New Delhi: Household savings increased sharply in the April to June quarter this fiscal with many Indian households preferring to invest in mutual funds, insurance and hold cash, the Reserve Bank of India (RBI) said.

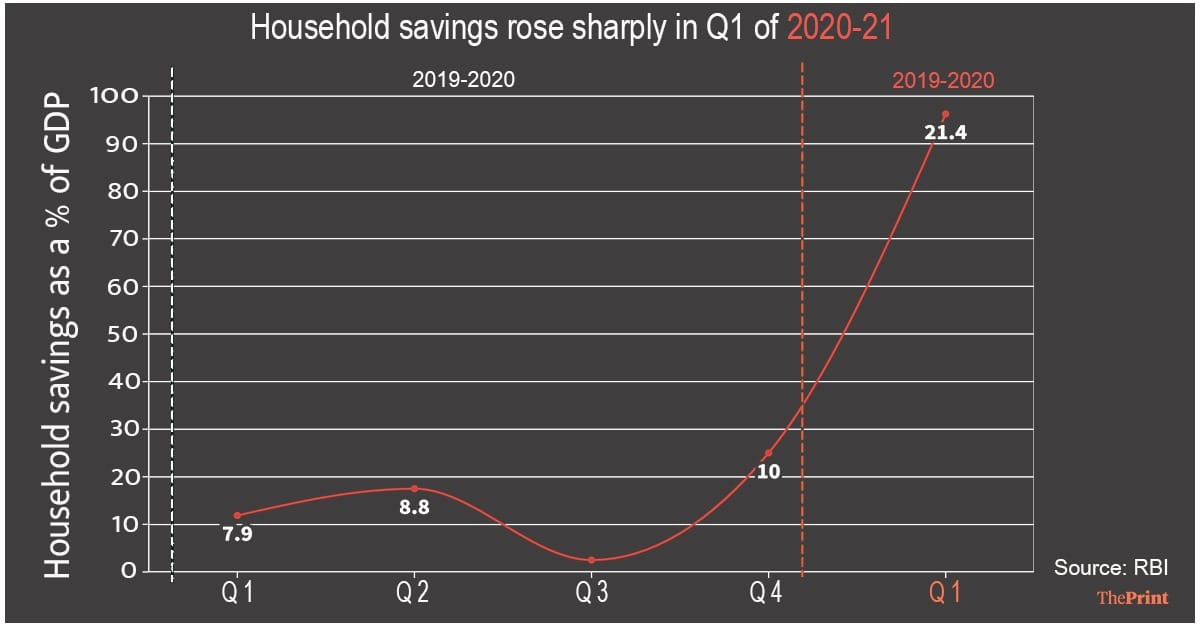

According to the central bank’s estimates, household financial savings rose to 21.4 per cent of GDP in the first quarter of 2020-21, up from 7.9 per cent in the corresponding period a year ago, and 10 per cent in the preceding January to March quarter of 2019-20.

The rise in savings were both on account of increase in financial assets and a decrease in the financial liabilities.

RBI said the propensity of households to save during the pandemic rose on two counts.

“First, the households would have been forced to save more, being unable to consume up to their normal levels,” the RBI said in its November bulletin. “Second, they may have raised their precautionary savings due to uncertainty about their future incomes, in large part flowing from cautious responses to reports of actual and potential job losses.”

‘Increase in assets led by mutual funds, insurance & cash’

