New Delhi: The Covid-19 pandemic may have derailed the Indian economy, but it has certainly sent the country’s stock markets rocketing.

Since the lockdown was introduced in March 2020, there has been a massive surge in retail investors — the ‘aam aadmi’ of the stock market. Around 10.7 million new demat accounts (for trading) were opened in the Covid-marred year — nearly double of what was the average trend in the preceding three years.

Amid concerns over such rapid growth in retail trading, a study by the National Stock Exchange (NSE)’s economics team has crucial insights to offer. Titled Market concentration and retail investment in India, the study by NSE chief economist Tirthankar Patnaik, was published in the October issue of the exchange’s monthly publication Market Pulse.

According to the study, not only have retail investors grown bigger in size, they are also investing in top-value stocks, and have the most diversified bouquet of stocks in their portfolio, as compared to institutions.

Also read: IPO frenzy pushes SEBI to propose tighter listing rules on investor exit, cash raised

Net buyers

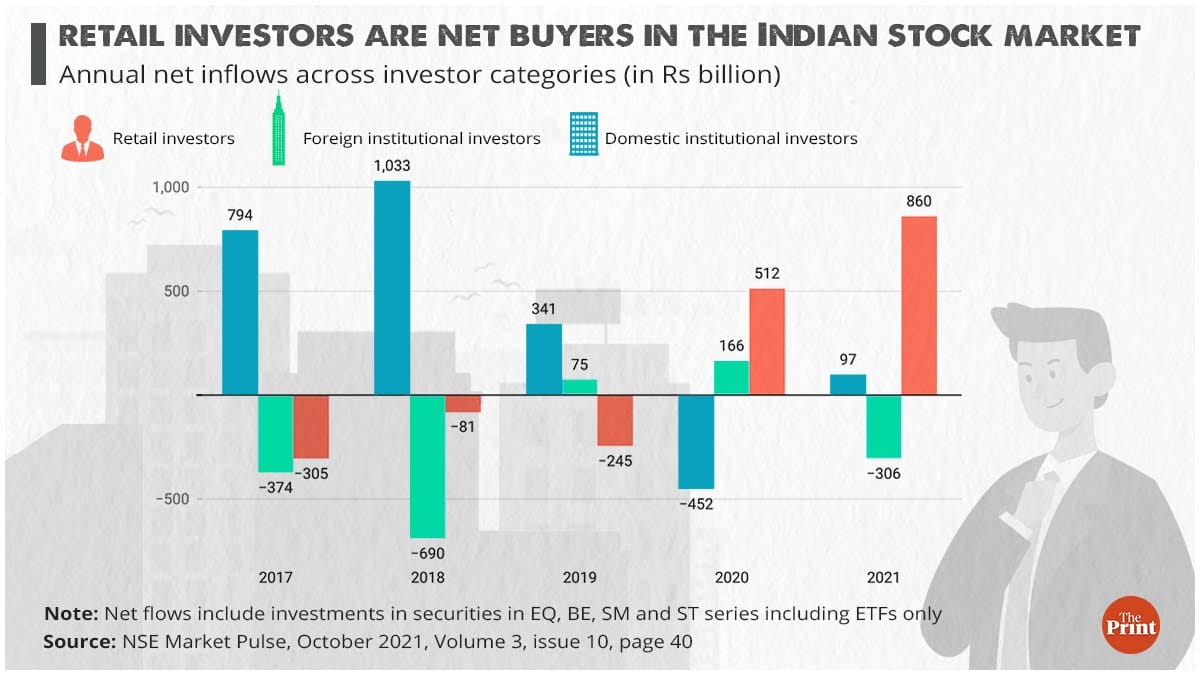

Before the pandemic, retail investors were net sellers of stocks, which means they withdrew more money than they put in. However, 2020 changed this as Covid-19 pushed people to park surplus funds in the stock markets.

The study divides investors into three broad categories — foreign institutional investors or FIIs (foreign companies investing in Indian stocks), domestic institutional investors or DIIs (Indian organisations investing in stocks) and retail investors (individuals). Promoters — Indian, foreign and the government — are the other kind of equity investors, who were outside the purview of the study.

The study shows that retail investors were net sellers of stocks till 2019. In 2017, these investors had a net outflow of Rs 30,500 crore. The number fell to Rs 8,100 crore the following year, but rose again in 2019 to Rs 24,500 crore.

In 2020, there was a reversal in the trend as a greater number of individuals bought more than what they sold — hence, there was a net inflow of Rs 51,200 crore. And by the third quarter of the calendar year 2021, the net inflow by retail investors jumped up to Rs 86,000 crore.

In comparison, the net inflow from DIIs in the same period was just Rs 9,700 crore.

Also read: WPI inflation jumps to 5-month high of 12.54% in October

Bigger & more diverse stocks, smaller amounts

Spending by retail investors is also much more diverse compared to institutions, the study shows.

FIIs spent in fewer stocks and in limited activities. Comparatively, the domestic institutions had more in their bouquet, leveraging their “geographical familiarity”. But retail investors went one step ahead and had the most diverse portfolio, investing in 1,900 stocks.

Their investment comes even as market concentration (investing in fewer and bigger stocks) rose during the Covid crisis.

“In line with what we saw in July 2020 on overall concentration, there is a clear, generic rise across all three portfolios since mid-2017, thanks to a general risk-off sentiment resulting from a multi-year macro downcycle that pushed trading to large-cap stocks,” the study says.

Despite that, domestic institutions and retail investors are still expanding their portfolios to diverse stocks. However, after July 2021, FIIs are limiting themselves from expanding, which is why their concentration levels have increased, it adds.

