to simplify land and labor laws were reversed in the face of social and political opposition.

The BJP leader, who turned 69 on Tuesday, has won plaudits for cementing an inflation target that’s kept prices in check, passing a new bankruptcy law and recapitalizing the nation’s troubled lenders. But the revolutionary changes that many investors expected from Modinomics have so far failed to materialize.

Also read: Modi govt’s Rs 50,000 crore export stimulus isn’t a ‘game changer’

In recent weeks, the government has focused primarily on efforts to shore up short-term growth as the U.S.-China trade war weighs on emerging markets globally. Modi’s administration on Sept. 14 unveiled at least $7 billion of tax breaks for exporters, adding to measures last month that included tax benefits for vehicle purchases, the rollback of an extra levy on capital gains earned by international funds and an easing of foreign investment rules in sectors including retail, manufacturing and coal mining.

But Modi’s fiscal firepower is limited by the region’s widest budget deficit (including federal and provincial finances) and a bevy of overly indebted state-owned companies. His own advisers have warned that without major reforms, India could face a structural slowdown that keeps long-term growth far below the 8% rate that many economists say India needs to create enough new jobs.

“Structural reforms will be critical for higher GDP growth as the government may have largely exhausted the fiscal and monetary options,” said Sanjeev Prasad, an analyst at Kotak Institutional Equities in Mumbai.

The risk is that as the economy slows, reforms will take a back seat to heavy-handed appeals to nationalism. Modi’s latest sweeping election victory in May was fueled by a combination of Hindu nationalism, economic populism and air strikes against arch-rival Pakistan. Last month, he revoked seven decades of autonomy in the disputed state of Kashmir, a move that further escalated tensions with Pakistan and unnerved markets.

“They have spent all this political capital on Kashmir, which is frustrating,” said Katalin Gingold, managing director at Cartica Management, an emerging markets focused hedge fund based in Washington DC. “It seems more important to deal with the economy which looks like it could fall into a vicious cycle.”

High up on investors’ reform wish list: privatize more state-run companies, make it easier to hire and fire workers, loosen government restrictions on land purchases, set up a bad bank to take soured debt off lenders’ balance sheets, and expedite tax refunds to small manufacturers that are getting squeezed by the shakeout in India’s shadow banking system.

Even some long-term Modi supporters aren’t sure he will deliver. Jefferies Financial Group Inc.’s Christopher Wood, author of the widely followed “Greed & Fear” investment strategy report wrote on Aug. 22 that he’s “not so sure what Modi can do about the economy in the short term.” As recently as May, Wood had called Modi the “most pro-growth leader in the world.” Wood reduced his India recommendation by one percentage point to 15% — still higher than the MSCI Asia ex-Japan weighting of 8.2% — and increased Indonesia to 9% versus 2.1% on the benchmark.

Also read: Funds-starved Modi govt gets LIC to invest Rs 10.7 lakh crore to help failing banks & PSUs

