New Delhi: The latest Annual Survey of Industries (ASI) for 2022-23 paints a dismal picture of India’s labour productivity and income levels—wage growth has lately been slower than inflation, and value added per worker actually contracted in 2022-23.

In other words, while output and employment have increased, workers have seen their real incomes shrink, and their productivity fall—highlighting a stark contrast between quantity and quality of employment.

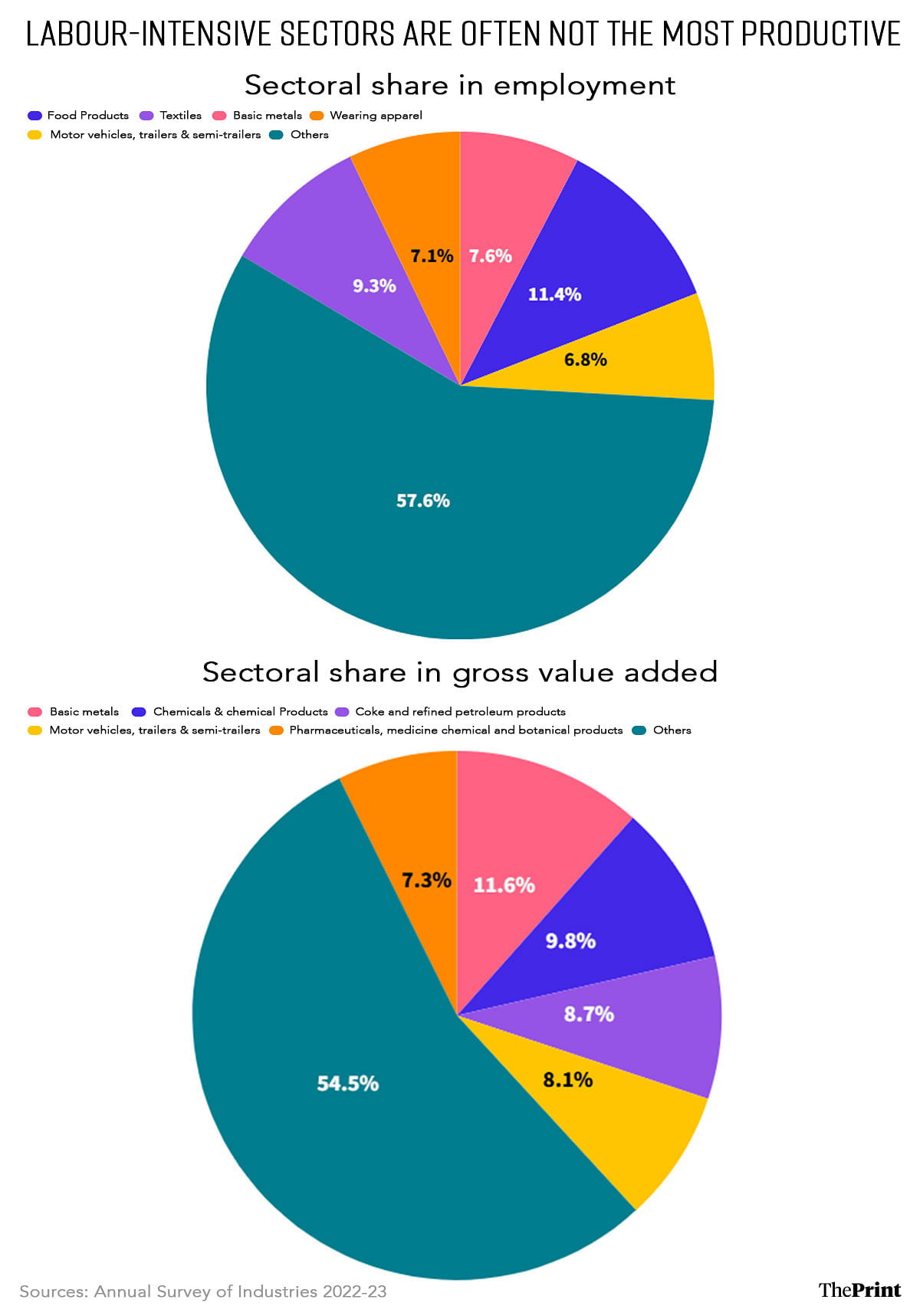

Additionally, the data shows that many of the sectors that employ the most people don’t feature among the sectors that add the most value to the economy, another indicator that a large part of India’s labour force is employed in low-value jobs.