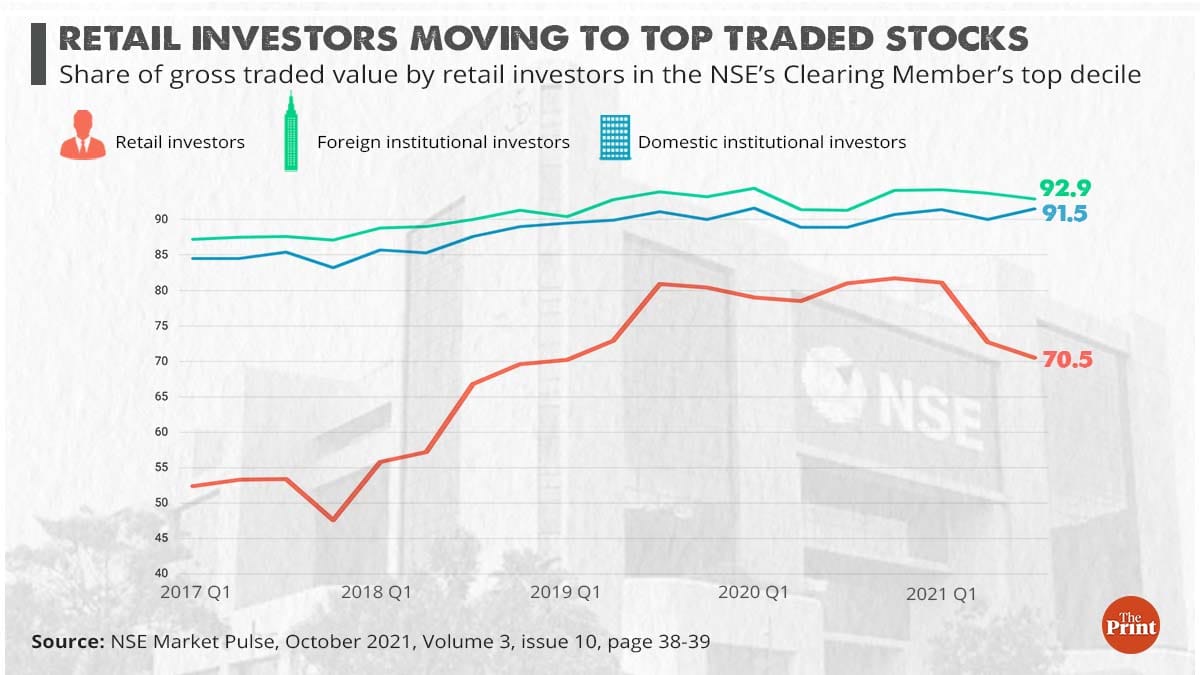

Another interesting insight from the study is that individual investors are now more interested in trading with the highest-value stocks.

FIIs and DIIs usually invest big in high-value stocks. However, after 2017, retail investors are also moving up the ladder.

In Q1 of 2017, the share of retail trade value of the top decile formed just about 52.4 per cent of the gross value traded by retail investors, which jumped to 81.7 per cent at its peak in the final quarter of last year. By the end of the third quarter of the calendar year 2021, the share of such stocks stood at 70.5 per cent.

Speaking to ThePrint, Patnaik said his study shows that “the portfolio had been turning cautious (more weight to large-cap stocks) over the years”.

“One would tend to characterise such behaviour as cautious, ceteris paribus. It is only since the second quarter of 2021 that the retail investor looked into a wider universe of opportunities, and that was in line with institutional investors. Both FIIs and DIIs added new stocks to their portfolios in the search for alpha,” said Patnaik.

However, the report also notes that the average holding of the retail investors, despite investing in top-value stocks, is in low amounts. About 80 per cent of the 19 million retail investors had invested less than Rs 50,000 on average, the study shows.

This likely explains why retail investors owned just 9.4 per cent of the NSE-listed stocks in September 2021, as compared to 13.4 per cent by DIIs and 21 per cent by the FIIs.

Terms and conditions apply for FD and gold lovers

The rise of retail investors also has to do with traditional investment options like fixed deposits (FD) and gold becoming less lucrative compared to the returns stock markets can provide.

“The net inflows in the last two years could be attributed to increased interest by retail investors who stayed or worked from home during the Covid-19 pandemic, shift in investments towards high-yielding investment avenues from a gradual fall in real interest rates in an easing monetary policy environment with high inflation,” the study says.

The trend also comes with a great deal of uncertainty, since stocks are subject to market risks.

“What happened during Covid was that salaried people were left with more disposable income, on account of not stepping out. They had more of both time and money to invest — and in some cases, they also took huge risks, i.e., investing without doing proper research or leveraging,” said Aditya Kondawar, chief operating officer of JST Investments, a Mumbai-based company.

“The spread of financial market information has also made it easier for people to construct informational videos/tweets/articles as recommendations. In some cases, they are literally taking quick advice from Twitter,” said Kondawar.

“But there are no free lunches in the market, and hence every investor must research and then only invest/take a decision,” he warned. “People are subscribing to IPOs like it’s a lottery ticket. A company that wants to raise Rs 500 crore ends up raising Rs 1-2 lakh crore and this definitely shows euphoria.”

Even Patnaik said this rise in retail investors needs to come up with increased information flow for sustainability.

“Improving investor awareness and knowledge remains the key to ushering these investors into the markets on a sustainable basis, as they look favourably towards equities as an asset class,” he said.

(Edited by Amit Upadhyaya)

Also read: India plans forward-looking measures on issues related to cryptocurrencies