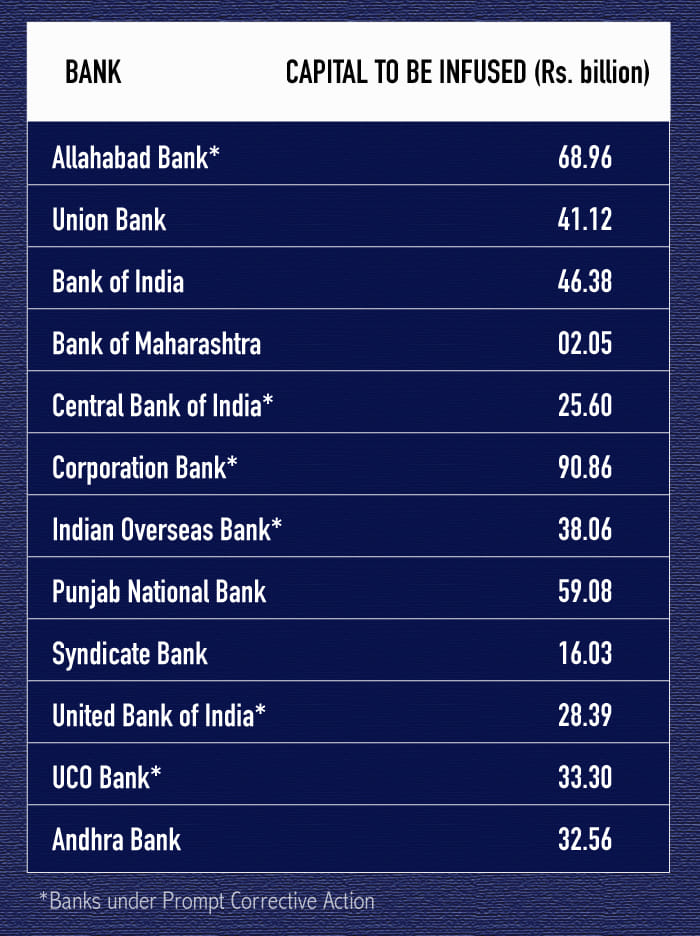

Mumbai: India will inject 482 billion rupees ($6.8 billion) into government-controlled lenders to help them meet tighter regulatory requirements and to boost credit growth.

The fund infusion will ensure that capital ratios for all state-run lenders are above the regulatory requirement and will help Allahabad Bank and Corporation Bank exit a so-called Prompt Corrective Action plan, Rajeev Kumar, secretary at India’s department of financial services said in a tweet on Wednesday.

The injection will help lenders struggling with an erosion in capital reserves to boost lending and support economic expansion. The government is hoping that a stronger banking system will help bolster loan growth hovering near a five-year high seen in December.

Earlier this year, Prime Minister Narendra Modi’s government got parliamentary approval to spend an additional 410 billion rupees to strengthen the bank balance sheets on top of a 1.35 trillion rupee recapitalization plan announced in 2017.

Also read: India Inc facing cost overrun to comply with Modi govt’s push to curb corruption