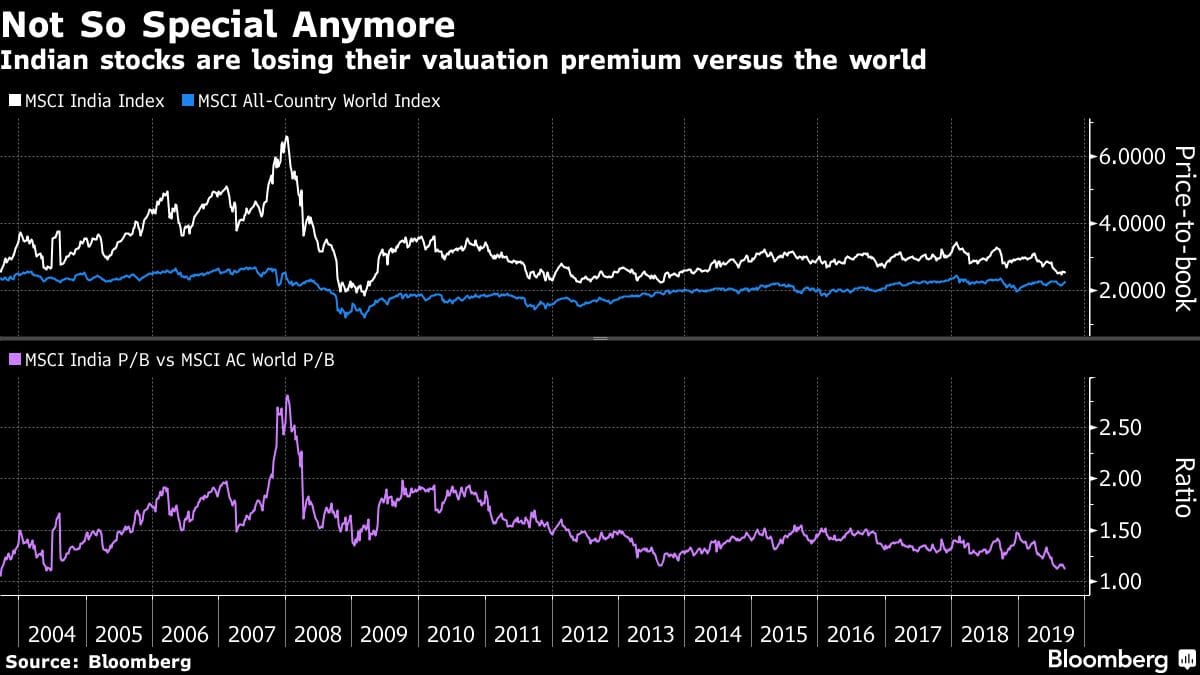

The MSCI India Index has dropped 9% from its all-time high in August 2018, cutting the gauge’s longstanding valuation premium over the MSCI All-Country World Index to the narrowest level since 2004. The Indian gauge now has a price-to-book ratio of 2.5, or 13% higher than the global measure. When Modi entered office, the premium was nearly 30%.

It’s not just investors that are turning more downbeat on Asia’s third-largest economy. Public expressions of pessimism from the nation’s corporate leaders, rare in the early years of Modi’s tenure, have become increasingly common.

Sanjiv Mehta, chairman of Hindustan Unilever Ltd., one of India’s biggest consumer-products producers, warned in May that the soaps and shampoos his company makes are “recession-resistant, but not recession-proof.” Guenter Butschek, chief executive officer at Tata Motors Ltd., said Sept. 5 that the Indian auto industry growth story “is about to collapse.” Vehicle makers contribute about half of national manufacturing output and are among India’s biggest employers.

“Absent a fast response from the government, the private sector risks facing a prolonged slowdown,” said Upasana Chachra, an economist at Morgan Stanley who recently cut her growth forecast for India.

(Updates to add Wood’s recommendation on Indian equities in 16th paragraph. A previous version of this story corrected the location of Cartica Management and the name of Morgan Stanley’s economist.)

BJP is least bothered about the slow down of Indian Economy,but are better rapist and does excellent work in Violence amongst it s own Indians,Leaders who have a poor financial background and kesser educated are better Dictators.the ruling in India at present is like the ruling of king Pharoah of Egypt

Modi euphoria gone where? In your dreams! Shame on such yellow journalism! eat your words when u saw the stock market rallying highest in 10 years! You are just an anti Modi media! The whole of India knows it!

Right, and the abysmal GDP growth and unemployment figures are also made up by the anti-Modi media? Not one economist of high intellectual stature based at a reputable university supports Modi’s disastrous management of the economy. I guess they too are all anti-Modi. Modi has installed an RBI governor who is MA history, not even a trained economist. And the results are self-evident. Perhaps you may ask yourself: At what point does one learn to remove the head from the rear end?

Modi ,and the Finance Minister are unable to manage India’s economy

they have made plenty of wrong decisions, which they don’t want to rectify.

Awesome . Keep it up . I amnhappy to see your message this media needs to be taught a lesson

Modi and BJP especially Amit Shah is more interested in hinduization of India, against minorities like Christians, Muslims and especially the Christian NGOs who are working in India… Trapping them in laws that restricts freedom of expression, freedom of choice of religion, freedom to propagate ones faith, crushing the cultural pluralism and federalism, bringing all kinds of people into their own one culture and one belief in Hinduism…

Good times are on the way………and euphoria or no euphoria, modi certainly was NOT the reason for those foreign investors who have withdrawn from the market at this point of time…….ELSE they would have continued as Modi infact is far stronger …far popular …..and far respected NOW than ever …….large investors are above the rhetorics the anti-india ssections of the media indulge in as part of the larger designs to destabilise the Nation’s economy. The headline is thus clearly ridden with malicious motive of fearmongering among the investors…… and is naturally rejected by those driving the Nation’s economy today bringing a great sense of hope and aspirations to crores of those people for whom the share-market has little or no impact …….any attempt to stretch the crookedly-headlined narrative to doomsaying will only-fail …….Modi continues to rule the roost !

Dr Arvind Panagariya wrote a column in ToI, suggesting that Moong ki daal ko ab Inflation ka tadka laga dijiye. 4% as the inflation target is too low. Nobody feels rich. If inflation surges, nominal profits will grow, the animal spirits will come roaring back.

La La la la…..la.