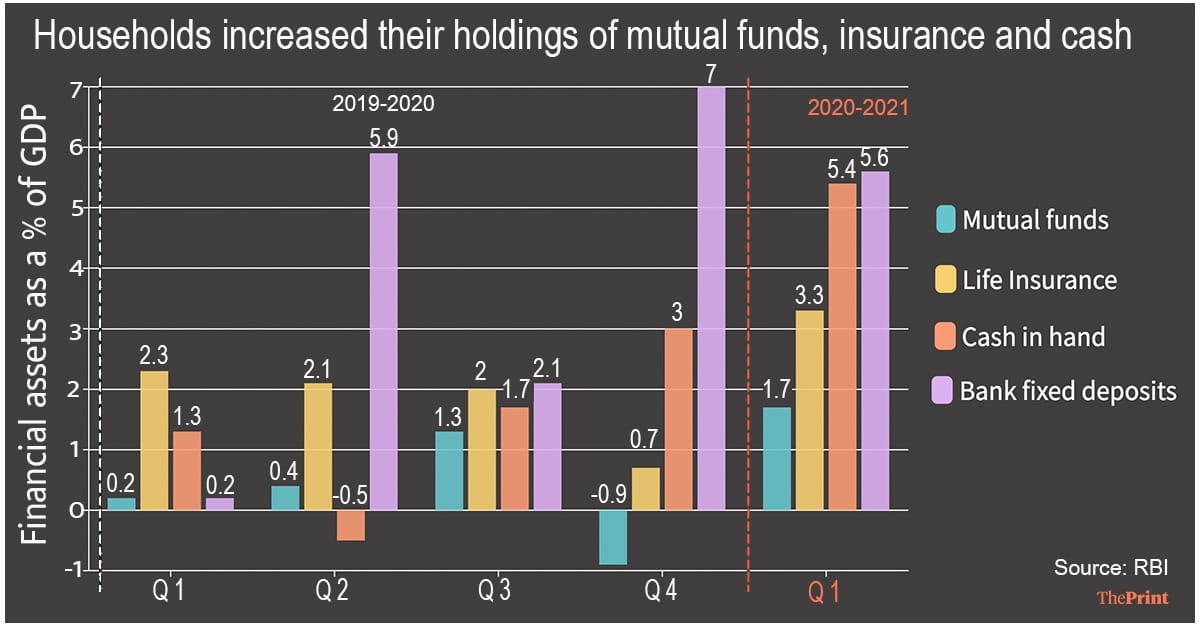

The increase in household financial assets was led by significant increase in the households’ holdings of mutual funds, insurance products and currency, the RBI said.

Household savings in mutual funds increased to 1.7 per cent of GDP in the first quarter of the current fiscal, from -0.9 per cent in the preceding quarter and 0.2 per cent in the same quarter a year ago.

“The increased flows to mutual funds seem to have been driven by low returns on bank deposits and the stock markets touching new peaks after initial volatility in March 2020 following the Covid-19,” the RBI said.

Household savings in life insurance products also increased to 3.3 per cent of the GDP in the April-June quarter from 0.7 per cent in the preceding quarter and and 2.3 per cent in the same period from a year ago.

“The rise in subscription to insurance products reflects the pandemic-led increased awareness of life insurance amongst the households,” the bulletin noted. “In these times of emergency, life insurance has become a necessity and not just a matter of benefit.”

Household holdings of cash also rose substantially to 5.4 per cent of GDP from 3 per cent in the January-March quarter of 2019-20 and 1.3 per cent in the April-June quarter of 2019-20.

The increase in currency holding on the part of households reflects flight to safety or ‘dash to cash’ behaviour under extreme uncertainty brought upon by the pandemic, the report said.

‘Bank deposits still saw substantial flows’

Though falling interest rates on fixed deposits has seen households look at mutual funds, bank deposits still saw substantial inflows in the first quarter.

Bank and non-bank deposits are estimated to be at 5.6 per cent of GDP in the April-June quarter, down from 7 per cent in the January to March quarter and 0.2 per cent in April-June quarter of last year.

These deposits generally turn negative in the first quarter of the financial year but there has been a sharp increase this year, the RBI said.

It also noted that during the lockdown, when income of the poor was likely to be impacted more, the balance in their Jan Dhan deposit accounts rose by around Rs 400 per account cumulatively in the April-June quarter due to increased money transfers under the Pradhan Mantri Garib Kalyan Yojana.

“It appears that part of the transfers has been saved by the poor households despite stagnant/reduced income,” the RBI said.

It said the trend of higher than usual household financial savings can persist for some time until “the pandemic recedes and consumption levels get normalised” but will taper off as the Covid curve begins to flatten allowing households to spend and economic activities to revive.

Also read: Respite for RBI – interest rates seen staying low as vegetable prices begin to cool