Wellington: India and the U.S. are the two most investor-friendly markets in the world in terms of best practice for portfolio disclosure, while Australia ranks at the bottom, according to a global study by Morningstar Inc.

The two countries earned top grades for their robust disclosure regimes across six categories including fees, transparency of fund holdings and issues such as conflicts of interest. The report covering 26 markets across North America, Europe, Asia and Africa singled out Australia as a notable laggard.

“The U.S. has consistently led the pack in this area, while India has gradually added global best practices to its disclosure framework,” Christina West, director of manager research services at Morningstar and co-author of the study, said in a statement. “India has also set a high standard with monthly required portfolio holdings disclosure.”

Also read: How containing Covid helped boost stock markets in these 5 countries in 2020

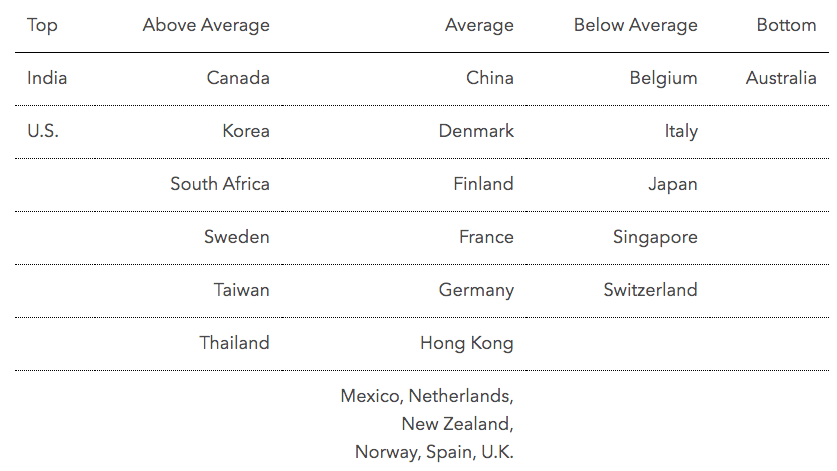

Morningstar applied a grading scale of top, above average, average, below average, and bottom to evaluate 26 markets based on six disclosure criteria: easy to understand prospectuses, fees, portfolio holdings, portfolio manager and compensation disclosures, and for the first time ESG and stewardship, and sales disclosures.

Despite being a sophisticated market, Australia remains the only one without regulated portfolio holdings disclosure, according to the report. The nation has also yet to adapt to increasing investor expectations around ESG and stewardship disclosures, it said.

Belgium, Italy, Japan, Singapore and Switzerland were ranked below average, while Canada, Korea, South Africa, Sweden, Taiwan and Thailand were ranked above average.

Most fund managers in Australia publish their top 10 holdings on their websites, but it’s difficult to get the entire portfolio breakdown, said Grant Kennaway, director of manager research for Australia at Morningstar and one of the report’s co-authors. In India, fund managers publish full portfolio allocations and what percentage is invested in them, he said.

Requirements are being tightened for pension funds in Australia. But even when regulations are finally implemented, they won’t bring the nation anywhere near global best practice because they only call for semiannual disclosure and don’t cover mutual funds, Morningstar said.

“It’s really hard to explain how Australia has failed to get its act together,” Kennaway said in an interview. “Being transparent about portfolio holdings should be just a simple matter. Some markets are providing portfolio holdings to investors every month. With the interest in ESG and sustainability, it’s becoming increasingly front of mind for investors.”- Bloomberg

Also read: Women in finance have to ask for promotions, men don’t, finds Australian study