Finally, the data presented in the ASI is in current prices, without incorporating the impact of inflation. Once inflation is incorporated, the real growth in value added shrinks to anaemic levels.

The ASI is a nation-wide study conducted by the Ministry of Statistics and Programme Implementation (MoSPI) to provide insight into the composition and growth of India’s manufacturing industries. Data from this survey is incorporated in the calculations of gross domestic product (GDP) and gross value added (GVA).

“The labour-intensive sectors like food products and textiles are low-productivity ones, but they contribute a large share of overall employment,” Amit Basole, professor of economics and head of the Centre for Sustainable Employment at Bengaluru-based Azim Premji University, told ThePrint.

“The fact that wage growth has been weak is confirmed by the data from the Periodic Labour Force Surveys as well, so there is consistency in the data there,” he added. “The stagnation in productivity and value added is concerning.”

Also Read: India mustn’t skip the manufacturing train. Services alone won’t tap into demographic dividend

Slowing wage growth, quickening inflation

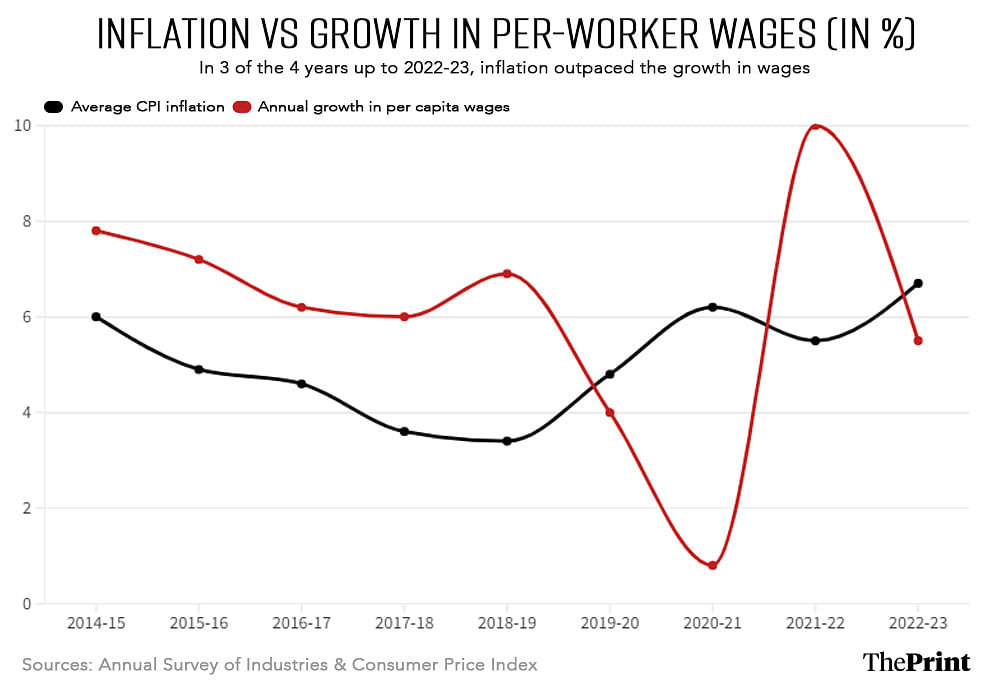

An analysis of data from the ASIs shows that inflation—after a period of easing—had largely been rising between 2018-19 and 2022-23. On the other hand, the growth in wages per worker has largely been slowing since 2014-15, except for a bounceback in the post-Covid year of 2021-22.

The annual rate of inflation eased from 6 percent in 2014-15 to 3.4 percent in 2018-19, while the growth in per-worker wages slowed from 7.8 percent in 2014-15 to 6.9 percent in 2018-19.

What this means is that, during this period, workers were seeing their real incomes grow, since their wage growth was faster than inflation. This situation reversed thereafter.

Three of the four years between 2019-20 and 2022-23 saw wage growth come in lower than the rate of inflation, effectively meaning that workers saw their real incomes shrink. This trend started in the pre-pandemic year of 2019-20, when inflation exceeded wage growth by 0.8 percentage points.

The Covid-19 pandemic naturally exacerbated this due to the disruptions in economic activity it caused. In 2020-21, inflation exceeded wage growth by 5.4 percentage points. In other words, workers saw their real incomes shrink by 5.4 percent.

The post-pandemic bounceback in economic activity led to this being temporarily reversed—with wage growth rebounding to 10 percent in 2021-22 while inflation stood at 5.5 percent. However, this was short-lived, with inflation once again exceeding wage growth in 2022-23, by 1.2 percentage points.

Slumping worker productivity

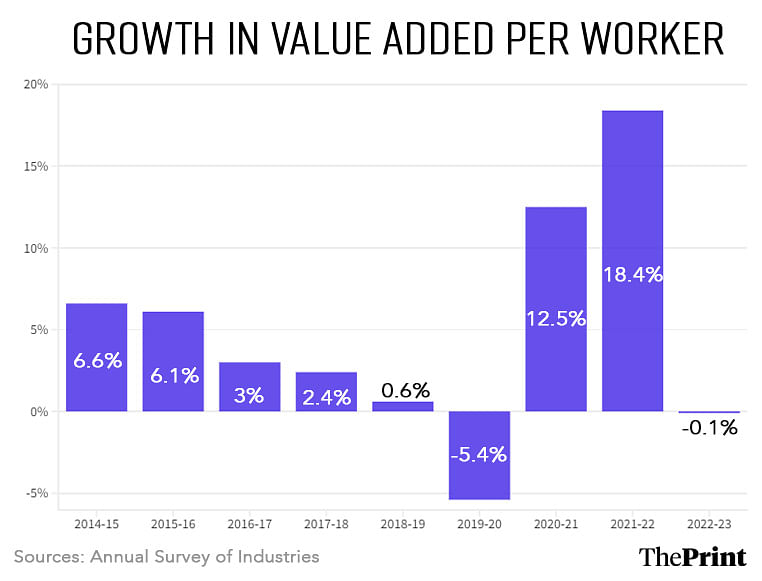

This poor wage growth can perhaps be explained by the fact that the improvement in the productivity of India’s manufacturing workforce has been declining consistently since 2014-15, except for a temporary statistical boost it received due to the impact of Covid-19.

The growth in the GVA per worker—a measure of the growth in their productivity—slowed from 6.6 percent in 2014-15 to just 0.6 percent by 2018-19, before actually contracting to -5.4 percent in 2019-20. That is, the gross value that a manufacturing worker added in 2019-20 was less than what they added in the previous year.

This then bounced back to a growth of 12.5 percent in the pandemic year 2020-21, not because productivity increased, but because the number of workers fell that year—by 3.2 percent—as companies laid off workers.

The post-pandemic 2021-22 saw worker productivity grow even faster as industries ramped up their production again. However, worker productivity again contracted in 2022-23, meaning each worker added less value that year than in 2021-22.

High-employment sectors don’t add commensurate value

The latest ASI also provides data on the sectors that contributed the most to employment and to value added. That is, which were the most labour-intensive and productive ones. Comparing these two parameters provides some insight into whether India’s labour is productively engaged or not.

In 2022-23, five sectors accounted for more than 40 percent of India’s manufacturing labour force—food products (11.4 percent), textiles (9.3 percent), basic metals (7.6 percent), wearing apparel (7.1 percent), and motor vehicles, trailers & semi-trailers (6.8 percent).

However, of these, only the sectors that were also capital intensive—such as basic metals and the auto sub-sector—also featured among the sectors that added the most value. In other words, the sectors that predominantly relied on labour—such as food products, textiles, and wearing apparel—were not among the most productive.

The most productive sectors by their share in GVA were basic metals (11.6 percent), chemicals & chemical products (9.8 percent), coke and refined petroleum products (8.7 percent), motor vehicles, trailers & semi-trailers (8.1 percent), and pharmaceuticals, medicinal, chemical and botanical products (7.3 percent).

This shows that large parts of India’s manufacturing labour force are employed in relatively low-value jobs.

Declining overall manufacturing growth

Finally, the data shows that the growth in the overall GVA for the manufacturing sector has been slowing to very low levels, once the impact of inflation is accounted for.

That is, where the sector’s GVA grew 9.4 percent in 2014-15 in nominal terms (without incorporating inflation), the real growth after factoring in the 6 percent inflation that year was actually only 3.4 percent.

This real growth slumped to 1.4 percent by 2018-19, before falling further into a sharp contraction of 8.2 percent in 2019-20. The pandemic saw real GVA growth for the manufacturing sector stay at a low 2.7 percent before surging to a recovery-aided 21.1 percent in 2021-22. However, real growth again fell to 0.6 percent in 2022-23, underscoring the persistent weakness in the sector.

(Edited by Radifah Kabir)

Also Read: Working-age Indian population rising; expected at around 64% in next census: SBI Research

Is it possible to share a copy of the report, or share a link to this ?